Fillable Online W as 2 Registration of Employer PDF 2019-2026

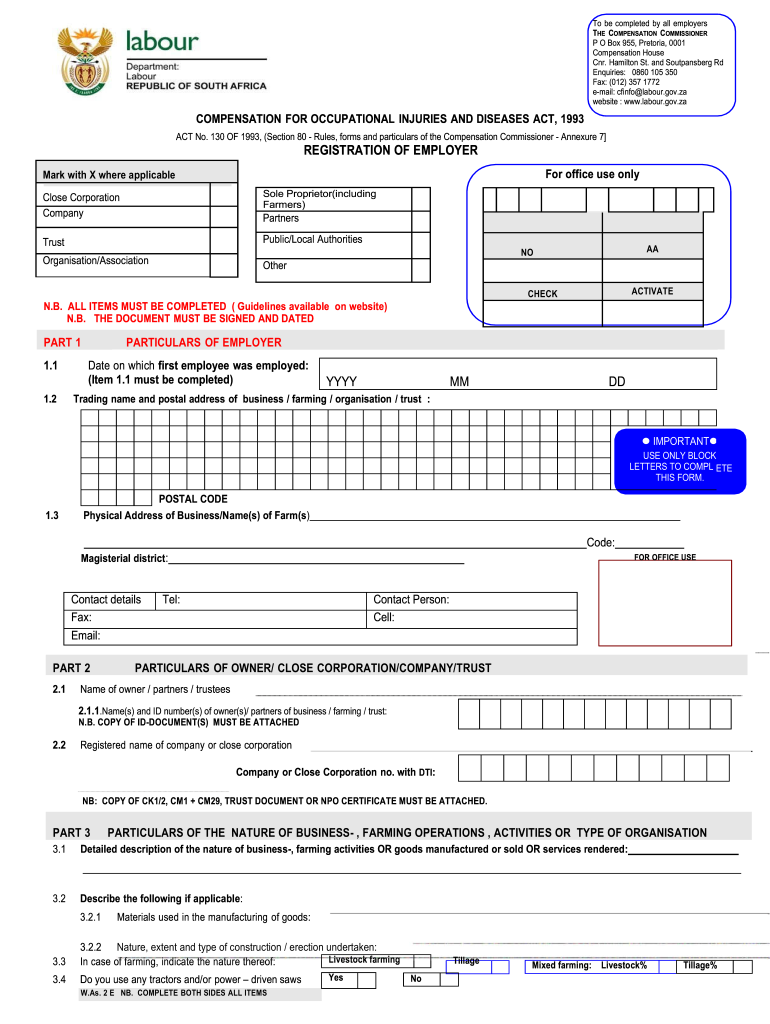

Understanding the COIDA Form

The COIDA form, officially known as the Compensation for Occupational Injuries and Diseases Act registration form, is essential for employers in the United States. This form facilitates the registration of employers with the relevant authorities to ensure compliance with occupational injury and disease compensation regulations. It serves as a critical document in the process of securing workers' compensation coverage, protecting both employees and employers in the event of workplace injuries.

Steps to Complete the COIDA Form

Filling out the COIDA form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information, including your business details, employee information, and any previous compensation claims. Follow these steps:

- Download the COIDA registration form from a reliable source.

- Carefully fill in your business name, address, and contact details.

- Provide information about the nature of your business and the number of employees.

- Review the completed form for accuracy before submission.

Once completed, the form should be submitted to the appropriate regulatory body for processing.

Required Documents for COIDA Registration

To successfully register using the COIDA form, certain documents are typically required. These may include:

- Proof of business registration and ownership.

- Details of your employees, including their roles and salaries.

- Any previous claims or compensation records, if applicable.

Having these documents ready will streamline the registration process and help avoid delays.

Legal Use of the COIDA Form

The COIDA form is legally binding and must be completed accurately to ensure compliance with state regulations. Employers are required to register to provide workers' compensation coverage for their employees. Failure to comply with these regulations can result in penalties, including fines and legal action. Understanding the legal implications of the COIDA form is crucial for maintaining a compliant and safe workplace.

Submission Methods for the COIDA Form

The COIDA form can typically be submitted through various methods, depending on the regulatory body overseeing workers' compensation in your state. Common submission methods include:

- Online submission through the official government portal.

- Mailing a hard copy of the completed form to the designated office.

- In-person submission at local regulatory offices.

Choosing the right submission method can help ensure that your registration is processed efficiently.

Penalties for Non-Compliance with COIDA Regulations

Employers who fail to register using the COIDA form or do not comply with the associated regulations may face significant penalties. These can include:

- Fines imposed by state authorities.

- Legal action from employees injured on the job.

- Increased insurance premiums due to non-compliance.

Understanding these potential consequences emphasizes the importance of timely and accurate registration.

Handy tips for filling out Fillable Online W AS 2 Registration Of Employer pdf online

Quick steps to complete and e-sign Fillable Online W AS 2 Registration Of Employer pdf online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing documents can be. Get access to a GDPR and HIPAA compliant platform for maximum efficiency. Use signNow to electronically sign and send out Fillable Online W AS 2 Registration Of Employer pdf for e-signing.

Create this form in 5 minutes or less

Find and fill out the correct fillable online w as 2 registration of employer pdf

Create this form in 5 minutes!

How to create an eSignature for the fillable online w as 2 registration of employer pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a coida form and why is it important?

A coida form is a document used for reporting workplace injuries and illnesses in compliance with the Compensation for Occupational Injuries and Diseases Act. It is crucial for ensuring that employees receive the necessary compensation and support after an incident. Using airSlate SignNow, you can easily create, send, and eSign coida forms to streamline the reporting process.

-

How does airSlate SignNow simplify the coida form process?

airSlate SignNow simplifies the coida form process by providing an intuitive platform for creating and managing documents. With features like templates, electronic signatures, and automated workflows, you can efficiently handle coida forms without the hassle of paper-based processes. This not only saves time but also reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for coida forms?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan includes features that facilitate the creation and management of coida forms, ensuring you get the best value for your investment. You can choose a plan that fits your budget while still benefiting from our comprehensive eSigning solutions.

-

Can I integrate airSlate SignNow with other software for managing coida forms?

Absolutely! airSlate SignNow offers seamless integrations with popular software applications, allowing you to manage coida forms alongside your existing tools. Whether you use CRM systems, project management software, or cloud storage solutions, our platform can enhance your workflow and improve efficiency.

-

What are the benefits of using airSlate SignNow for coida forms?

Using airSlate SignNow for coida forms provides numerous benefits, including faster processing times, reduced paperwork, and enhanced security. The platform ensures that your documents are securely stored and easily accessible, while electronic signatures expedite the approval process. This leads to improved compliance and better employee satisfaction.

-

How secure is the information on coida forms when using airSlate SignNow?

Security is a top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect the information on your coida forms. Additionally, our platform complies with industry standards to ensure that your sensitive data remains confidential and secure throughout the signing process.

-

Can I track the status of my coida forms with airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your coida forms in real-time. You can see when a document is sent, viewed, and signed, providing you with complete visibility throughout the process. This feature helps you stay organized and ensures that all necessary steps are completed promptly.

Get more for Fillable Online W AS 2 Registration Of Employer pdf

- Control number sd p004 pkg form

- Control number sd p006 pkg form

- From any insurance company with respect to any policy of health or medical insurance under form

- Taxessouth dakota department of revenue form

- Control number sd p008 pkg form

- Control number sd p009 pkg form

- Control number sd p011 pkg form

- Control number sd p012 pkg form

Find out other Fillable Online W AS 2 Registration Of Employer pdf

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure