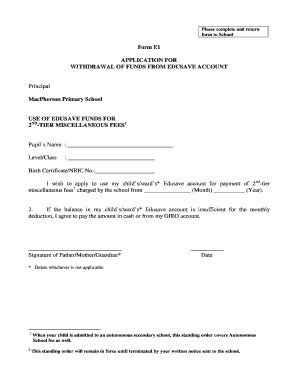

Form E1 APPLICATION for WITHDRAWAL of FUNDS

Understanding the Form E1 APPLICATION FOR WITHDRAWAL OF FUNDS

The Form E1 APPLICATION FOR WITHDRAWAL OF FUNDS is a crucial document used primarily in financial transactions where individuals or entities request the withdrawal of funds from a specific account or fund. This form is often utilized in various contexts, including investment accounts, retirement plans, and other financial instruments. Proper completion of this form ensures that the withdrawal request is processed efficiently and in compliance with applicable regulations.

Steps to Complete the Form E1 APPLICATION FOR WITHDRAWAL OF FUNDS

Completing the Form E1 APPLICATION FOR WITHDRAWAL OF FUNDS involves several key steps:

- Gather necessary information: Collect all relevant details, including account numbers, withdrawal amounts, and personal identification.

- Fill out the form: Accurately enter the required information in the designated fields, ensuring clarity and correctness.

- Review your entries: Double-check all information for accuracy to avoid processing delays.

- Sign and date the form: Ensure that you provide your signature, as this is essential for the validation of the request.

- Submit the form: Follow the specified submission method, whether online, by mail, or in person, as outlined by the issuing authority.

Legal Use of the Form E1 APPLICATION FOR WITHDRAWAL OF FUNDS

The legal use of the Form E1 APPLICATION FOR WITHDRAWAL OF FUNDS is governed by financial regulations and institutional policies. It is essential to ensure that the form is used in accordance with the laws applicable to the specific financial context. Misuse or fraudulent completion of this form can lead to legal repercussions, including penalties or denial of the withdrawal request. Understanding the legal framework surrounding this form is critical for compliance and protection of one’s financial interests.

Key Elements of the Form E1 APPLICATION FOR WITHDRAWAL OF FUNDS

Several key elements must be included in the Form E1 APPLICATION FOR WITHDRAWAL OF FUNDS to ensure its validity:

- Personal information: Name, address, and contact details of the individual or entity requesting the withdrawal.

- Account details: Specific account numbers and types of accounts from which funds are being withdrawn.

- Withdrawal amount: The exact amount of money being requested for withdrawal.

- Reason for withdrawal: A brief explanation of the purpose of the withdrawal may be required.

- Signature: The form must be signed by the account holder or authorized representative.

Required Documents for the Form E1 APPLICATION FOR WITHDRAWAL OF FUNDS

When submitting the Form E1 APPLICATION FOR WITHDRAWAL OF FUNDS, certain documents may be required to support the request. These typically include:

- Proof of identity, such as a government-issued ID.

- Account statements or documentation verifying the account ownership.

- Any additional forms or documentation specified by the financial institution.

Form Submission Methods

The Form E1 APPLICATION FOR WITHDRAWAL OF FUNDS can generally be submitted through various methods, depending on the policies of the issuing institution. Common submission methods include:

- Online submission: Many institutions offer a secure online portal for submitting forms electronically.

- Mail: The completed form can often be sent via postal service to the designated address provided by the financial institution.

- In-person submission: Individuals may also choose to deliver the form directly to a branch or office location.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form e1 application for withdrawal of funds

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form E1 APPLICATION FOR WITHDRAWAL OF FUNDS?

The Form E1 APPLICATION FOR WITHDRAWAL OF FUNDS is a document used to request the withdrawal of funds from a specific account. This form is essential for ensuring that the withdrawal process is compliant with regulatory requirements. By using airSlate SignNow, you can easily fill out and eSign this form, streamlining your financial transactions.

-

How can airSlate SignNow help with the Form E1 APPLICATION FOR WITHDRAWAL OF FUNDS?

airSlate SignNow provides a user-friendly platform to create, send, and eSign the Form E1 APPLICATION FOR WITHDRAWAL OF FUNDS. Our solution simplifies the process, allowing you to manage your documents efficiently and securely. With our features, you can ensure that your withdrawal requests are processed quickly and accurately.

-

Is there a cost associated with using airSlate SignNow for the Form E1 APPLICATION FOR WITHDRAWAL OF FUNDS?

Yes, there is a cost associated with using airSlate SignNow, but we offer competitive pricing plans that cater to various business needs. Our pricing is designed to be cost-effective, especially for businesses that frequently handle documents like the Form E1 APPLICATION FOR WITHDRAWAL OF FUNDS. You can choose a plan that best fits your requirements and budget.

-

What features does airSlate SignNow offer for the Form E1 APPLICATION FOR WITHDRAWAL OF FUNDS?

airSlate SignNow offers a range of features for the Form E1 APPLICATION FOR WITHDRAWAL OF FUNDS, including customizable templates, secure eSigning, and document tracking. These features enhance the efficiency of your withdrawal process and ensure that all necessary steps are completed. Additionally, our platform allows for easy collaboration among team members.

-

Can I integrate airSlate SignNow with other applications for the Form E1 APPLICATION FOR WITHDRAWAL OF FUNDS?

Absolutely! airSlate SignNow supports integrations with various applications, making it easy to manage the Form E1 APPLICATION FOR WITHDRAWAL OF FUNDS alongside your existing tools. This integration capability allows for seamless workflows and enhances productivity by connecting your document management processes with other business applications.

-

What are the benefits of using airSlate SignNow for the Form E1 APPLICATION FOR WITHDRAWAL OF FUNDS?

Using airSlate SignNow for the Form E1 APPLICATION FOR WITHDRAWAL OF FUNDS offers numerous benefits, including increased efficiency, reduced processing time, and enhanced security. Our platform ensures that your documents are handled with care and compliance, allowing you to focus on your core business activities. Additionally, the ease of use makes it accessible for all team members.

-

How secure is the airSlate SignNow platform for handling the Form E1 APPLICATION FOR WITHDRAWAL OF FUNDS?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption and security protocols to protect your documents, including the Form E1 APPLICATION FOR WITHDRAWAL OF FUNDS. You can trust that your sensitive information is safe while using our services, ensuring peace of mind during your financial transactions.

Get more for Form E1 APPLICATION FOR WITHDRAWAL OF FUNDS

- Aha acls roster form

- Psychological checklist form

- Additional signature addendum form

- Sonyma form r7 12 14

- Example alphanumeric outline form

- Form i 601 instructions for application for waiver of

- Form i 918 supplement b u nonimmigrant status certification form i 918 supplement b u nonimmigrant status certification

- Form i 918 supplement a petition for qualifying family member of u 1 recipient form i 918 supplement a petition for qualifying

Find out other Form E1 APPLICATION FOR WITHDRAWAL OF FUNDS

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself