Income Tax Refund Request Form City of Springfield, Ohio 2021

What is the Income Tax Refund Request Form City Of Springfield, Ohio

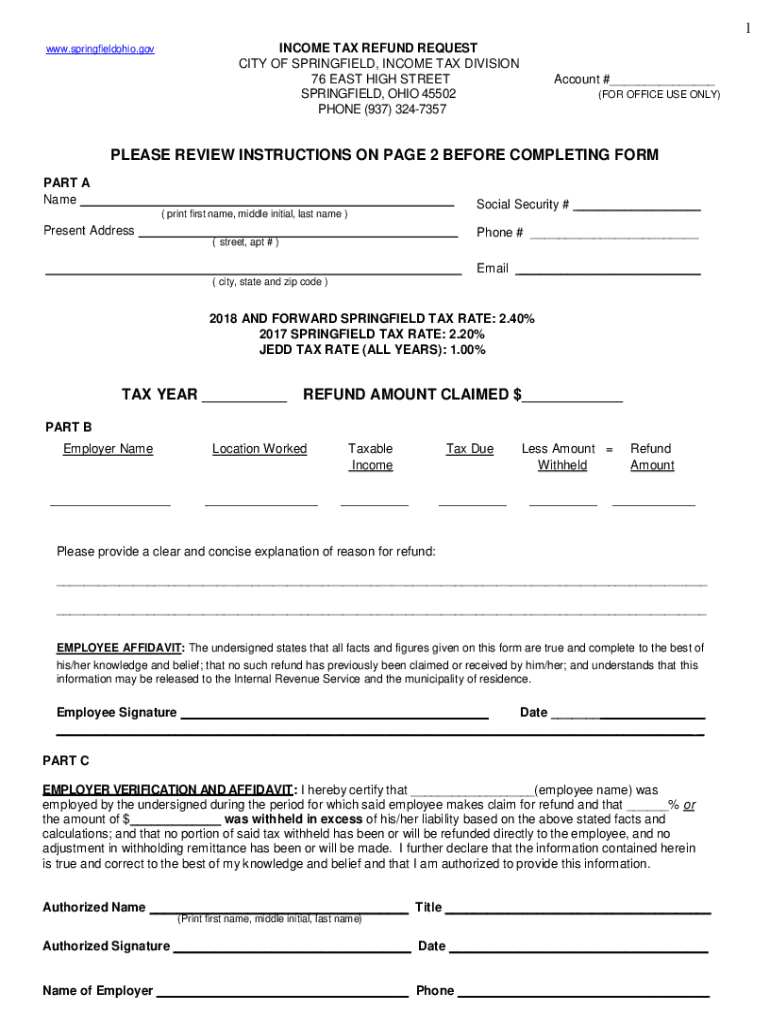

The Income Tax Refund Request Form for the City of Springfield, Ohio, is a document that allows residents to formally request a refund of overpaid income taxes. This form is essential for individuals who have made excess tax payments or have been subject to erroneous tax assessments. By submitting this form, taxpayers can initiate the process to recover funds that are rightfully theirs, ensuring compliance with local tax regulations.

How to use the Income Tax Refund Request Form City Of Springfield, Ohio

Using the Income Tax Refund Request Form involves several straightforward steps. First, obtain the form from the official Springfield city website or local tax office. Next, fill out the required fields, providing accurate personal information and details about the tax payments in question. Once completed, submit the form through the designated channels, which may include online submission, mailing it to the tax office, or delivering it in person. Ensure that all necessary documentation, such as proof of payment, is included to support your request.

Steps to complete the Income Tax Refund Request Form City Of Springfield, Ohio

Completing the Income Tax Refund Request Form requires careful attention to detail. Follow these steps:

- Download or obtain the form from the Springfield tax office.

- Provide your full name, address, and contact information at the top of the form.

- Indicate the tax year for which you are requesting a refund.

- Detail the amount of tax overpaid and include any relevant documentation.

- Sign and date the form to certify that the information is accurate.

- Submit the form via the preferred method as outlined by the city’s tax department.

Required Documents

When submitting the Income Tax Refund Request Form, certain documents are typically required to support your claim. These may include:

- Copies of tax returns for the year in question.

- Proof of payment, such as bank statements or receipts.

- Any correspondence from the tax office regarding the overpayment.

Having these documents ready can expedite the processing of your refund request.

Form Submission Methods

The Income Tax Refund Request Form can be submitted through various methods, allowing flexibility for taxpayers. Options typically include:

- Online submission through the City of Springfield’s official tax portal.

- Mailing the completed form to the designated tax office address.

- In-person delivery at the local tax office during business hours.

Choosing the method that best suits your needs can help ensure a smooth submission process.

Eligibility Criteria

To be eligible for a refund using the Income Tax Refund Request Form, taxpayers must meet specific criteria. Generally, eligibility includes:

- Having overpaid income taxes for the applicable tax year.

- Submitting the request within the time frame set by local tax regulations.

- Providing accurate and complete information on the form.

Meeting these criteria is essential for a successful refund request.

Create this form in 5 minutes or less

Find and fill out the correct income tax refund request form city of springfield ohio

Create this form in 5 minutes!

How to create an eSignature for the income tax refund request form city of springfield ohio

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Income Tax Refund Request Form City Of Springfield, Ohio?

The Income Tax Refund Request Form City Of Springfield, Ohio is a document that residents can use to request a refund for overpaid income taxes. This form is essential for ensuring that taxpayers receive the money they are owed in a timely manner. By utilizing airSlate SignNow, you can easily fill out and submit this form electronically.

-

How can airSlate SignNow help with the Income Tax Refund Request Form City Of Springfield, Ohio?

airSlate SignNow simplifies the process of completing the Income Tax Refund Request Form City Of Springfield, Ohio by providing an intuitive platform for eSigning and document management. Users can fill out the form, sign it, and send it directly to the appropriate city department without the hassle of printing or mailing. This streamlines the refund request process signNowly.

-

Is there a cost associated with using airSlate SignNow for the Income Tax Refund Request Form City Of Springfield, Ohio?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, including individual users and businesses. The cost is competitive and provides excellent value considering the time saved and the convenience offered in managing the Income Tax Refund Request Form City Of Springfield, Ohio. You can choose a plan that best fits your requirements.

-

What features does airSlate SignNow offer for the Income Tax Refund Request Form City Of Springfield, Ohio?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are particularly beneficial for the Income Tax Refund Request Form City Of Springfield, Ohio. These features ensure that your requests are processed efficiently and securely. Additionally, you can collaborate with others in real-time to complete the form.

-

Can I integrate airSlate SignNow with other applications for the Income Tax Refund Request Form City Of Springfield, Ohio?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow when handling the Income Tax Refund Request Form City Of Springfield, Ohio. Whether you use CRM systems, cloud storage, or other productivity tools, you can easily connect them to enhance your document management process.

-

What are the benefits of using airSlate SignNow for tax-related documents like the Income Tax Refund Request Form City Of Springfield, Ohio?

Using airSlate SignNow for tax-related documents, such as the Income Tax Refund Request Form City Of Springfield, Ohio, offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform ensures that your sensitive information is protected while allowing you to complete forms quickly and accurately. This leads to faster processing of your refund requests.

-

How secure is airSlate SignNow when submitting the Income Tax Refund Request Form City Of Springfield, Ohio?

Security is a top priority for airSlate SignNow. When submitting the Income Tax Refund Request Form City Of Springfield, Ohio, your data is encrypted and stored securely. The platform complies with industry standards to protect your personal information, ensuring that your tax documents are safe throughout the submission process.

Get more for Income Tax Refund Request Form City Of Springfield, Ohio

- Jury instruction possession 497334277 form

- Jury instruction bribery or reward of bank officer form

- Obstruction of correspondence form

- Waiver of exclusion ground form

- Omega psi phi fraternity inc special event checklist form

- Omega psi phi fraternity inc special event checklist boppforgb form

- Doc form hpc serv delivery monthly 031710sampledoc cuyahogabdd

- Electrical work permit application e gov link form

Find out other Income Tax Refund Request Form City Of Springfield, Ohio

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free