VR 299 VR 299 2020-2026

What is the VR 299 VR 299

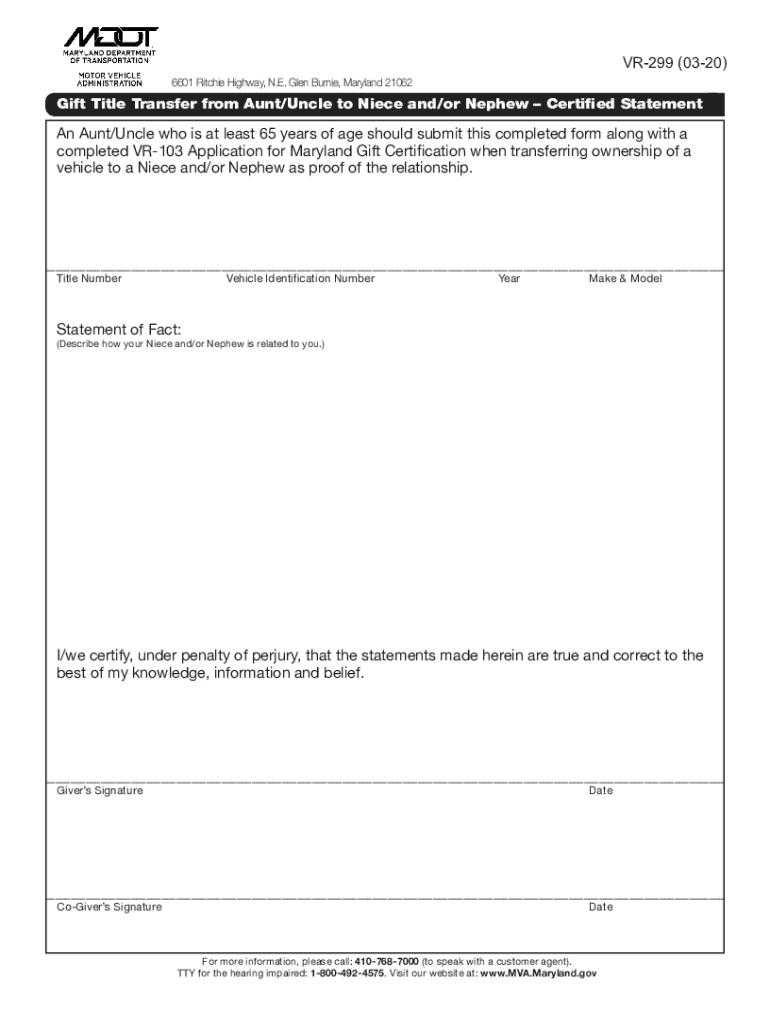

The VR 299 is a specific form used in various legal and administrative contexts. It is primarily associated with the documentation required for vehicle registration and title transfers in certain jurisdictions. This form captures essential information about the vehicle, including its identification number, ownership details, and any liens that may exist. Understanding the purpose of the VR 299 is crucial for individuals and businesses involved in vehicle transactions.

How to use the VR 299 VR 299

Using the VR 299 involves several straightforward steps. First, ensure you have all necessary information about the vehicle and its ownership. This includes the Vehicle Identification Number (VIN), the previous owner's details, and any relevant lien information. Once you have gathered this data, complete the form accurately, ensuring all fields are filled out correctly. After completing the form, you can submit it to the appropriate state agency, either online or via mail, depending on your state's regulations.

Steps to complete the VR 299 VR 299

Completing the VR 299 requires careful attention to detail. Follow these steps for accurate submission:

- Gather required documents, including the vehicle title and identification.

- Fill out the form with accurate information, ensuring all sections are completed.

- Review the form for any errors or omissions.

- Submit the completed form to your local Department of Motor Vehicles (DMV) or equivalent agency.

Legal use of the VR 299 VR 299

The VR 299 serves a legal purpose in vehicle registration and title transfer processes. It is essential for ensuring that ownership is accurately recorded and that any liens are disclosed. Failing to use the form correctly can lead to legal complications, including disputes over vehicle ownership or issues with financing. Therefore, understanding the legal implications of the VR 299 is vital for compliance and protection of rights.

Who Issues the Form

The VR 299 is typically issued by state motor vehicle departments or equivalent regulatory agencies. These organizations are responsible for overseeing vehicle registrations, titles, and related documentation. Each state may have its own version of the form, but the core purpose remains consistent across jurisdictions. It is important to obtain the correct version of the VR 299 from your state's official resources to ensure compliance.

Required Documents

When completing the VR 299, several documents are typically required to support your application. These may include:

- The original vehicle title or a copy, if applicable.

- Proof of identification, such as a driver's license or state ID.

- Any lien release documents, if the vehicle is financed.

- Proof of residency, if required by your state.

Filing Deadlines / Important Dates

Filing deadlines for the VR 299 can vary by state and the specific circumstances of the vehicle transaction. It is crucial to be aware of any deadlines to avoid penalties or complications. Typically, vehicle registration must be completed within a certain period after purchase or transfer of ownership, often within thirty days. Check with your local motor vehicle department for specific deadlines relevant to your situation.

Create this form in 5 minutes or less

Find and fill out the correct vr 299 vr 299

Create this form in 5 minutes!

How to create an eSignature for the vr 299 vr 299

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is VR 299 VR 299?

VR 299 VR 299 is an advanced eSignature solution offered by airSlate SignNow. It allows businesses to send, sign, and manage documents electronically, streamlining the signing process and enhancing productivity.

-

How much does VR 299 VR 299 cost?

The pricing for VR 299 VR 299 is competitive and designed to fit various business needs. You can choose from different plans based on your usage, ensuring you get the best value for your investment in eSignature technology.

-

What features does VR 299 VR 299 offer?

VR 299 VR 299 includes features such as customizable templates, real-time tracking, and secure cloud storage. These features make it easy for businesses to manage their documents efficiently while ensuring compliance and security.

-

How can VR 299 VR 299 benefit my business?

By using VR 299 VR 299, your business can save time and reduce costs associated with traditional paper-based processes. The solution enhances collaboration and speeds up the signing process, allowing you to close deals faster.

-

Is VR 299 VR 299 easy to integrate with other tools?

Yes, VR 299 VR 299 is designed to integrate seamlessly with various business applications. This flexibility allows you to incorporate eSigning into your existing workflows without disruption, enhancing overall efficiency.

-

Can I use VR 299 VR 299 on mobile devices?

Absolutely! VR 299 VR 299 is mobile-friendly, enabling users to send and sign documents from their smartphones or tablets. This convenience ensures that you can manage your documents on the go, increasing accessibility.

-

What security measures are in place for VR 299 VR 299?

VR 299 VR 299 prioritizes security with features like encryption and secure access controls. These measures protect your sensitive documents and ensure that your eSignature process complies with industry standards.

Get more for VR 299 VR 299

- Answer to complaint for eviction expedited proceedings form

- Idaho eviction writ of resititution form

- Illinois request for name change additional children form

- Illinois publication notice of court date for request for name change adult form

- Illinois uniform order for support

- Cook county uniform order for support

- Supreme court rule 10 101 illinois courts form

- N 649 form

Find out other VR 299 VR 299

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure