AEIG Personal Andor Commercial Farm Quality Equine Insurance Form

What is the AEIG Personal Andor Commercial Farm Quality Equine Insurance

The AEIG Personal Andor Commercial Farm Quality Equine Insurance is a specialized insurance policy designed to protect equine-related businesses and personal horse ownership. This insurance covers various risks associated with horse ownership, including liability for injuries or damages caused by horses, coverage for property damage, and protection against loss due to theft or illness. It is tailored for both personal and commercial use, ensuring that horse owners and farm operators can safeguard their investments and manage potential liabilities effectively.

How to obtain the AEIG Personal Andor Commercial Farm Quality Equine Insurance

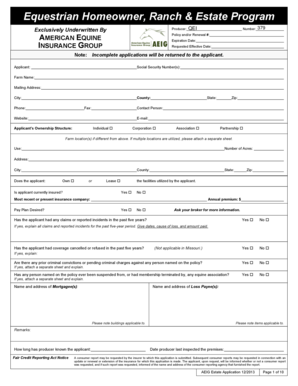

To obtain the AEIG Personal Andor Commercial Farm Quality Equine Insurance, individuals or businesses should start by researching reputable insurance providers that offer this specific coverage. It is advisable to gather necessary information, such as details about the horses, farm operations, and any previous claims. Prospective policyholders can then request quotes from multiple insurers to compare coverage options and premiums. After selecting a suitable policy, applicants will need to complete an application form and provide any required documentation to finalize the purchase.

Key elements of the AEIG Personal Andor Commercial Farm Quality Equine Insurance

Key elements of the AEIG Personal Andor Commercial Farm Quality Equine Insurance include liability coverage, which protects against claims for bodily injury or property damage caused by horses. Additionally, the policy often includes coverage for veterinary expenses, loss of use, and coverage for tack and equipment. It is essential for policyholders to understand the specific terms, conditions, and exclusions of their policy to ensure comprehensive protection. Furthermore, optional endorsements may be available to enhance coverage based on individual needs.

Steps to complete the AEIG Personal Andor Commercial Farm Quality Equine Insurance

Completing the AEIG Personal Andor Commercial Farm Quality Equine Insurance involves several steps. First, gather all necessary information about your horses and farm operations. Next, contact an insurance agent or provider to discuss your needs and obtain a quote. Once you receive the quote, review the coverage options and select the policy that best fits your requirements. After that, fill out the application form accurately, providing any requested documentation. Finally, submit the completed application and await confirmation of your coverage.

Eligibility Criteria

Eligibility for the AEIG Personal Andor Commercial Farm Quality Equine Insurance typically depends on several factors, including the type of equine activities conducted, the number of horses owned, and the specific risks associated with the farm or business operations. Insurers may also consider the applicant's claims history and overall risk management practices. It is important for potential policyholders to discuss their specific situation with an insurance agent to determine eligibility and any necessary adjustments to coverage.

Legal use of the AEIG Personal Andor Commercial Farm Quality Equine Insurance

The legal use of the AEIG Personal Andor Commercial Farm Quality Equine Insurance involves adhering to the terms and conditions set forth in the policy. Policyholders must ensure that they comply with any legal requirements related to horse ownership and farm operations, such as licensing and zoning laws. Additionally, maintaining accurate records of horse care and any incidents that may lead to claims is essential for legal protection. Understanding the legal implications of the coverage can help policyholders navigate potential disputes and ensure compliance with state regulations.

Examples of using the AEIG Personal Andor Commercial Farm Quality Equine Insurance

Examples of using the AEIG Personal Andor Commercial Farm Quality Equine Insurance include situations where a horse causes injury to a visitor on the property, resulting in a liability claim. Another example is when a horse falls ill and incurs significant veterinary costs, which can be covered under the policy. Additionally, if a horse is stolen, the insurance can provide compensation for the loss. These examples illustrate the importance of having comprehensive coverage to protect against various risks associated with equine ownership and operations.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the aeig personal andor commercial farm quality equine insurance

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is AEIG Personal Andor Commercial Farm Quality Equine Insurance?

AEIG Personal Andor Commercial Farm Quality Equine Insurance is a specialized insurance product designed to protect equine-related businesses and personal horse ownership. It covers various risks associated with owning and operating a farm or commercial equine facility, ensuring peace of mind for horse owners and operators.

-

What types of coverage are included in AEIG Personal Andor Commercial Farm Quality Equine Insurance?

AEIG Personal Andor Commercial Farm Quality Equine Insurance typically includes coverage for liability, property damage, and loss of income due to unforeseen events. Additionally, it may cover veterinary expenses and other specific needs related to equine care, making it a comprehensive solution for horse owners.

-

How much does AEIG Personal Andor Commercial Farm Quality Equine Insurance cost?

The cost of AEIG Personal Andor Commercial Farm Quality Equine Insurance varies based on factors such as the type of coverage, the number of horses insured, and the specific risks associated with your farm. It's best to request a quote to get an accurate estimate tailored to your needs.

-

What are the benefits of AEIG Personal Andor Commercial Farm Quality Equine Insurance?

The primary benefits of AEIG Personal Andor Commercial Farm Quality Equine Insurance include financial protection against unexpected events, peace of mind for horse owners, and the ability to focus on your equine business without worrying about potential liabilities. This insurance helps ensure that you can recover quickly from losses.

-

Can I customize my AEIG Personal Andor Commercial Farm Quality Equine Insurance policy?

Yes, AEIG Personal Andor Commercial Farm Quality Equine Insurance policies can often be customized to fit your specific needs. You can choose from various coverage options and limits to ensure that your policy aligns with your unique equine business requirements.

-

How do I file a claim with AEIG Personal Andor Commercial Farm Quality Equine Insurance?

Filing a claim with AEIG Personal Andor Commercial Farm Quality Equine Insurance is straightforward. You can contact your insurance agent or the claims department directly, providing necessary documentation and details about the incident to initiate the claims process.

-

Is AEIG Personal Andor Commercial Farm Quality Equine Insurance available for all types of equine businesses?

Yes, AEIG Personal Andor Commercial Farm Quality Equine Insurance is designed to cater to a wide range of equine businesses, including riding schools, breeding farms, and personal horse ownership. This flexibility ensures that various equine operations can find suitable coverage.

Get more for AEIG Personal Andor Commercial Farm Quality Equine Insurance

Find out other AEIG Personal Andor Commercial Farm Quality Equine Insurance

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer