Sc Tax Forms Fillable Fill Online, Printable, Fillable, Blank

What is the SC Tax Forms Fillable

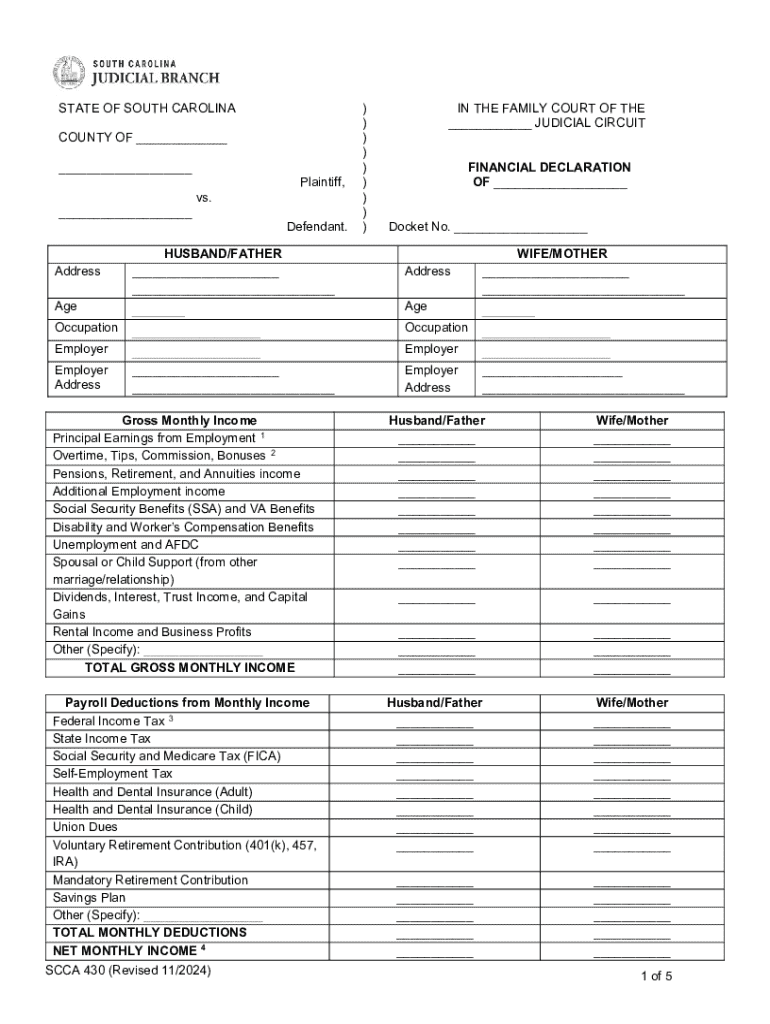

The SC Tax Forms Fillable are official documents used for filing state taxes in South Carolina. These forms allow taxpayers to report their income, claim deductions, and determine their tax liability. The fillable format enables users to complete the forms electronically, making the process more efficient and reducing the likelihood of errors. These forms are available in both online fillable and printable versions, ensuring accessibility for all users.

How to Use the SC Tax Forms Fillable

Using the SC Tax Forms Fillable involves several straightforward steps. First, access the desired form through a reliable source. Once you have the form, you can fill it out directly online or print it for manual completion. When filling out the form, ensure that all required fields are completed accurately. After completing the form, review it for any errors before submitting it to the appropriate state tax authority.

Steps to Complete the SC Tax Forms Fillable

To complete the SC Tax Forms Fillable, follow these steps:

- Download the form from a trusted source.

- Open the form using a compatible PDF reader or directly in your web browser.

- Fill in your personal information, including your name, address, and Social Security number.

- Enter your income details and any deductions you wish to claim.

- Review all entries for accuracy.

- Save the completed form for your records.

- Submit the form either electronically or by mailing it to the appropriate address.

Legal Use of the SC Tax Forms Fillable

The SC Tax Forms Fillable are legally recognized documents required for tax compliance in South Carolina. Properly completing and submitting these forms is essential for meeting state tax obligations. Failure to use the correct forms or provide accurate information can result in penalties or delays in processing your tax return. It is important to stay informed about any changes to tax laws that may affect the forms and their requirements.

