Clergy Housing Allowance Worksheet Form

What is the Clergy Housing Allowance Worksheet

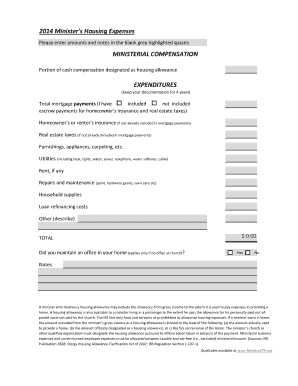

The Clergy Housing Allowance Worksheet is a crucial document for clergy members in the United States. It helps determine the amount of housing allowance that can be excluded from taxable income. This worksheet is essential for ensuring that clergy can accurately report their housing expenses, which may include rent, mortgage payments, utilities, and maintenance costs. By using this worksheet, clergy can maximize their tax benefits while remaining compliant with IRS regulations.

How to use the Clergy Housing Allowance Worksheet

Using the Clergy Housing Allowance Worksheet involves several straightforward steps. First, gather all relevant financial documents, such as receipts and statements for housing-related expenses. Next, fill in the sections of the worksheet that pertain to your actual housing costs. Be sure to include all eligible expenses, as this will impact the total amount you can exclude from your taxable income. Once completed, review the worksheet for accuracy and retain a copy for your records, as it may be needed for future tax filings.

Steps to complete the Clergy Housing Allowance Worksheet

Completing the Clergy Housing Allowance Worksheet requires careful attention to detail. Begin by entering your total housing expenses in the designated sections. This includes your rent or mortgage, property taxes, and any additional costs related to your housing. After listing these expenses, calculate the total amount and ensure it aligns with your financial records. Finally, sign and date the worksheet to certify its accuracy. It is advisable to consult a tax professional if you have questions about specific entries or IRS guidelines.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the Clergy Housing Allowance Worksheet. According to IRS regulations, clergy members can exclude a portion of their housing allowance from taxable income, provided it is used for qualified housing expenses. It is important to adhere to these guidelines to avoid potential penalties. Familiarizing yourself with IRS Publication 517 can offer further insights into the allowances and exclusions applicable to clergy members.

Eligibility Criteria

To qualify for using the Clergy Housing Allowance Worksheet, individuals must meet certain eligibility criteria. Primarily, the individual must be a recognized member of the clergy, which includes ministers, priests, rabbis, and similar religious leaders. Additionally, the housing allowance must be officially designated by the employing church or religious organization. Meeting these criteria is essential for ensuring compliance with tax regulations and maximizing potential tax benefits.

Required Documents

When preparing to complete the Clergy Housing Allowance Worksheet, specific documents are necessary. Essential documents include proof of housing expenses, such as lease agreements, mortgage statements, and utility bills. Additionally, any documentation that verifies the designation of the housing allowance by the religious organization should be included. Having these documents readily available will facilitate an accurate and efficient completion of the worksheet.

Examples of using the Clergy Housing Allowance Worksheet

Examples of using the Clergy Housing Allowance Worksheet can provide clarity on how to apply it effectively. For instance, if a clergy member pays a monthly rent of $1,200, they would total their rent payments for the year to report on the worksheet. If they also incur $300 monthly in utilities, these costs should be included as well. By compiling these figures, the clergy member can determine the total housing allowance to exclude from their taxable income, ensuring they maximize their tax benefits.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the clergy housing allowance worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a housing allowance worksheet?

A housing allowance worksheet is a tool used to calculate and document housing allowances for employees. It helps ensure that the allowances are compliant with tax regulations and accurately reflect the costs incurred by employees. Using a housing allowance worksheet can streamline the process of managing employee benefits.

-

How can airSlate SignNow help with housing allowance worksheets?

airSlate SignNow provides an easy-to-use platform for creating, sending, and eSigning housing allowance worksheets. With its intuitive interface, you can quickly customize your worksheets to meet your specific needs. This not only saves time but also enhances accuracy in your documentation process.

-

Is there a cost associated with using airSlate SignNow for housing allowance worksheets?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan includes features that support the creation and management of housing allowance worksheets. You can choose a plan that fits your budget while still benefiting from our comprehensive eSigning solutions.

-

What features does airSlate SignNow offer for housing allowance worksheets?

airSlate SignNow includes features such as customizable templates, real-time collaboration, and secure eSigning for housing allowance worksheets. These features ensure that your documents are not only professional but also compliant with legal standards. Additionally, you can track the status of your worksheets easily.

-

Can I integrate airSlate SignNow with other software for housing allowance worksheets?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to incorporate housing allowance worksheets into your existing workflows. Whether you use HR software or accounting tools, our platform can seamlessly connect to enhance your document management process.

-

What are the benefits of using airSlate SignNow for housing allowance worksheets?

Using airSlate SignNow for housing allowance worksheets provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. The platform allows for quick edits and approvals, ensuring that your housing allowances are processed promptly. This ultimately leads to improved employee satisfaction and streamlined operations.

-

How secure is airSlate SignNow when handling housing allowance worksheets?

Security is a top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect your housing allowance worksheets and sensitive data. You can trust that your documents are safe and secure while being processed through our platform.

Get more for Clergy Housing Allowance Worksheet

Find out other Clergy Housing Allowance Worksheet

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip