Rc65 E 2022-2026

What is the Rc65 E

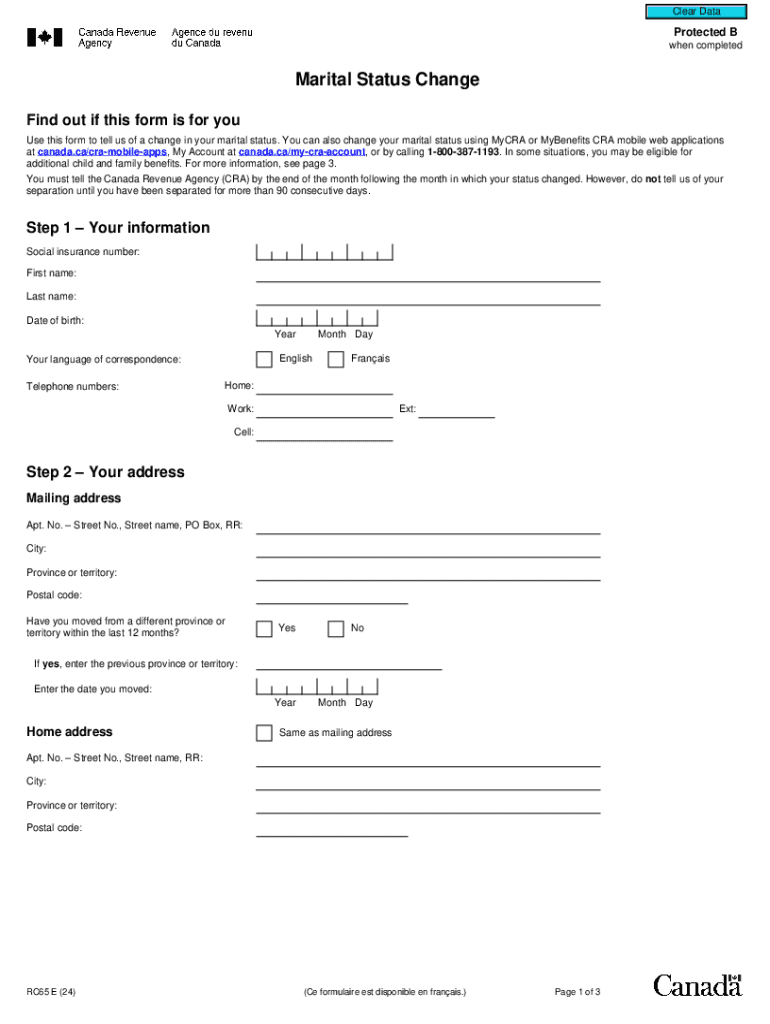

The Rc65 E is a specific form used primarily in the context of tax reporting and compliance in the United States. It is designed to facilitate the reporting of certain financial information to the Internal Revenue Service (IRS). This form may be utilized by various entities, including individuals and businesses, to ensure accurate reporting of income, deductions, and other relevant financial data. Understanding the purpose of the Rc65 E is crucial for maintaining compliance with federal tax regulations.

How to use the Rc65 E

Using the Rc65 E involves several key steps to ensure that the form is completed accurately. First, gather all necessary financial documents and information that pertain to the reporting period. Next, fill out the form with precise details, ensuring that all entries are clear and legible. It is important to double-check the information for accuracy before submission. After completing the form, it can be filed electronically or mailed to the appropriate IRS office, depending on the specific requirements for your situation.

Steps to complete the Rc65 E

Completing the Rc65 E requires a systematic approach to ensure accuracy and compliance. Follow these steps:

- Collect all relevant financial documents, including income statements and receipts.

- Review the instructions provided with the form to understand the requirements.

- Fill in the form, ensuring all fields are completed accurately.

- Verify the information entered to avoid errors that could lead to penalties.

- Submit the form electronically or by mail, based on your preference and IRS guidelines.

Legal use of the Rc65 E

The Rc65 E must be used in accordance with IRS regulations to ensure legal compliance. It is essential to understand the specific legal requirements associated with the form, including who is eligible to file it and under what circumstances. Misuse or incorrect filing of the Rc65 E can result in penalties, so it is advisable to consult a tax professional if there are any uncertainties regarding its use.

Filing Deadlines / Important Dates

Filing deadlines for the Rc65 E are crucial for maintaining compliance with tax regulations. Typically, the form must be submitted by a specific date each year, which aligns with the overall tax filing deadline. It is important to stay informed about any changes to these dates, as they can vary from year to year. Marking these deadlines on a calendar can help ensure timely submission and avoid potential penalties.

Required Documents

When preparing to complete the Rc65 E, certain documents are required to provide the necessary information. These may include:

- Income statements, such as W-2s or 1099s.

- Receipts for deductible expenses.

- Previous tax returns for reference.

Having these documents on hand will streamline the process of filling out the form and help ensure that all information is accurate and complete.

Who Issues the Form

The Rc65 E is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and enforcement in the United States. The IRS provides guidelines and instructions for completing the form, ensuring that taxpayers understand their obligations and the necessary steps for compliance. Keeping abreast of any updates from the IRS regarding the Rc65 E is essential for accurate reporting.

Handy tips for filling out Rc65 E online

Quick steps to complete and e-sign Rc65 E online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing documents can be. Obtain access to a HIPAA and GDPR compliant service for optimum simpleness. Use signNow to e-sign and share Rc65 E for collecting e-signatures.

Create this form in 5 minutes or less

Find and fill out the correct rc65 e

Create this form in 5 minutes!

How to create an eSignature for the rc65 e

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Rc65 E and how does it work?

Rc65 E is a powerful eSignature solution offered by airSlate SignNow that allows businesses to send and sign documents electronically. It streamlines the signing process, making it faster and more efficient. With Rc65 E, users can easily create, send, and manage documents from any device.

-

What are the key features of Rc65 E?

Rc65 E includes features such as customizable templates, real-time tracking, and secure cloud storage. These features enhance the user experience by providing flexibility and ensuring document security. Additionally, Rc65 E supports multiple file formats, making it versatile for various business needs.

-

How much does Rc65 E cost?

The pricing for Rc65 E is competitive and designed to fit various business budgets. airSlate SignNow offers different subscription plans, allowing users to choose the one that best meets their needs. You can visit our pricing page for detailed information on the available plans and features.

-

What are the benefits of using Rc65 E for my business?

Using Rc65 E can signNowly reduce the time spent on document management and signing processes. It enhances productivity by allowing teams to collaborate seamlessly and eliminates the need for physical paperwork. Moreover, Rc65 E ensures compliance with legal standards, providing peace of mind for businesses.

-

Can Rc65 E integrate with other software?

Yes, Rc65 E offers integration capabilities with various third-party applications, including CRM and project management tools. This allows businesses to streamline their workflows and enhance productivity. By integrating Rc65 E with your existing software, you can create a more cohesive operational environment.

-

Is Rc65 E secure for sensitive documents?

Absolutely, Rc65 E prioritizes security and compliance, ensuring that all documents are protected with advanced encryption. The platform adheres to industry standards for data protection, making it safe for handling sensitive information. Users can trust Rc65 E to keep their documents secure throughout the signing process.

-

How can I get started with Rc65 E?

Getting started with Rc65 E is simple. You can sign up for a free trial on the airSlate SignNow website to explore its features. Once registered, you can easily upload documents, create templates, and start sending them for eSignature.

Get more for Rc65 E

- And preview page form

- County ohio declare this as a codicil to my will dated form

- All forms in this package are provided without any warranty express or implied as

- To their legal effect and completeness form

- Search results for this form

- If you own real form

- Ohio living trust create a living trust in ohio state form

- Ohio passed away on form

Find out other Rc65 E

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF