Form W 4 Employee's Withholding Certificate

What is the Form W-4 Employee's Withholding Certificate

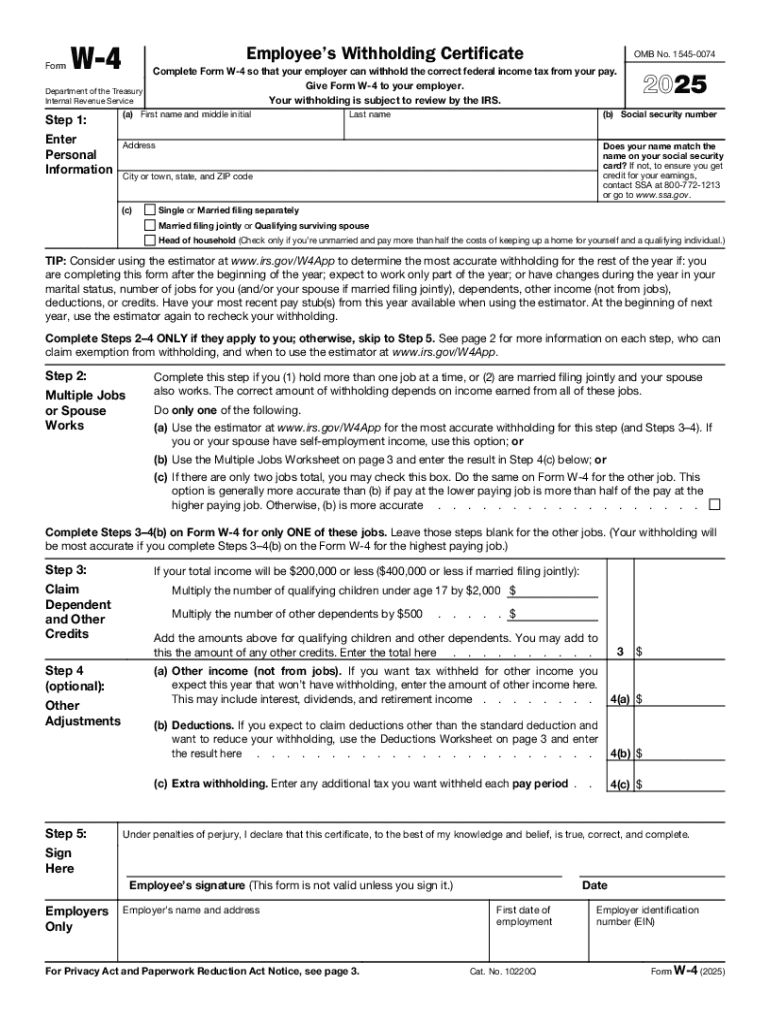

The Form W-4 Employee's Withholding Certificate is a crucial document used by employees in the United States to inform their employers about the amount of federal income tax to withhold from their paychecks. This form helps ensure that the correct amount of tax is deducted, thereby preventing underpayment or overpayment of taxes throughout the year. The W-4 form is particularly important for new employees or those who experience changes in their personal or financial situations, such as marriage, divorce, or the birth of a child.

How to use the Form W-4 Employee's Withholding Certificate

Using the Form W-4 is straightforward. Employees need to complete the form and submit it to their employer. The information provided on the form determines the withholding amount from each paycheck. Employees can adjust their withholding by submitting a new W-4 whenever they experience significant life changes or wish to modify their tax withholding for any reason. It is advisable to review the form annually or when personal circumstances change to ensure the withholding aligns with the tax obligations.

Steps to complete the Form W-4 Employee's Withholding Certificate

Completing the Form W-4 involves several key steps:

- Personal Information: Fill out your name, address, Social Security number, and filing status.

- Multiple Jobs or Spouse Works: Indicate if you have more than one job or if your spouse works, which may affect your withholding.

- Claim Dependents: If applicable, claim any dependents to reduce your taxable income.

- Other Adjustments: Specify any additional income or deductions that may affect your withholding.

- Signature: Sign and date the form to validate it.

Key elements of the Form W-4 Employee's Withholding Certificate

The Form W-4 includes several key elements that employees must understand:

- Filing Status: Indicates whether the employee is single, married, or head of household.

- Dependents: Allows employees to claim qualifying children and other dependents.

- Additional Withholding: Provides an option to request additional amounts to be withheld from each paycheck.

- Signature and Date: Required to confirm the accuracy of the information provided.

IRS Guidelines

The IRS provides specific guidelines regarding the completion and submission of the Form W-4. Employees should refer to the IRS website or the instructions included with the form for the most current information. These guidelines outline how to accurately determine the number of allowances to claim and provide examples of various scenarios that may affect withholding. Staying informed about IRS updates is essential for ensuring compliance and making informed decisions regarding tax withholding.

Form Submission Methods

Employees can submit the Form W-4 to their employer through various methods, including:

- Online Submission: Many employers offer digital platforms for employees to submit their W-4 forms electronically.

- Mail: Employees may also choose to print the completed form and mail it to their employer's HR department.

- In-Person: Submitting the form in person is an option for those who prefer direct communication with their employer.

Handy tips for filling out Form W 4 Employee's Withholding Certificate online

Quick steps to complete and e-sign Form W 4 Employee's Withholding Certificate online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing documents can be. Obtain access to a GDPR and HIPAA compliant solution for optimum simpleness. Use signNow to electronically sign and share Form W 4 Employee's Withholding Certificate for collecting e-signatures.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form w 4 employees withholding certificate 771302722

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form W 4 Employee's Withholding Certificate?

The Form W 4 Employee's Withholding Certificate is a tax form used by employees to indicate their tax situation to their employer. This form helps employers determine the correct amount of federal income tax to withhold from employees' paychecks. Understanding how to fill out the Form W 4 Employee's Withholding Certificate can help you manage your tax obligations effectively.

-

How can airSlate SignNow help with the Form W 4 Employee's Withholding Certificate?

airSlate SignNow provides a seamless platform for electronically signing and sending the Form W 4 Employee's Withholding Certificate. With our user-friendly interface, you can easily complete and submit this important tax document without the hassle of printing or mailing. This streamlines the process and ensures that your form is submitted accurately and on time.

-

Is there a cost associated with using airSlate SignNow for the Form W 4 Employee's Withholding Certificate?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our cost-effective solutions allow you to manage documents like the Form W 4 Employee's Withholding Certificate efficiently. You can choose a plan that fits your budget while enjoying the benefits of our comprehensive eSignature services.

-

What features does airSlate SignNow offer for managing the Form W 4 Employee's Withholding Certificate?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and real-time tracking for the Form W 4 Employee's Withholding Certificate. These features enhance your document management experience, making it easier to keep track of submissions and ensure compliance. Additionally, our platform supports multiple file formats for added convenience.

-

Can I integrate airSlate SignNow with other software for the Form W 4 Employee's Withholding Certificate?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to streamline your workflow for the Form W 4 Employee's Withholding Certificate. Whether you use HR software or accounting tools, our integrations help you manage documents more efficiently and reduce manual data entry.

-

What are the benefits of using airSlate SignNow for the Form W 4 Employee's Withholding Certificate?

Using airSlate SignNow for the Form W 4 Employee's Withholding Certificate provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are signed and stored securely, minimizing the risk of loss or unauthorized access. Additionally, you can save time and resources by automating the signing process.

-

How secure is airSlate SignNow when handling the Form W 4 Employee's Withholding Certificate?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect your Form W 4 Employee's Withholding Certificate and other sensitive documents. Our platform complies with industry standards to ensure that your data remains confidential and secure throughout the signing process.

Get more for Form W 4 Employee's Withholding Certificate

- Notice nonresponsibility 497323622 form

- Claim of lien by individual oregon form

- Quitclaim deed by two individuals to corporation oregon form

- Warranty deed from two individuals to corporation oregon form

- Oregon lien 497323627 form

- Filing lien oregon form

- Quitclaim deed from individual to corporation oregon form

- Warranty deed from individual to corporation oregon form

Find out other Form W 4 Employee's Withholding Certificate

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast