Joint Agreement to Affirm Independent Relationship for Certain Building and Construction Workers Form

Understanding the Joint Agreement To Affirm Independent Relationship For Certain Building And Construction Workers

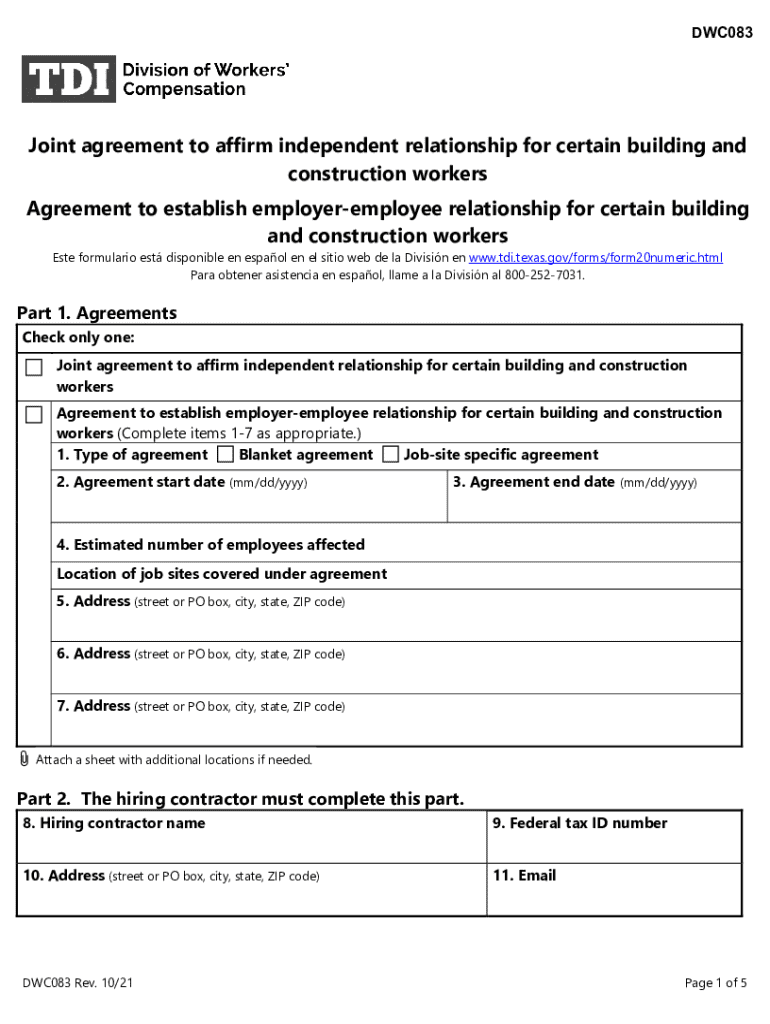

The Joint Agreement To Affirm Independent Relationship For Certain Building And Construction Workers is a legal document designed to clarify the nature of the working relationship between construction workers and their employers. This agreement is particularly relevant in the construction industry, where independent contractors often operate. By affirming the independent status of these workers, the agreement helps to delineate responsibilities, rights, and obligations, ensuring compliance with labor laws and regulations.

Steps to Complete the Joint Agreement To Affirm Independent Relationship For Certain Building And Construction Workers

Completing the Joint Agreement To Affirm Independent Relationship involves several key steps:

- Gather necessary information about the workers and the employer.

- Clearly define the scope of work and the terms of the independent relationship.

- Ensure all parties understand their rights and responsibilities under the agreement.

- Review the document for compliance with local and federal regulations.

- Have all parties sign the agreement to formalize the independent relationship.

Key Elements of the Joint Agreement To Affirm Independent Relationship For Certain Building And Construction Workers

The key elements of this agreement typically include:

- Identification of Parties: Names and addresses of the employer and the independent contractor.

- Scope of Work: Detailed description of the work to be performed.

- Payment Terms: Information on compensation and payment schedules.

- Duration: The time frame for the agreement and completion of work.

- Liability and Insurance: Clarification of liability and insurance responsibilities.

Legal Use of the Joint Agreement To Affirm Independent Relationship For Certain Building And Construction Workers

This agreement serves a critical legal function by establishing the independent status of workers. It protects both parties by reducing the risk of misclassification, which can lead to legal disputes and penalties. Properly executed, it can provide a clear framework that aligns with state and federal labor laws, ensuring that both employers and workers understand their legal rights and obligations.

How to Obtain the Joint Agreement To Affirm Independent Relationship For Certain Building And Construction Workers

Obtaining the Joint Agreement can be done through various methods:

- Consulting with legal professionals who specialize in labor law.

- Accessing templates from reputable legal resources or industry associations.

- Utilizing digital document solutions to create and customize the agreement.

Examples of Using the Joint Agreement To Affirm Independent Relationship For Certain Building And Construction Workers

Examples of scenarios where this agreement is applicable include:

- A construction company hiring subcontractors for a specific project.

- Independent electricians or plumbers working on a contract basis.

- Freelance architects collaborating with builders on design plans.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the joint agreement to affirm independent relationship for certain building and construction workers

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Joint Agreement To Affirm Independent Relationship For Certain Building And Construction Workers?

A Joint Agreement To Affirm Independent Relationship For Certain Building And Construction Workers is a legal document that clarifies the independent status of workers in the construction industry. This agreement helps protect both the workers and employers by outlining the terms of their relationship, ensuring compliance with labor laws.

-

How can airSlate SignNow help with creating a Joint Agreement To Affirm Independent Relationship For Certain Building And Construction Workers?

airSlate SignNow provides an easy-to-use platform for drafting and eSigning a Joint Agreement To Affirm Independent Relationship For Certain Building And Construction Workers. With customizable templates and a user-friendly interface, businesses can quickly create legally binding agreements that meet their specific needs.

-

What are the benefits of using airSlate SignNow for my Joint Agreement To Affirm Independent Relationship For Certain Building And Construction Workers?

Using airSlate SignNow for your Joint Agreement To Affirm Independent Relationship For Certain Building And Construction Workers offers numerous benefits, including faster turnaround times, reduced paperwork, and enhanced security. The platform ensures that all documents are stored securely and can be accessed anytime, streamlining the signing process.

-

Is airSlate SignNow cost-effective for managing Joint Agreements?

Yes, airSlate SignNow is a cost-effective solution for managing Joint Agreements To Affirm Independent Relationship For Certain Building And Construction Workers. With various pricing plans available, businesses can choose an option that fits their budget while still enjoying robust features and support.

-

Can I integrate airSlate SignNow with other tools for my Joint Agreement To Affirm Independent Relationship For Certain Building And Construction Workers?

Absolutely! airSlate SignNow offers seamless integrations with various business tools and applications, making it easy to manage your Joint Agreement To Affirm Independent Relationship For Certain Building And Construction Workers alongside your existing workflows. This integration capability enhances productivity and efficiency.

-

What features does airSlate SignNow offer for Joint Agreements?

airSlate SignNow includes features such as customizable templates, real-time tracking, and automated reminders for your Joint Agreement To Affirm Independent Relationship For Certain Building And Construction Workers. These features help ensure that all parties are informed and that the signing process is smooth and efficient.

-

How secure is airSlate SignNow for handling Joint Agreements?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption and compliance measures to protect your Joint Agreement To Affirm Independent Relationship For Certain Building And Construction Workers. This ensures that your sensitive information remains confidential and secure throughout the signing process.

Get more for Joint Agreement To Affirm Independent Relationship For Certain Building And Construction Workers

- Felony arraignment in circuit court ag form

- 512018 wisconsin legislature form

- 201a2 form

- Justia order of commitment extension of commitment or form

- Whitewash the disturbing truth about cows milk and your form

- Order for hearing on form

- Self help law center wisconsin court system form

- Upon discharge form

Find out other Joint Agreement To Affirm Independent Relationship For Certain Building And Construction Workers

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later

- How Can I eSign North Carolina lease agreement

- eSign Montana Lease agreement form Computer

- Can I eSign New Hampshire Lease agreement form

- How To eSign West Virginia Lease agreement contract

- Help Me With eSign New Mexico Lease agreement form

- Can I eSign Utah Lease agreement form

- Can I eSign Washington lease agreement

- Can I eSign Alabama Non disclosure agreement sample

- eSign California Non disclosure agreement sample Now