Small Business Tax Preparation Checklist Daveramsey Com Form

What is the Small business Tax Preparation Checklist Daveramsey com

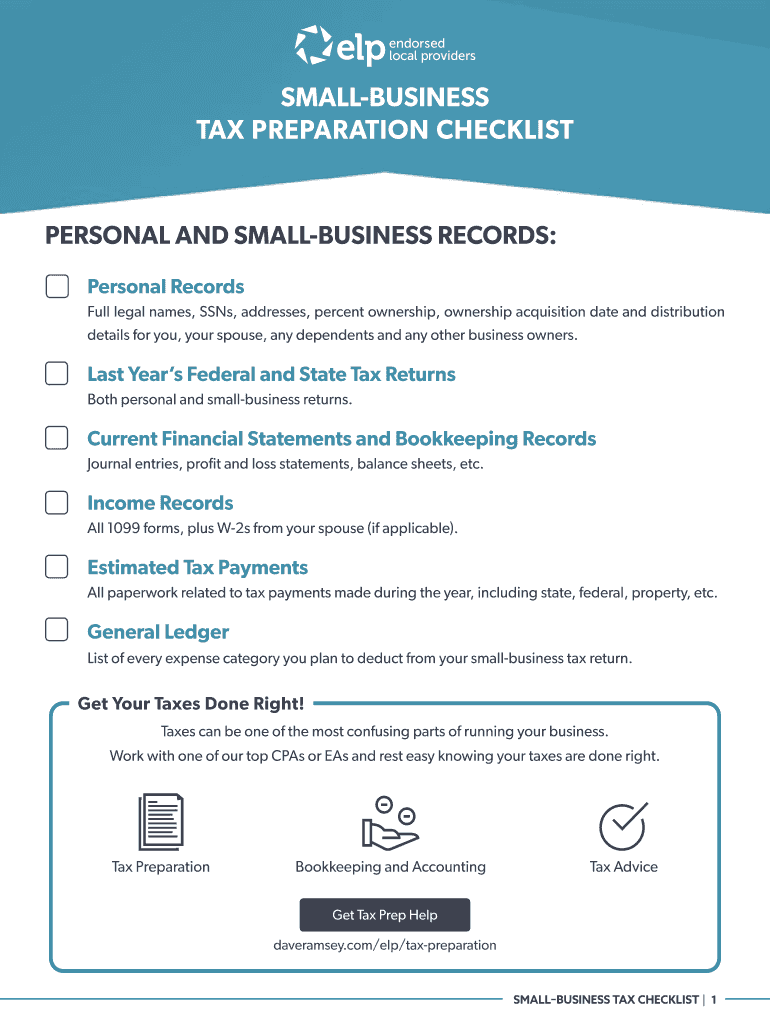

The Small business Tax Preparation Checklist from Daveramsey.com is a comprehensive guide designed to assist small business owners in preparing their taxes efficiently. This checklist outlines essential tasks and documents needed for accurate tax filing, ensuring that all necessary information is gathered and organized. It serves as a valuable resource for navigating the complexities of tax preparation, helping business owners stay compliant with IRS regulations while maximizing potential deductions.

Key elements of the Small business Tax Preparation Checklist Daveramsey com

The checklist includes several critical components that small business owners should consider during tax preparation. Key elements typically encompass:

- Income documentation, including sales records and bank statements.

- Expense records, such as receipts for business-related purchases.

- Payroll information for employees, including W-2 and 1099 forms.

- Tax forms specific to the business structure, such as Schedule C for sole proprietorships.

- Information regarding any applicable tax credits or deductions.

By ensuring all these elements are accounted for, business owners can streamline their tax preparation process and reduce the risk of errors.

Steps to complete the Small business Tax Preparation Checklist Daveramsey com

Completing the Small business Tax Preparation Checklist involves several systematic steps:

- Gather all necessary financial documents, including income and expense records.

- Review the checklist to ensure all required forms and information are included.

- Organize documents by category, such as income, expenses, and payroll.

- Consult with a tax professional if needed to clarify any complex issues.

- Complete the necessary tax forms based on the gathered information.

- Review the completed forms for accuracy before submission.

- Submit the forms through the appropriate channels, whether online or via mail.

Following these steps can help ensure a thorough and accurate tax preparation process.

Required Documents

To effectively use the Small business Tax Preparation Checklist, certain documents are essential. These documents typically include:

- Bank statements that reflect business income and expenses.

- Invoices and receipts for all business-related purchases.

- Payroll records, including W-2 forms for employees and 1099 forms for independent contractors.

- Previous year’s tax return for reference and consistency.

- Any relevant tax credits or deductions documentation.

Having these documents readily available can significantly simplify the tax preparation process.

IRS Guidelines

Understanding IRS guidelines is crucial for small business owners when preparing taxes. The IRS provides specific instructions regarding:

- Filing requirements based on business structure and income level.

- Deadlines for submitting tax forms to avoid penalties.

- Recordkeeping requirements to substantiate income and deductions.

- Eligibility for various tax credits and deductions available to small businesses.

Staying informed about these guidelines helps ensure compliance and can lead to potential tax savings.

Filing Deadlines / Important Dates

Being aware of filing deadlines is essential for small business owners to avoid penalties. Key dates generally include:

- March 15 for S Corporations and partnerships.

- April 15 for sole proprietorships and single-member LLCs.

- Extensions available, typically until September 15 or October 15, depending on the business structure.

Marking these dates on a calendar can help ensure timely submission of tax forms.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the small business tax preparation checklist daveramsey com

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Small business Tax Preparation Checklist Daveramsey com?

The Small business Tax Preparation Checklist Daveramsey com is a comprehensive guide designed to help small business owners prepare for tax season efficiently. It outlines essential documents and steps needed to ensure a smooth tax filing process. By following this checklist, you can minimize errors and maximize deductions.

-

How can airSlate SignNow assist with the Small business Tax Preparation Checklist Daveramsey com?

airSlate SignNow streamlines the document signing process, making it easier to manage the paperwork required for the Small business Tax Preparation Checklist Daveramsey com. With our platform, you can quickly send, sign, and store important tax documents securely. This saves time and reduces the stress associated with tax preparation.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes. Our plans are designed to provide cost-effective solutions for managing documents, including those related to the Small business Tax Preparation Checklist Daveramsey com. You can choose a plan that best fits your needs and budget.

-

What features does airSlate SignNow offer for tax preparation?

airSlate SignNow includes features such as eSignature, document templates, and secure cloud storage, all of which are beneficial for the Small business Tax Preparation Checklist Daveramsey com. These features help you organize your documents, ensure compliance, and facilitate easy collaboration with your accountant or tax professional.

-

Are there any integrations available with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various accounting and productivity tools, enhancing your experience with the Small business Tax Preparation Checklist Daveramsey com. These integrations allow you to sync your documents and data effortlessly, ensuring that all your tax-related information is in one place.

-

How does airSlate SignNow ensure document security?

Security is a top priority at airSlate SignNow. We use advanced encryption and secure cloud storage to protect your documents, including those related to the Small business Tax Preparation Checklist Daveramsey com. This ensures that your sensitive tax information remains confidential and secure.

-

Can I access airSlate SignNow on mobile devices?

Absolutely! airSlate SignNow is accessible on mobile devices, allowing you to manage your documents on the go. This is particularly useful for small business owners who need to refer to the Small business Tax Preparation Checklist Daveramsey com while away from their desks.

Get more for Small business Tax Preparation Checklist Daveramsey com

- Training employment pass application form

- Editable customizable grocery list template form

- Ap biology chapter 10 reading guide answers form

- Although worksheet form

- Request for evidence of insurance template 215903100 form

- Elementary drawing exam papers pdf form

- Seiu509 form

- Dan kennedy newsletter pdf form

Find out other Small business Tax Preparation Checklist Daveramsey com

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later