Filing Deadlines / Important Dates

Filing deadlines for the SC Tax Forms Fillable typically align with federal tax deadlines. For most individuals, the deadline to file state tax returns is April 15th of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is crucial to check for any specific announcements from the South Carolina Department of Revenue regarding changes to deadlines or extensions.

Who Issues the Form

The SC Tax Forms Fillable are issued by the South Carolina Department of Revenue. This state agency is responsible for administering tax laws, collecting taxes, and providing guidance to taxpayers. For any questions or clarifications regarding the forms, taxpayers can contact the Department of Revenue directly or visit their official website for more information.

Handy tips for filling out Sc Tax Forms Fillable Fill Online, Printable, Fillable, Blank online

Quick steps to complete and e-sign Sc Tax Forms Fillable Fill Online, Printable, Fillable, Blank online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms could be. Gain access to a GDPR and HIPAA compliant platform for optimum straightforwardness. Use signNow to e-sign and share Sc Tax Forms Fillable Fill Online, Printable, Fillable, Blank for e-signing.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sc tax forms fillable fill online printable fillable blank

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are SC Tax Forms Fillable options available on airSlate SignNow?

airSlate SignNow offers a variety of SC Tax Forms Fillable options that you can fill online, print, or save as blank forms. These forms are designed to simplify the tax filing process, ensuring you have everything you need at your fingertips. With our platform, you can easily access and manage your SC Tax Forms Fillable, Fill Online, Printable, Fillable, Blank.

-

How does airSlate SignNow ensure the security of my SC Tax Forms Fillable?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure cloud storage to protect your SC Tax Forms Fillable, Fill Online, Printable, Fillable, Blank. You can trust that your sensitive information is safe while you complete your tax forms.

-

Can I integrate airSlate SignNow with other software for SC Tax Forms Fillable?

Yes, airSlate SignNow offers seamless integrations with various software applications, making it easy to manage your SC Tax Forms Fillable. Whether you use accounting software or CRM systems, our platform can connect to enhance your workflow. This ensures that your SC Tax Forms Fillable, Fill Online, Printable, Fillable, Blank are always accessible.

-

What are the pricing options for using SC Tax Forms Fillable on airSlate SignNow?

airSlate SignNow provides flexible pricing plans to accommodate different needs for SC Tax Forms Fillable. You can choose from monthly or annual subscriptions, with options that fit both individual and business requirements. Our pricing is designed to be cost-effective while providing access to SC Tax Forms Fillable, Fill Online, Printable, Fillable, Blank.

-

Is it easy to fill out SC Tax Forms Fillable online?

Absolutely! airSlate SignNow makes it incredibly easy to fill out SC Tax Forms Fillable online. Our user-friendly interface guides you through the process, allowing you to complete your forms quickly and efficiently. You can fill online, print, or save your SC Tax Forms Fillable, Fillable, Blank with just a few clicks.

-

What benefits do I get from using airSlate SignNow for SC Tax Forms Fillable?

Using airSlate SignNow for SC Tax Forms Fillable offers numerous benefits, including time savings and increased accuracy. Our platform reduces the hassle of paperwork and minimizes errors, ensuring your forms are completed correctly. Enjoy the convenience of SC Tax Forms Fillable, Fill Online, Printable, Fillable, Blank at your fingertips.

-

Can I access my SC Tax Forms Fillable from any device?

Yes, airSlate SignNow is designed to be accessible from any device, whether it's a computer, tablet, or smartphone. This flexibility allows you to fill out your SC Tax Forms Fillable, Fill Online, Printable, Fillable, Blank anytime and anywhere. Stay productive on the go with our mobile-friendly platform.

Get more for Sc Tax Forms Fillable Fill Online, Printable, Fillable, Blank

- Cfa book 3 financial statement analysis an introduction form

- Capital gains montana department of revenue form

- Payment disbursement dates san diego mesa college form

- How to determine a trusts schedule of distributions dummies form

- Vermont executor form

- Decree of distribution vermont form

- Decree of distribution alternate form vermont

- Request for findings regarding motor vehicle title vermont form

Find out other Sc Tax Forms Fillable Fill Online, Printable, Fillable, Blank

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement