California Homestead File Form

What is the California Homestead Form?

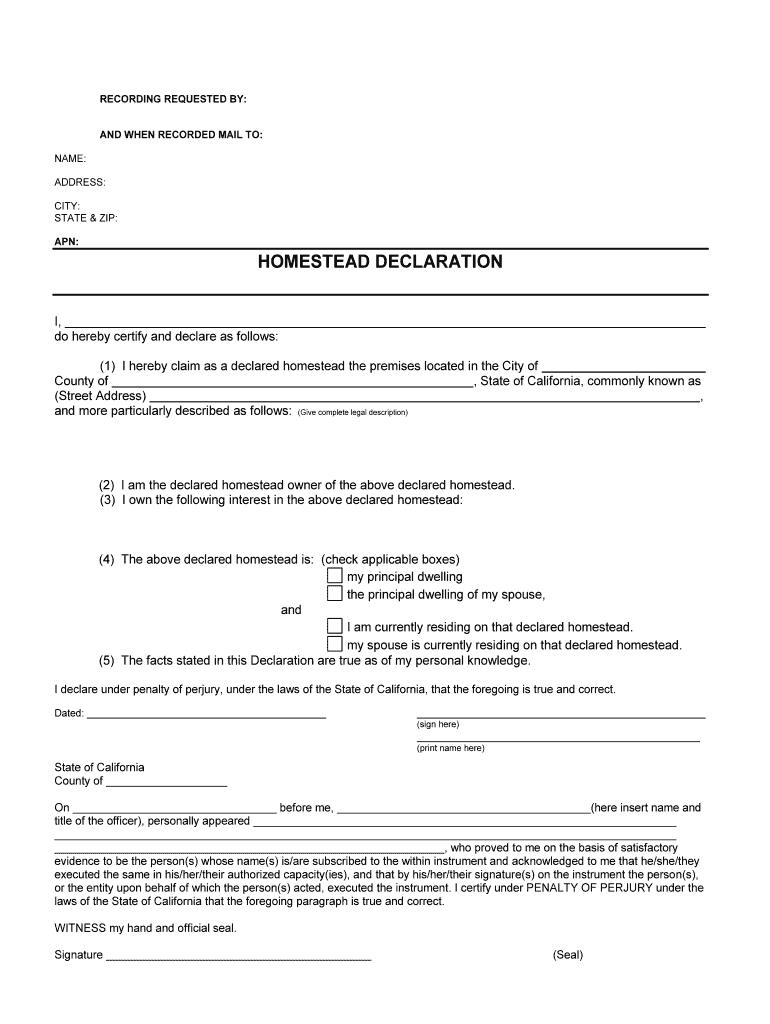

The California homestead form is a legal document that allows homeowners to declare a portion of their property as a homestead. This declaration provides certain protections against creditors and can shield a specified amount of equity in a home from being seized in the event of bankruptcy or other financial difficulties. The homestead law in California is designed to protect individuals and families, ensuring they have a place to live even in challenging financial circumstances.

Steps to Complete the California Homestead Form

Completing the California homestead form involves several key steps:

- Obtain the correct homestead declaration form from your county recorder's office or download it from a reliable source.

- Provide accurate information regarding your property, including the address and legal description.

- Include personal details such as your name, marital status, and any co-owners of the property.

- Sign the form in the presence of a notary public to validate the declaration.

- Submit the completed form to your local county recorder's office for official recording.

Legal Use of the California Homestead Form

The legal use of the California homestead form is to establish a homestead exemption, which can protect homeowners from losing their primary residence due to certain types of debt. Under California law, the homestead exemption amount varies based on the homeowner's circumstances, such as age or disability status. It is important to understand the legal implications and protections offered by this form, as it can significantly impact financial security.

Eligibility Criteria for the California Homestead Form

To qualify for the California homestead exemption, homeowners must meet specific eligibility criteria. These include:

- The property must be the homeowner's primary residence.

- The homeowner must be at least 18 years old.

- Homeowners must not have declared a homestead exemption on any other property.

- Individuals who are married or in a domestic partnership must include their spouse or partner in the declaration.

Required Documents for the California Homestead Form

When filing the California homestead form, certain documents are required to ensure a smooth application process. These typically include:

- A completed homestead declaration form.

- Proof of identity, such as a driver's license or state ID.

- Documentation proving ownership of the property, such as a deed.

- Any additional information requested by the county recorder's office.

Form Submission Methods for the California Homestead Form

Homeowners can submit the California homestead form through various methods, including:

- Online submission via the county recorder's office website, if available.

- Mailing the completed form to the appropriate county recorder's office.

- In-person delivery at the county recorder's office during business hours.

Key Elements of the California Homestead Form

The key elements of the California homestead form include:

- Property information: Address and legal description of the property.

- Homeowner details: Name, marital status, and co-owners.

- Declaration statement: A formal declaration of the intent to establish a homestead exemption.

- Signature and notarization: Required for legal validation.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the california homestead file

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the California homestead form?

The California homestead form is a legal document that allows homeowners to protect a portion of their home equity from creditors. By filing this form, you can secure your primary residence against certain types of claims, ensuring that you retain your home in times of financial difficulty.

-

How can airSlate SignNow help with the California homestead form?

airSlate SignNow provides an efficient platform for completing and eSigning the California homestead form. Our user-friendly interface simplifies the process, allowing you to fill out the form digitally and securely send it to the necessary parties without any hassle.

-

Is there a cost associated with using airSlate SignNow for the California homestead form?

Yes, airSlate SignNow offers various pricing plans that cater to different needs. Our cost-effective solutions ensure that you can manage your documents, including the California homestead form, without breaking the bank, making it accessible for everyone.

-

What features does airSlate SignNow offer for managing the California homestead form?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which enhance your experience with the California homestead form. These tools streamline the process, ensuring that you can complete your paperwork efficiently and securely.

-

Can I integrate airSlate SignNow with other applications for the California homestead form?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to seamlessly manage your California homestead form alongside other tools you use. This flexibility enhances your workflow and ensures that all your documents are easily accessible.

-

What are the benefits of using airSlate SignNow for the California homestead form?

Using airSlate SignNow for the California homestead form provides numerous benefits, including time savings, enhanced security, and ease of use. Our platform ensures that you can complete your form quickly while keeping your information safe and secure.

-

How do I get started with airSlate SignNow for the California homestead form?

Getting started with airSlate SignNow is simple! Just sign up for an account, and you can begin creating and eSigning your California homestead form in minutes. Our intuitive platform guides you through each step, making the process straightforward.

Get more for California Homestead File

- Cambodia visa application form pdf

- Construction work permit form

- Fidelity retirement terms and conditions of withdrawal form

- Utah pistol permit renewal form

- Utah immunization exemption form pdf

- Page 1 of 5 job hazard analysis offical use only rac 1 2 form

- Sollicitud dexercici dels drets de les persones interessades en relaci amb les dades de carcter personal form

- S02 form

Find out other California Homestead File

- eSignature Minnesota Email Cover Letter Template Fast

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself