Hawaii State Tax Forms

What are Hawaii State Tax Forms?

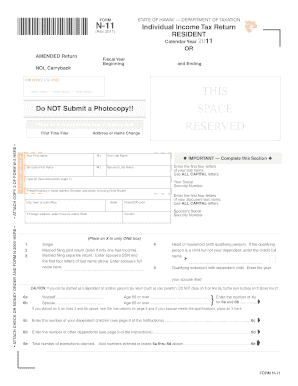

Hawaii State Tax Forms are official documents used by residents and businesses in Hawaii to report income, calculate taxes owed, and claim deductions or credits. These forms are essential for compliance with state tax laws and vary depending on the type of taxpayer, such as individual filers, corporations, or partnerships. Common forms include the Hawaii Individual Income Tax Return (Form N-11) and the Hawaii Corporate Income Tax Return (Form N-30). Understanding the purpose and requirements of each form is crucial for accurate tax filing.

How to Obtain Hawaii State Tax Forms

Hawaii State Tax Forms can be obtained through several methods. The most convenient way is to visit the official website of the Hawaii Department of Taxation, where forms are available for download in PDF format. Alternatively, taxpayers can request forms to be mailed to them by contacting the department directly. Local tax offices may also provide physical copies of the necessary forms. Ensuring you have the correct form for your specific tax situation is important for compliance.

Steps to Complete Hawaii State Tax Forms

Completing Hawaii State Tax Forms involves several steps to ensure accuracy and compliance. First, gather all necessary documents, such as W-2s, 1099s, and any other income statements. Next, determine the correct form based on your filing status and income type. Fill out the form carefully, following the provided instructions for each section. After completing the form, review it for any errors or omissions. Finally, sign and date the form before submitting it to the appropriate tax authority.

Filing Deadlines and Important Dates

Filing deadlines for Hawaii State Tax Forms typically align with federal tax deadlines. For individual taxpayers, the deadline is usually April 20 of each year. However, extensions may be available, allowing additional time to file, though any taxes owed must still be paid by the original deadline to avoid penalties. Businesses may have different deadlines depending on their tax structure. Keeping track of these important dates helps ensure timely compliance with state tax obligations.

Form Submission Methods

Hawaii State Tax Forms can be submitted through various methods, including online filing, mail, or in-person submission. Online filing is often the most efficient option, allowing for immediate processing and confirmation. For those who prefer traditional methods, forms can be mailed to the Hawaii Department of Taxation or submitted in person at designated tax offices. It is important to choose a submission method that aligns with your comfort level and ensures timely processing of your tax return.

Legal Use of Hawaii State Tax Forms

The legal use of Hawaii State Tax Forms is governed by state tax laws and regulations. These forms must be completed accurately and submitted by the specified deadlines to avoid penalties. Taxpayers are legally obligated to report all income and claim only eligible deductions or credits. Misuse or fraudulent reporting can result in significant legal consequences, including fines or criminal charges. Understanding the legal implications of tax filing is essential for all taxpayers in Hawaii.

Key Elements of Hawaii State Tax Forms

Key elements of Hawaii State Tax Forms include personal identification information, income details, deductions, and credits. Each form typically requires the taxpayer's name, address, and Social Security number. Income sections must accurately reflect all sources of income, while deductions and credits must be claimed according to state guidelines. Familiarity with these elements ensures that taxpayers provide the necessary information for accurate tax calculations and compliance with state laws.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the hawaii state tax forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Hawaii State Tax Forms?

Hawaii State Tax Forms are official documents required for filing state taxes in Hawaii. These forms include various tax returns and schedules that individuals and businesses must complete to report their income and calculate their tax liabilities. Using airSlate SignNow, you can easily access and eSign these forms, ensuring a smooth filing process.

-

How can airSlate SignNow help with Hawaii State Tax Forms?

airSlate SignNow simplifies the process of managing Hawaii State Tax Forms by allowing users to electronically sign and send documents securely. Our platform ensures that all forms are completed accurately and submitted on time, reducing the risk of errors. Additionally, you can track the status of your documents in real-time.

-

Are there any costs associated with using airSlate SignNow for Hawaii State Tax Forms?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our plans are designed to be cost-effective, providing access to essential features for managing Hawaii State Tax Forms without breaking the bank. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for Hawaii State Tax Forms?

airSlate SignNow provides a range of features for managing Hawaii State Tax Forms, including eSignature capabilities, document templates, and secure cloud storage. These features streamline the process of preparing and submitting tax forms, making it easier for users to stay organized and compliant. Our user-friendly interface enhances the overall experience.

-

Can I integrate airSlate SignNow with other software for Hawaii State Tax Forms?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to connect your existing tools for managing Hawaii State Tax Forms. This integration capability enhances workflow efficiency and ensures that all your documents are synchronized across platforms, saving you time and effort.

-

Is airSlate SignNow secure for handling Hawaii State Tax Forms?

Yes, airSlate SignNow prioritizes security and compliance when handling Hawaii State Tax Forms. Our platform uses advanced encryption and security protocols to protect your sensitive information. You can trust that your documents are safe and secure while using our eSigning services.

-

How can I get started with airSlate SignNow for Hawaii State Tax Forms?

Getting started with airSlate SignNow for Hawaii State Tax Forms is easy! Simply sign up for an account on our website, choose a pricing plan that suits your needs, and start uploading your tax forms. Our intuitive platform will guide you through the process of eSigning and submitting your documents.

Get more for Hawaii State Tax Forms

Find out other Hawaii State Tax Forms

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement