IRS Form 13844 Application for Reduced Fee

What is the IRS Form 13844 Application For Reduced Fee

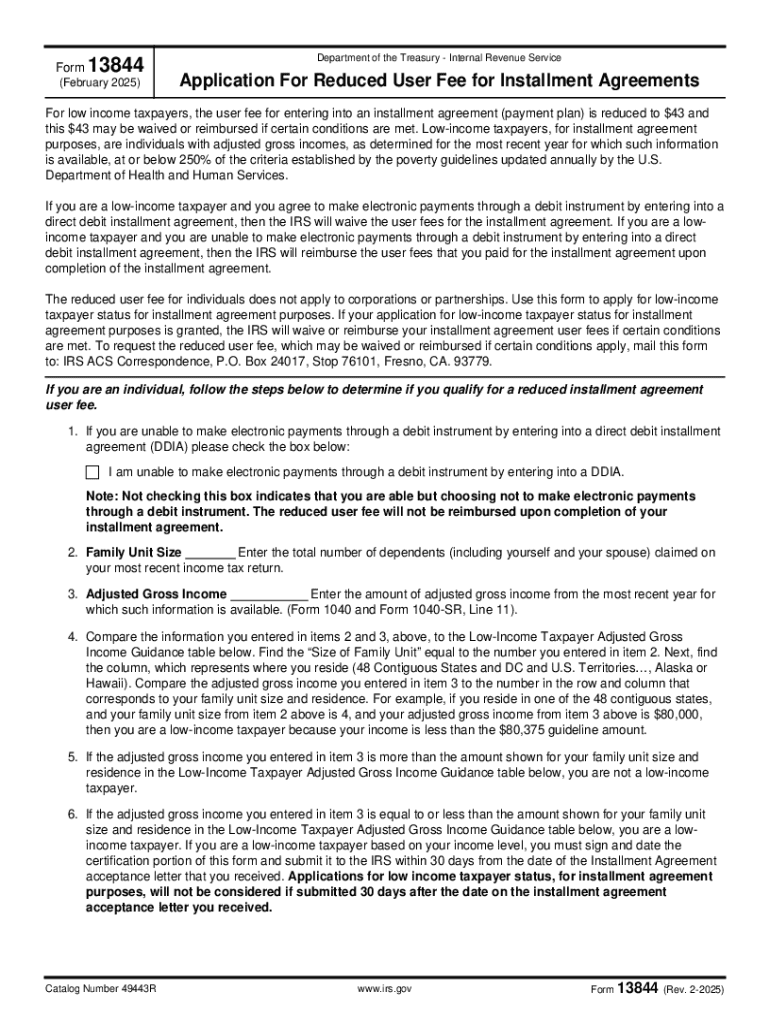

The IRS Form 13844 is an application designed for taxpayers seeking a reduction in the user fee associated with certain IRS services. This form allows individuals with limited income to apply for a reduced fee, making it more accessible for them to receive necessary tax assistance. The application is particularly relevant for those who may face financial hardship but still require help with tax-related matters.

Eligibility Criteria

To qualify for a reduced fee using the IRS Form 13844, applicants must meet specific income guidelines set forth by the IRS. Generally, these guidelines consider household size and total income, ensuring that only those who genuinely need financial assistance can benefit from the program. Taxpayers are encouraged to review the current income thresholds to determine their eligibility before submitting the application.

Steps to Complete the IRS Form 13844 Application For Reduced Fee

Completing the IRS Form 13844 involves several straightforward steps:

- Gather necessary documentation, including proof of income and household size.

- Download the form from the IRS website or obtain a copy from a local IRS office.

- Fill out the form accurately, ensuring all required fields are completed.

- Attach any supporting documents that verify your income and eligibility.

- Review the completed form for accuracy before submission.

- Submit the form via mail to the appropriate IRS address as indicated in the instructions.

How to Obtain the IRS Form 13844 Application For Reduced Fee

The IRS Form 13844 can be obtained through various channels. Taxpayers can download the form directly from the IRS website in PDF format, allowing for easy printing and completion. Additionally, physical copies of the form are available at local IRS offices and certain community organizations that offer tax assistance. It is important to ensure that the most current version of the form is used to avoid any issues during the application process.

Required Documents

When applying for a reduced fee using the IRS Form 13844, applicants must provide certain documents to support their application. These typically include:

- Proof of income, such as recent pay stubs or tax returns.

- Documentation of household size, which may include identification for all household members.

- Any additional forms or documents specified in the instructions accompanying Form 13844.

Application Process & Approval Time

The application process for the IRS Form 13844 involves submitting the completed form along with the required documentation to the IRS. Once submitted, the IRS will review the application to determine eligibility for the reduced fee. The approval time can vary, but applicants should expect to receive a response within a few weeks. It is advisable to keep a copy of the submitted application for personal records.

Handy tips for filling out IRS Form 13844 Application For Reduced Fee online

Quick steps to complete and e-sign IRS Form 13844 Application For Reduced Fee online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms could be. Gain access to a GDPR and HIPAA compliant solution for maximum simplicity. Use signNow to e-sign and send out IRS Form 13844 Application For Reduced Fee for e-signing.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs form 13844 application for reduced fee

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 13844 form and how can airSlate SignNow help?

The 13844 form is a document used for specific business processes, and airSlate SignNow simplifies its management. With our platform, you can easily upload, send, and eSign the 13844 form, ensuring a seamless workflow. Our user-friendly interface makes it accessible for all team members, enhancing productivity.

-

Is there a cost associated with using airSlate SignNow for the 13844 form?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Each plan provides access to features that streamline the handling of the 13844 form, ensuring you get the best value for your investment. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the 13844 form?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure eSigning for the 13844 form. These tools help you manage documents efficiently and reduce turnaround time. Additionally, you can track the status of your forms in real-time.

-

Can I integrate airSlate SignNow with other applications for the 13844 form?

Absolutely! airSlate SignNow supports integrations with various applications, allowing you to streamline your processes involving the 13844 form. Whether you use CRM systems, cloud storage, or other business tools, our platform can connect seamlessly to enhance your workflow.

-

What are the benefits of using airSlate SignNow for the 13844 form?

Using airSlate SignNow for the 13844 form offers numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. Our platform ensures that your documents are signed and stored securely, while also speeding up the approval process. This leads to better overall productivity for your business.

-

How secure is the 13844 form when using airSlate SignNow?

Security is a top priority at airSlate SignNow. When handling the 13844 form, we utilize advanced encryption and secure storage solutions to protect your data. You can trust that your documents are safe and compliant with industry standards.

-

Can I access the 13844 form on mobile devices with airSlate SignNow?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to manage the 13844 form on the go. Whether you’re using a smartphone or tablet, you can easily access, send, and eSign documents anytime, anywhere. This flexibility enhances your ability to stay productive.

Get more for IRS Form 13844 Application For Reduced Fee

Find out other IRS Form 13844 Application For Reduced Fee

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors