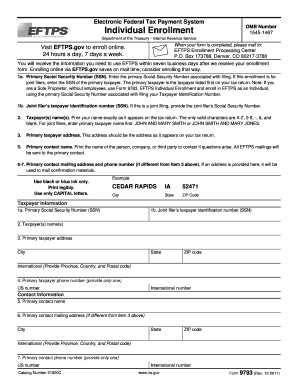

Form 9783 Rev 12 Electronic Federal Tax Payment System Individual Enrollment

What is the Form 9783 Rev 12 Electronic Federal Tax Payment System Individual Enrollment

The Form 9783 Rev 12 is an essential document used for enrolling individuals in the Electronic Federal Tax Payment System (EFTPS). This system allows taxpayers to make federal tax payments electronically, providing a secure and efficient method for managing tax obligations. By completing this form, individuals can set up their EFTPS accounts, enabling them to pay various federal taxes, including income, employment, and estimated taxes, directly from their bank accounts.

Steps to complete the Form 9783 Rev 12 Electronic Federal Tax Payment System Individual Enrollment

Completing the Form 9783 Rev 12 involves several straightforward steps:

- Gather necessary information, including your Social Security number, bank account details, and contact information.

- Fill out the form accurately, providing all required personal and financial information.

- Review the completed form to ensure all information is correct and complete.

- Submit the form as directed, either online or by mail, following the submission guidelines provided.

How to obtain the Form 9783 Rev 12 Electronic Federal Tax Payment System Individual Enrollment

The Form 9783 Rev 12 can be obtained directly from the IRS website or through various tax preparation services. It is advisable to ensure that you are using the most current version of the form to avoid any issues with your enrollment. Additionally, many tax professionals can assist in obtaining and completing this form as part of their services.

Eligibility Criteria for the Form 9783 Rev 12 Electronic Federal Tax Payment System Individual Enrollment

To be eligible for enrollment using the Form 9783 Rev 12, individuals must have a valid Social Security number or Employer Identification Number (EIN). Furthermore, individuals should have a checking or savings account in their name to facilitate electronic payments. This form is designed for taxpayers who wish to manage their federal tax payments electronically, making it suitable for various taxpayer scenarios, including self-employed individuals and those with multiple tax obligations.

Form Submission Methods for the Form 9783 Rev 12 Electronic Federal Tax Payment System Individual Enrollment

The completed Form 9783 Rev 12 can be submitted through multiple methods. Taxpayers can enroll online via the EFTPS website, which is a convenient option for many. Alternatively, the form can be mailed to the designated IRS address specified in the form instructions. It is important to follow the submission guidelines carefully to ensure timely processing of your enrollment.

IRS Guidelines for the Form 9783 Rev 12 Electronic Federal Tax Payment System Individual Enrollment

The IRS provides specific guidelines for completing and submitting the Form 9783 Rev 12. These guidelines include instructions on filling out the form accurately, the importance of providing correct bank account information, and the need to keep a copy of the submitted form for personal records. Adhering to these guidelines helps prevent delays in the enrollment process and ensures compliance with federal tax payment requirements.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 9783 rev 12 electronic federal tax payment system individual enrollment

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 9783 Rev 12 Electronic Federal Tax Payment System Individual Enrollment?

The Form 9783 Rev 12 Electronic Federal Tax Payment System Individual Enrollment is a document used by individuals to enroll in the Electronic Federal Tax Payment System (EFTPS). This system allows taxpayers to pay their federal taxes electronically, ensuring timely and secure payments. Completing this form is essential for individuals who wish to manage their tax payments efficiently.

-

How can airSlate SignNow help with the Form 9783 Rev 12 Electronic Federal Tax Payment System Individual Enrollment?

airSlate SignNow simplifies the process of completing and submitting the Form 9783 Rev 12 Electronic Federal Tax Payment System Individual Enrollment. Our platform allows users to fill out the form electronically, eSign it, and send it securely. This streamlines the enrollment process, making it faster and more efficient.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including the Form 9783 Rev 12 Electronic Federal Tax Payment System Individual Enrollment, offers numerous benefits. It provides a user-friendly interface, ensures document security, and allows for easy tracking of submissions. Additionally, it reduces the risk of errors and delays associated with paper forms.

-

Is there a cost associated with using airSlate SignNow for the Form 9783 Rev 12 Electronic Federal Tax Payment System Individual Enrollment?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be a cost-effective solution for businesses and individuals. Pricing plans vary based on features and usage, ensuring that users can find a plan that fits their needs. The investment in airSlate SignNow can lead to signNow time and cost savings in managing tax documents.

-

Can I integrate airSlate SignNow with other software for managing tax documents?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing your ability to manage tax documents like the Form 9783 Rev 12 Electronic Federal Tax Payment System Individual Enrollment. This allows for seamless workflows and improved efficiency in handling your tax-related tasks.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides a range of features for document management, including eSigning, document templates, and secure storage. These features are particularly useful for handling forms like the Form 9783 Rev 12 Electronic Federal Tax Payment System Individual Enrollment. Users can easily create, send, and track documents all in one place.

-

How secure is the airSlate SignNow platform for handling sensitive tax documents?

The airSlate SignNow platform prioritizes security, employing advanced encryption and compliance measures to protect sensitive tax documents, including the Form 9783 Rev 12 Electronic Federal Tax Payment System Individual Enrollment. Users can trust that their information is safe and secure while using our services. Regular security audits and updates further enhance our commitment to data protection.

Get more for Form 9783 Rev 12 Electronic Federal Tax Payment System Individual Enrollment

- Stormi giovanni suffixes ible and able pearson education answers form

- Gastatetax form

- In form 54763

- Form of declaration for ministers licence

- Asap 20 form

- 57 1 13 form of quitclaim deed effect 1 a conveyance of land le utah

- Worksheet punnett square reviewmr form

- Application for salvage title or non repairable certificate form

Find out other Form 9783 Rev 12 Electronic Federal Tax Payment System Individual Enrollment

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now