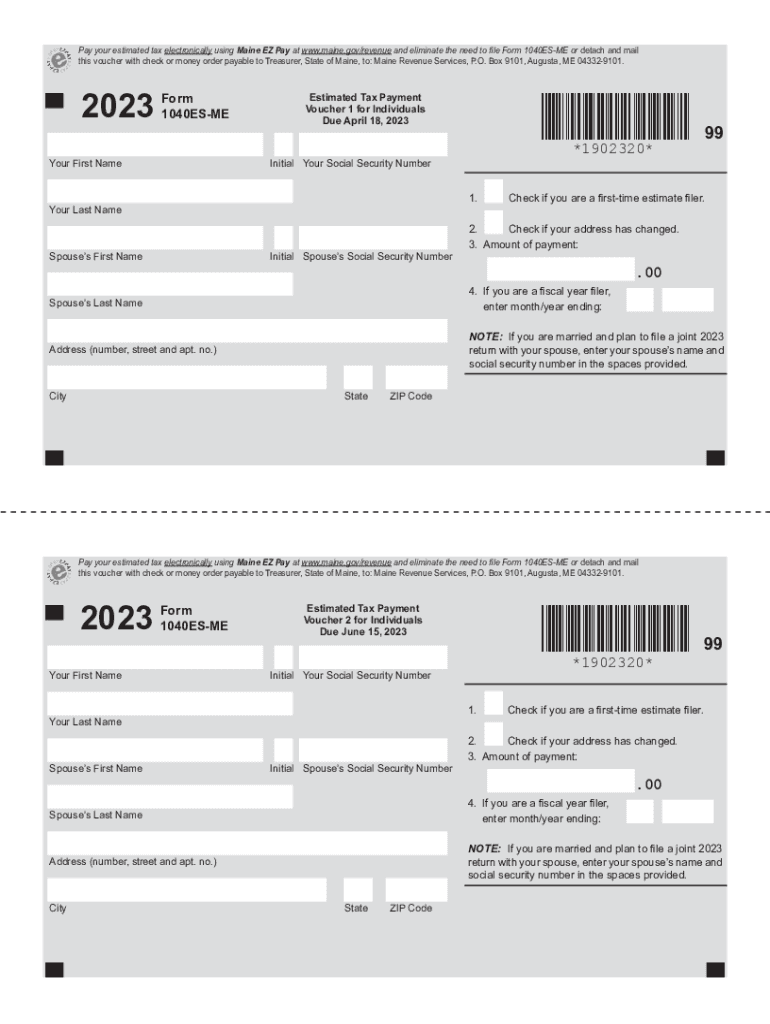

State of Maine Estimated Tax for Individuals Form 1040es Me 2023-2026

Understanding the Maine Estimated Tax Payment for Individuals

The Maine Estimated Tax Payment for Individuals, officially known as Form 1040ES, is designed for taxpayers who expect to owe tax of one thousand dollars or more when filing their annual return. This form allows individuals to make quarterly estimated tax payments to avoid penalties for underpayment at the end of the tax year. It is essential for self-employed individuals, retirees, and those with significant income not subject to withholding.

Steps to Complete the Maine Estimated Tax Payment Form

To complete the Maine Estimated Tax Payment Form 1040ES, follow these steps:

- Gather your financial information, including income sources and deductions.

- Calculate your expected tax liability for the year.

- Determine your estimated payments based on your expected tax liability.

- Fill out the Form 1040ES, providing your personal information and estimated payment amounts.

- Submit the form by the appropriate deadline, either online or via mail.

Filing Deadlines for Estimated Tax Payments

It is crucial to adhere to the filing deadlines for estimated tax payments to avoid penalties. For the state of Maine, estimated tax payments are generally due on the fifteenth day of April, June, September, and January of the following year. If the due date falls on a weekend or holiday, the deadline is extended to the next business day.

Required Documents for Filing

When preparing to file your Maine Estimated Tax Payment, ensure you have the following documents ready:

- Previous year’s tax return for reference.

- Documentation of all income sources, including W-2s and 1099s.

- Records of any deductions or credits you plan to claim.

- Form 1040ES itself, which can be obtained online or through tax professionals.

Legal Use of the Maine Estimated Tax Payment Form

The Maine Estimated Tax Payment Form is legally required for individuals who expect to owe taxes at the end of the year. Filing this form ensures compliance with state tax laws and helps in managing tax liabilities effectively. Failure to file can result in penalties and interest on unpaid taxes.

Examples of Taxpayer Scenarios

Different taxpayer scenarios can affect the need for estimated tax payments. For instance:

- Self-employed individuals must make estimated payments since taxes are not withheld from their income.

- Retirees receiving pension or annuity payments may need to file if their withholding is insufficient.

- Individuals with significant investment income may also find themselves needing to make estimated payments.

Create this form in 5 minutes or less

Find and fill out the correct state of maine estimated tax for individuals form 1040es me

Create this form in 5 minutes!

How to create an eSignature for the state of maine estimated tax for individuals form 1040es me

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for making a Maine estimated tax payment?

To make a Maine estimated tax payment, you can use the Maine Revenue Services online portal or mail a check with the appropriate form. It's important to calculate your estimated tax accurately to avoid penalties. Using airSlate SignNow can streamline the document signing process for any related forms.

-

How can airSlate SignNow help with Maine estimated tax payment documentation?

airSlate SignNow allows you to easily create, send, and eSign documents related to your Maine estimated tax payment. This ensures that all your paperwork is organized and securely stored. The platform's user-friendly interface makes it simple to manage your tax documents efficiently.

-

Are there any fees associated with making a Maine estimated tax payment?

While the Maine Revenue Services does not charge a fee for making an estimated tax payment, there may be fees associated with using third-party services. airSlate SignNow offers a cost-effective solution for managing your tax documents, ensuring you can focus on your payments without additional costs.

-

What features does airSlate SignNow offer for tax professionals handling Maine estimated tax payments?

airSlate SignNow provides features like document templates, bulk sending, and real-time tracking, which are beneficial for tax professionals managing Maine estimated tax payments. These tools enhance efficiency and ensure that all documents are signed and submitted on time. Additionally, the platform integrates seamlessly with other accounting software.

-

Can I integrate airSlate SignNow with my accounting software for Maine estimated tax payments?

Yes, airSlate SignNow can be integrated with various accounting software to streamline your Maine estimated tax payment process. This integration allows for automatic document generation and easy access to signed documents. It helps maintain accurate records and simplifies tax preparation.

-

What are the benefits of using airSlate SignNow for Maine estimated tax payments?

Using airSlate SignNow for your Maine estimated tax payments offers numerous benefits, including time savings and enhanced security. The platform ensures that your documents are signed quickly and stored securely, reducing the risk of lost paperwork. Additionally, it provides a clear audit trail for all transactions.

-

How does airSlate SignNow ensure the security of my Maine estimated tax payment documents?

airSlate SignNow employs advanced encryption and security protocols to protect your Maine estimated tax payment documents. All data is stored securely, and access is restricted to authorized users only. This commitment to security helps you feel confident in managing sensitive tax information.

Get more for State Of Maine Estimated Tax For Individuals Form 1040es me

- Ky deed search form

- Form landlord tenant 481369907

- Missouri missouri limited liability company llc formation package

- Texas pllc 481369911 form

- Texas managing conservator form

- Florida trust search form

- Utah wills last form

- New jersey mutual wills package with last wills and testaments for married couple with minor children form

Find out other State Of Maine Estimated Tax For Individuals Form 1040es me

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors