Form IL 1065 Partnership Replacement Tax Return

What is the Form IL 1065 Partnership Replacement Tax Return

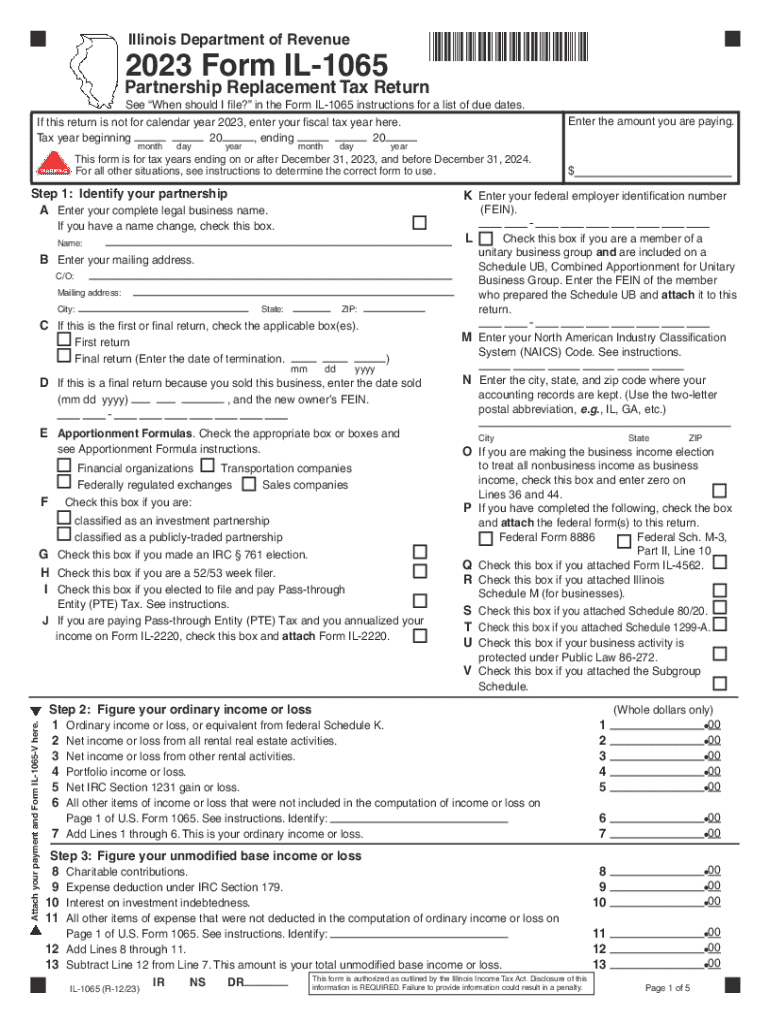

The Form IL 1065 is a tax return specifically designed for partnerships operating in Illinois. It serves as the Partnership Replacement Tax Return, which is required for partnerships to report their income, deductions, and credits to the state. The form is essential for ensuring compliance with Illinois tax laws and is used to calculate the partnership's tax liability under the state's replacement tax provisions.

How to Use the Form IL 1065 Partnership Replacement Tax Return

To use the Form IL 1065 effectively, partnerships must gather all necessary financial information, including income, expenses, and any applicable deductions. The form requires detailed reporting of each partner's share of income and losses. Partnerships must ensure that all information is accurate and complete before submission to avoid penalties. Utilizing software or professional tax assistance can streamline the process and help ensure compliance with state regulations.

Steps to Complete the Form IL 1065 Partnership Replacement Tax Return

Completing the Form IL 1065 involves several key steps:

- Gather financial records, including income statements and expense reports.

- Fill out the form with accurate income and deduction figures.

- Calculate each partner's share of income and losses.

- Review the form for accuracy and completeness.

- Submit the form by the designated filing deadline.

Following these steps helps ensure that the partnership meets its tax obligations efficiently.

Filing Deadlines / Important Dates

Partnerships must be aware of the filing deadlines for the Form IL 1065. Typically, the form is due on the fifteenth day of the third month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the form is due by March 15. It is crucial for partnerships to mark these dates on their calendars to avoid late filing penalties.

Required Documents

To complete the Form IL 1065, partnerships need to prepare several documents, including:

- Income statements detailing all sources of revenue.

- Expense reports outlining all deductible costs.

- Records of each partner's contributions and distributions.

- Any additional documentation that supports claimed deductions or credits.

Having these documents ready can facilitate a smoother filing process.

Penalties for Non-Compliance

Failure to file the Form IL 1065 on time or providing inaccurate information can result in significant penalties. Illinois imposes fines for late submissions and may charge interest on any unpaid taxes. Partnerships should prioritize compliance to avoid these financial repercussions and maintain good standing with state tax authorities.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form il 1065 partnership replacement tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the il 1065 form and why is it important?

The il 1065 form is a partnership return used for reporting income, deductions, and credits for partnerships in Illinois. It is crucial for ensuring compliance with state tax regulations and accurately reporting the financial activities of the partnership. Properly completing the il 1065 can help avoid penalties and ensure that partners receive their correct share of income.

-

How can airSlate SignNow help with the il 1065 form?

airSlate SignNow simplifies the process of completing and signing the il 1065 form by providing an intuitive platform for document management. Users can easily upload, edit, and eSign the form, ensuring that all necessary information is accurately captured. This streamlines the filing process and helps maintain compliance with state requirements.

-

What are the pricing options for using airSlate SignNow for the il 1065?

airSlate SignNow offers various pricing plans to accommodate different business needs, starting with a free trial. The plans are designed to provide cost-effective solutions for managing documents, including the il 1065 form. By choosing the right plan, businesses can benefit from features tailored to their specific requirements without overspending.

-

What features does airSlate SignNow offer for managing the il 1065 form?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are essential for managing the il 1065 form. These tools enhance efficiency and ensure that all parties can easily collaborate on the document. Additionally, the platform supports integration with other software, making it versatile for various business processes.

-

Can I integrate airSlate SignNow with other software for the il 1065 process?

Yes, airSlate SignNow offers seamless integrations with popular software applications, enhancing the workflow for managing the il 1065 form. This allows users to connect their existing tools, such as accounting software, to streamline data transfer and document management. Integrating these systems can save time and reduce errors in the filing process.

-

What are the benefits of using airSlate SignNow for the il 1065 form?

Using airSlate SignNow for the il 1065 form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick eSigning and real-time collaboration, which speeds up the filing process. Additionally, the secure storage of documents ensures that sensitive information is protected.

-

Is airSlate SignNow user-friendly for completing the il 1065 form?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete the il 1065 form without extensive training. The intuitive interface guides users through the process, ensuring that all necessary fields are filled out correctly. This accessibility is particularly beneficial for small business owners and partners who may not be tech-savvy.

Get more for Form IL 1065 Partnership Replacement Tax Return

Find out other Form IL 1065 Partnership Replacement Tax Return

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself