Maine Revenue Services Salesexcise Tax Division Affidavit of Exemption Form

What is the Maine Revenue Services Salesexcise Tax Division Affidavit Of Exemption Form

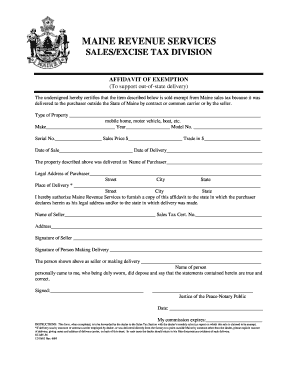

The Maine Revenue Services Salesexcise Tax Division Affidavit Of Exemption Form is a legal document that allows individuals and businesses to claim an exemption from sales and excise taxes in specific situations. This form is essential for those who qualify under certain criteria, such as non-profit organizations, government entities, or specific purchases that are tax-exempt. By submitting this affidavit, taxpayers can ensure compliance with state tax regulations while avoiding unnecessary tax liabilities.

How to use the Maine Revenue Services Salesexcise Tax Division Affidavit Of Exemption Form

This affidavit is designed for use by individuals or businesses seeking to assert their tax-exempt status. To use the form, applicants must accurately fill out all required fields, providing necessary information about their organization or the nature of the exemption. Once completed, the form should be submitted to the appropriate vendor or service provider to validate the tax-exempt status. It is important to retain a copy of the submitted affidavit for personal records and future reference.

Steps to complete the Maine Revenue Services Salesexcise Tax Division Affidavit Of Exemption Form

Completing the Maine Revenue Services Salesexcise Tax Division Affidavit Of Exemption Form involves several key steps:

- Obtain the form from the Maine Revenue Services website or through authorized channels.

- Fill in the required information, including the name of the exempt organization, the type of exemption claimed, and the relevant tax identification number.

- Provide details regarding the specific transaction or purchase for which the exemption is being claimed.

- Sign and date the affidavit to certify the accuracy of the information provided.

- Submit the completed form to the vendor or service provider involved in the transaction.

Eligibility Criteria

To qualify for using the Maine Revenue Services Salesexcise Tax Division Affidavit Of Exemption Form, applicants must meet specific eligibility criteria. Generally, exemptions are available for:

- Non-profit organizations recognized under IRS regulations.

- Government entities at the federal, state, or local level.

- Purchases made for specific exempt purposes, such as educational or charitable activities.

It is crucial for applicants to review the detailed eligibility requirements outlined by the Maine Revenue Services to ensure compliance.

Legal use of the Maine Revenue Services Salesexcise Tax Division Affidavit Of Exemption Form

The legal use of the Maine Revenue Services Salesexcise Tax Division Affidavit Of Exemption Form is governed by state tax laws. This form serves as a declaration of tax-exempt status, and misuse or fraudulent claims can lead to penalties. It is important for users to understand the legal implications of submitting this affidavit and to ensure that all information provided is truthful and accurate. Keeping thorough records of all transactions and submitted forms can help protect against potential audits or disputes with tax authorities.

Form Submission Methods

The Maine Revenue Services Salesexcise Tax Division Affidavit Of Exemption Form can be submitted through several methods, depending on the vendor's requirements. Common submission methods include:

- In-person delivery to the vendor or service provider.

- Mailing the completed form to the appropriate address specified by the vendor.

- In some cases, electronic submission may be accepted, depending on the vendor's policies.

It is advisable to confirm the preferred submission method with the vendor to ensure proper processing of the exemption claim.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the maine revenue services salesexcise tax division affidavit of exemption form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Maine Revenue Services Salesexcise Tax Division Affidavit Of Exemption Form?

The Maine Revenue Services Salesexcise Tax Division Affidavit Of Exemption Form is a document that allows certain entities to claim exemption from sales and excise taxes. This form is essential for businesses that qualify for tax exemptions under specific conditions set by the state of Maine.

-

How can airSlate SignNow help with the Maine Revenue Services Salesexcise Tax Division Affidavit Of Exemption Form?

airSlate SignNow provides a streamlined platform for businesses to create, send, and eSign the Maine Revenue Services Salesexcise Tax Division Affidavit Of Exemption Form. Our user-friendly interface ensures that you can complete the form quickly and efficiently, saving you time and effort.

-

Is there a cost associated with using airSlate SignNow for the Maine Revenue Services Salesexcise Tax Division Affidavit Of Exemption Form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our plans are designed to be cost-effective, ensuring that you can manage the Maine Revenue Services Salesexcise Tax Division Affidavit Of Exemption Form without breaking the bank.

-

What features does airSlate SignNow offer for managing the Maine Revenue Services Salesexcise Tax Division Affidavit Of Exemption Form?

airSlate SignNow includes features such as customizable templates, secure eSigning, and real-time tracking for the Maine Revenue Services Salesexcise Tax Division Affidavit Of Exemption Form. These features enhance your document management process and ensure compliance with state regulations.

-

Can I integrate airSlate SignNow with other software for the Maine Revenue Services Salesexcise Tax Division Affidavit Of Exemption Form?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to seamlessly manage the Maine Revenue Services Salesexcise Tax Division Affidavit Of Exemption Form alongside your existing tools. This integration capability enhances your workflow and boosts productivity.

-

What are the benefits of using airSlate SignNow for the Maine Revenue Services Salesexcise Tax Division Affidavit Of Exemption Form?

Using airSlate SignNow for the Maine Revenue Services Salesexcise Tax Division Affidavit Of Exemption Form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled safely and are easily accessible whenever needed.

-

How secure is airSlate SignNow when handling the Maine Revenue Services Salesexcise Tax Division Affidavit Of Exemption Form?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your documents, including the Maine Revenue Services Salesexcise Tax Division Affidavit Of Exemption Form. You can trust that your sensitive information is safe with us.

Get more for Maine Revenue Services Salesexcise Tax Division Affidavit Of Exemption Form

Find out other Maine Revenue Services Salesexcise Tax Division Affidavit Of Exemption Form

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer