High Balance Loan Feature Form

What is the High Balance Loan Feature

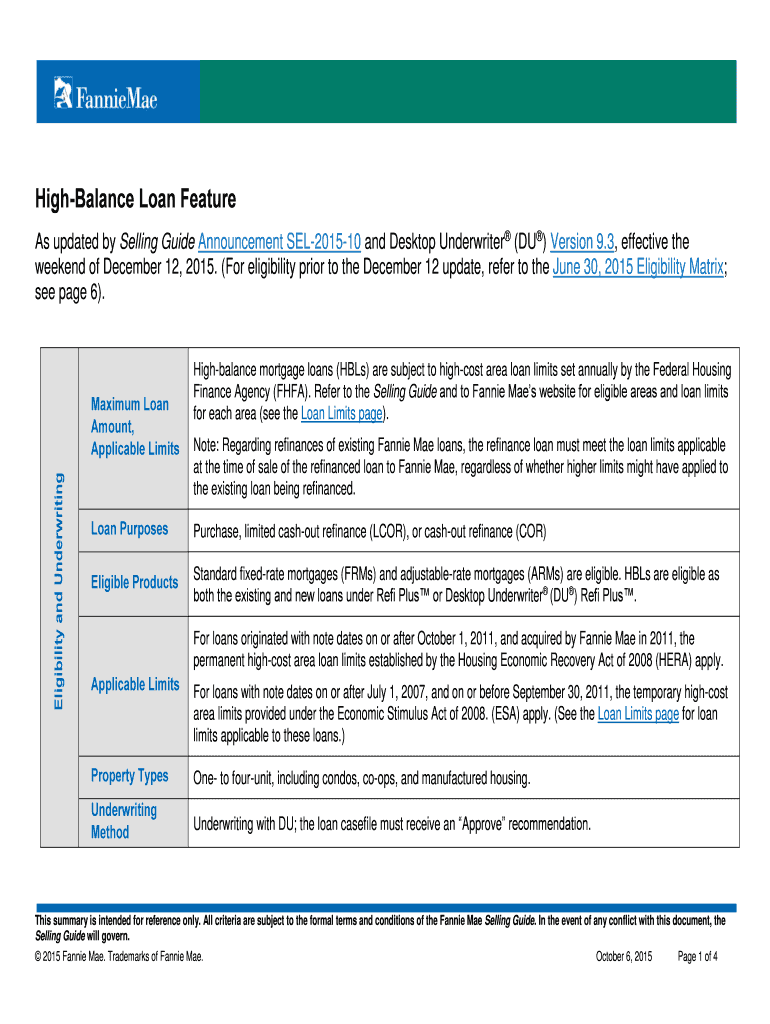

The High Balance Loan Feature allows borrowers to access larger loan amounts than standard limits, typically in high-cost areas. This feature is especially beneficial for homebuyers in regions where property prices exceed conventional loan limits. By utilizing this feature, borrowers can secure financing that aligns with the market rates of their specific locations, making homeownership more attainable.

How to use the High Balance Loan Feature

Using the High Balance Loan Feature involves several steps. First, potential borrowers should assess their financial situation and determine the loan amount needed. Next, they should consult with a mortgage lender who offers this feature. The lender will guide them through the application process, which includes submitting necessary documentation and undergoing a credit evaluation. Once approved, borrowers can use the funds to purchase or refinance a property within the designated high-cost area.

Eligibility Criteria

To qualify for the High Balance Loan Feature, borrowers typically need to meet specific eligibility criteria. These may include having a stable income, a satisfactory credit score, and a manageable debt-to-income ratio. Additionally, the property must be located in a high-cost area as defined by the Federal Housing Finance Agency. Understanding these criteria is crucial for prospective borrowers to ensure they meet the necessary requirements before applying.

Steps to complete the High Balance Loan Feature

Completing the High Balance Loan Feature involves a series of systematic steps:

- Evaluate your financial health and determine the loan amount you need.

- Research lenders who offer the High Balance Loan Feature.

- Gather necessary documentation, including income verification and credit history.

- Submit your application to the chosen lender.

- Await approval and review the loan terms provided by the lender.

- Finalize the loan agreement and complete any required closing procedures.

Key elements of the High Balance Loan Feature

Several key elements define the High Balance Loan Feature. These include the maximum loan limits, which vary by county and are set to reflect local housing market conditions. Additionally, the interest rates may differ from standard loans, and borrowers should be aware of any associated fees. Understanding these elements helps borrowers make informed decisions regarding their financing options.

Examples of using the High Balance Loan Feature

Practical examples of the High Balance Loan Feature can illustrate its benefits. For instance, a family looking to purchase a home in San Francisco may find that the average property price exceeds conventional loan limits. By utilizing the High Balance Loan Feature, they can secure a loan that allows them to purchase a suitable home without compromising on their needs. Similarly, a homeowner in a high-cost area may use this feature to refinance their existing mortgage, potentially lowering their monthly payments and accessing equity.

Quick guide on how to complete high balance loan feature

Effortlessly Prepare High Balance Loan Feature on Any Device

Managing documents online has become increasingly favored by organizations and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can access the correct template and securely keep it online. airSlate SignNow provides all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Handle High Balance Loan Feature on any system with the airSlate SignNow applications for Android or iOS and streamline any document-related task today.

How to Modify and eSign High Balance Loan Feature with Ease

- Find High Balance Loan Feature and click Get Form to begin.

- Utilize the tools available to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Select how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, cumbersome form searching, or errors that necessitate reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign High Balance Loan Feature and ensure exceptional communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the high balance loan feature

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the High Balance Loan Feature in airSlate SignNow?

The High Balance Loan Feature in airSlate SignNow allows businesses to manage larger loan amounts efficiently. This feature streamlines the documentation process, ensuring that all necessary forms are completed and signed electronically. It is designed to enhance the user experience for both lenders and borrowers.

-

How does the High Balance Loan Feature benefit my business?

Utilizing the High Balance Loan Feature can signNowly reduce the time spent on paperwork, allowing your team to focus on closing deals. It also minimizes errors associated with manual processes, ensuring that all documents are accurate and compliant. This leads to improved customer satisfaction and faster loan processing times.

-

Is there an additional cost for using the High Balance Loan Feature?

The High Balance Loan Feature is included in the standard pricing plans of airSlate SignNow, making it a cost-effective solution for businesses. There are no hidden fees, and you can take advantage of this feature without worrying about extra charges. This transparency helps you budget effectively for your document management needs.

-

Can I integrate the High Balance Loan Feature with other software?

Yes, the High Balance Loan Feature can be seamlessly integrated with various CRM and financial software solutions. This integration allows for a smoother workflow, as you can manage your documents and loan processes from a single platform. It enhances productivity and ensures that all your systems work together efficiently.

-

What types of documents can I manage with the High Balance Loan Feature?

With the High Balance Loan Feature, you can manage a variety of loan-related documents, including applications, agreements, and disclosures. The feature supports multiple document formats, ensuring that you can handle all necessary paperwork electronically. This flexibility helps streamline your loan processing operations.

-

How secure is the High Balance Loan Feature?

The High Balance Loan Feature is built with robust security measures to protect sensitive information. airSlate SignNow employs encryption and secure access protocols to ensure that all documents are safe from unauthorized access. You can trust that your data is secure while using this feature for your loan management.

-

Can I track the status of documents sent using the High Balance Loan Feature?

Absolutely! The High Balance Loan Feature includes tracking capabilities that allow you to monitor the status of documents in real-time. You will receive notifications when documents are viewed, signed, or completed, providing you with full visibility throughout the loan process. This feature enhances communication and accountability.

Get more for High Balance Loan Feature

Find out other High Balance Loan Feature

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template