Form it 251 Credit for Employment of Persons with Disabilities Tax Year

Understanding the Form IT 251 Credit For Employment Of Persons With Disabilities Tax Year

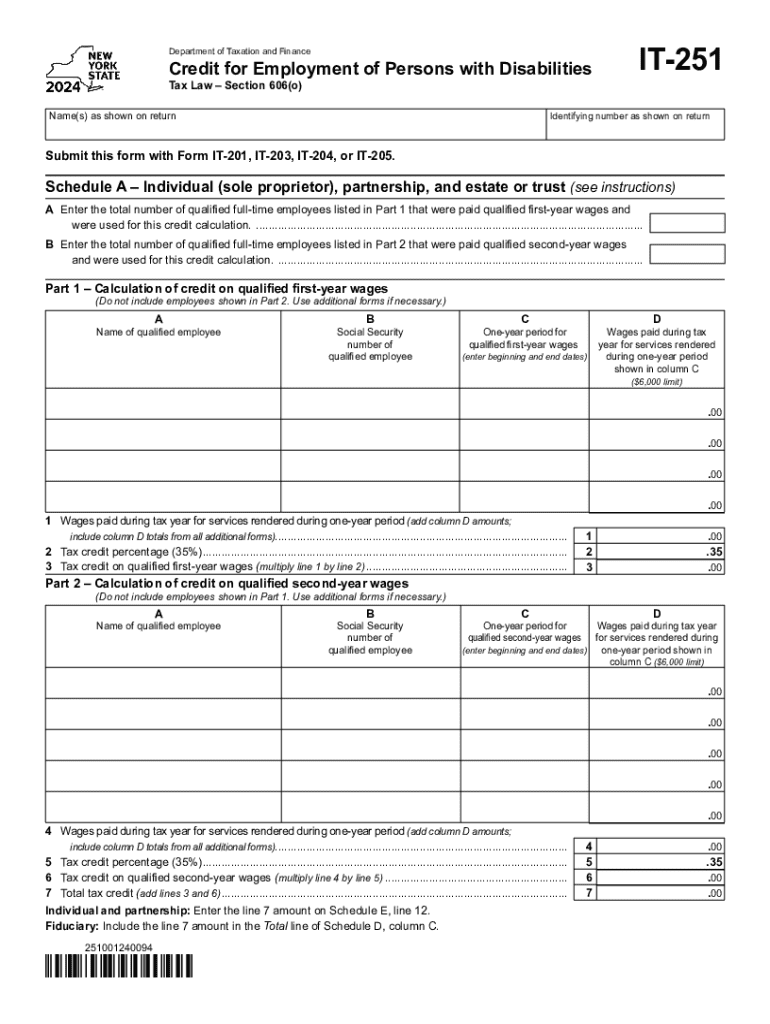

The Form IT 251 is a tax credit application designed to incentivize businesses that employ individuals with disabilities. This credit aims to encourage the hiring of persons with disabilities by providing tax relief to employers. The credit can significantly reduce the tax burden for businesses, promoting inclusivity in the workforce. It is particularly relevant for businesses looking to support diversity and fulfill corporate social responsibility goals while benefiting financially.

How to Obtain the Form IT 251 Credit For Employment Of Persons With Disabilities Tax Year

To obtain the Form IT 251, employers can visit the official state tax department website or contact their local tax office. The form is typically available for download in PDF format, allowing for easy access and printing. Employers may also request a physical copy through mail if preferred. It is important to ensure that the correct tax year version of the form is used to avoid any compliance issues.

Steps to Complete the Form IT 251 Credit For Employment Of Persons With Disabilities Tax Year

Completing the Form IT 251 involves several key steps:

- Gather necessary documentation, including employee information and proof of disability.

- Fill out the employer's details, including business name, address, and tax identification number.

- Provide information about the employed individual with disabilities, including their name, Social Security number, and the nature of their disability.

- Calculate the credit amount based on the number of qualifying employees and their wages.

- Review the completed form for accuracy before submission.

Eligibility Criteria for the Form IT 251 Credit For Employment Of Persons With Disabilities Tax Year

To qualify for the Form IT 251 credit, employers must meet specific eligibility criteria. These include:

- The business must be located in the United States.

- At least one employee must be a person with a documented disability.

- Wages paid to the eligible employee must meet the minimum threshold set by the state.

- The employer must comply with all relevant employment laws and regulations.

Filing Deadlines for the Form IT 251 Credit For Employment Of Persons With Disabilities Tax Year

Filing deadlines for the Form IT 251 vary by state but generally align with the standard tax filing deadlines. Employers should submit the form along with their annual tax return or as specified by the state tax authority. It is crucial to be aware of any specific state deadlines to ensure timely submission and avoid potential penalties.

Key Elements of the Form IT 251 Credit For Employment Of Persons With Disabilities Tax Year

The Form IT 251 includes several key elements that must be accurately filled out. These elements typically consist of:

- Employer identification details, including name and tax ID.

- Information about the employee with a disability, including their employment start date.

- Details regarding the nature of the disability and any required documentation.

- The calculation of the credit amount based on qualifying wages.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 251 credit for employment of persons with disabilities tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form IT 251 Credit For Employment Of Persons With Disabilities Tax Year?

Form IT 251 Credit For Employment Of Persons With Disabilities Tax Year is a tax form that allows businesses to claim a credit for hiring individuals with disabilities. This form helps incentivize employers to create inclusive workplaces while benefiting from potential tax savings.

-

How can airSlate SignNow assist with Form IT 251 Credit For Employment Of Persons With Disabilities Tax Year?

airSlate SignNow provides an efficient platform for businesses to manage and eSign documents related to Form IT 251 Credit For Employment Of Persons With Disabilities Tax Year. Our solution streamlines the documentation process, ensuring that all necessary forms are completed accurately and submitted on time.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for small businesses and larger enterprises. Each plan provides access to features that can help with managing Form IT 251 Credit For Employment Of Persons With Disabilities Tax Year and other essential documents.

-

What features does airSlate SignNow offer for managing tax forms?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax forms like Form IT 251 Credit For Employment Of Persons With Disabilities Tax Year. These tools enhance efficiency and ensure compliance with tax regulations.

-

Are there any benefits to using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including Form IT 251 Credit For Employment Of Persons With Disabilities Tax Year, offers numerous benefits such as reduced paperwork, faster processing times, and improved accuracy. This can lead to signNow time and cost savings for businesses.

-

Can airSlate SignNow integrate with other software for tax management?

Yes, airSlate SignNow can integrate with various accounting and tax management software, making it easier to handle Form IT 251 Credit For Employment Of Persons With Disabilities Tax Year alongside other financial documents. This integration helps streamline workflows and enhances overall productivity.

-

Is airSlate SignNow secure for handling sensitive tax information?

Absolutely, airSlate SignNow prioritizes security and compliance, ensuring that all documents, including Form IT 251 Credit For Employment Of Persons With Disabilities Tax Year, are protected with advanced encryption and secure access controls. Your sensitive tax information is safe with us.

Get more for Form IT 251 Credit For Employment Of Persons With Disabilities Tax Year

Find out other Form IT 251 Credit For Employment Of Persons With Disabilities Tax Year

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy

- Sign Massachusetts Business Letter Template Fast