Personal Overdraft Suncorp Form

Understanding the Personal Overdraft Suncorp

The Personal Overdraft Suncorp is a financial product designed to provide customers with access to additional funds when their account balance falls below zero. This service allows individuals to cover unexpected expenses or manage cash flow issues without the need for a separate loan. The overdraft facility is linked to a personal transaction account, enabling seamless access to funds while maintaining the convenience of everyday banking.

How to Use the Personal Overdraft Suncorp

Using the Personal Overdraft Suncorp is straightforward. Once approved, customers can withdraw funds beyond their account balance up to a predetermined limit. This can be done through various channels, including ATMs, online banking, or in-branch transactions. It is essential to monitor account activity regularly to avoid excessive overdraft fees, which can accrue if the overdraft limit is exceeded or if the balance remains negative for an extended period.

Eligibility Criteria for the Personal Overdraft Suncorp

To qualify for the Personal Overdraft Suncorp, applicants typically need to meet specific criteria. These may include being a resident of the United States, maintaining a Suncorp personal transaction account, and demonstrating a stable income. Additionally, the bank may assess creditworthiness to determine the overdraft limit and associated fees. Meeting these requirements helps ensure that customers can responsibly manage their overdraft usage.

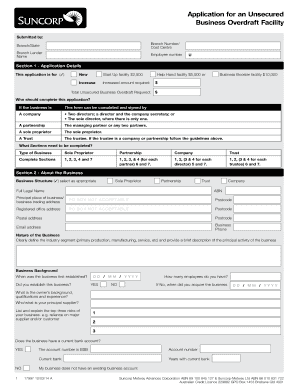

Application Process for the Personal Overdraft Suncorp

Applying for the Personal Overdraft Suncorp involves a few key steps. First, customers should gather necessary documentation, such as proof of identity and income. Next, they can submit an application through Suncorp’s online banking platform or by visiting a local branch. After submission, the bank will review the application, assess eligibility, and communicate the outcome, including the approved overdraft limit and any applicable fees.

Key Elements of the Personal Overdraft Suncorp

Several key elements define the Personal Overdraft Suncorp. These include the overdraft limit, which is the maximum amount customers can access beyond their account balance, and the associated fees, which may vary based on usage and account terms. Understanding these elements is crucial for effective financial management, as they directly impact the cost of borrowing through the overdraft facility.

Legal Use of the Personal Overdraft Suncorp

The Personal Overdraft Suncorp must be used in accordance with the terms and conditions set by the bank. Customers are encouraged to use the facility responsibly, ensuring they repay any overdraft amounts promptly to avoid incurring additional fees. Legal implications may arise if the overdraft is misused, such as failing to repay the borrowed amount or exceeding the agreed limit, which could affect credit ratings and future banking relationships.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the personal overdraft suncorp

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Suncorp overdraft fees?

Suncorp overdraft fees are charges applied when your account balance falls below zero due to withdrawals or transactions. These fees can vary based on your account type and the amount overdrawn. Understanding these fees is crucial for managing your finances effectively.

-

How can I avoid Suncorp overdraft fees?

To avoid Suncorp overdraft fees, ensure that you maintain a positive balance in your account. You can also set up alerts for low balances or link your account to a savings account for overdraft protection. Regularly monitoring your transactions can help you stay informed.

-

What features does airSlate SignNow offer for managing documents related to Suncorp overdraft fees?

airSlate SignNow provides features like eSigning and document tracking, which can help you manage important documents related to Suncorp overdraft fees. With our easy-to-use platform, you can quickly send and sign documents, ensuring you stay organized and compliant.

-

Are there any benefits to using airSlate SignNow for financial documents?

Yes, using airSlate SignNow for financial documents offers several benefits, including enhanced security and faster processing times. You can streamline your workflow, reduce paperwork, and ensure that all documents related to Suncorp overdraft fees are signed and stored securely.

-

How does airSlate SignNow integrate with banking platforms?

airSlate SignNow integrates seamlessly with various banking platforms, allowing you to manage documents related to Suncorp overdraft fees efficiently. This integration helps you automate workflows and ensures that all necessary documents are easily accessible.

-

What is the pricing structure for airSlate SignNow?

airSlate SignNow offers a flexible pricing structure that caters to businesses of all sizes. Our plans are designed to be cost-effective, ensuring that you can manage your documents related to Suncorp overdraft fees without breaking the bank.

-

Can I track my documents related to Suncorp overdraft fees with airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of your documents in real-time. This feature is particularly useful for keeping tabs on important documents related to Suncorp overdraft fees, ensuring you never miss a deadline.

Get more for Personal Overdraft Suncorp

Find out other Personal Overdraft Suncorp

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online