Consumer Installment Loan Agreement and Truth in Lending Act Bb Form

What is the Consumer Installment Loan Agreement and Truth in Lending Act BB

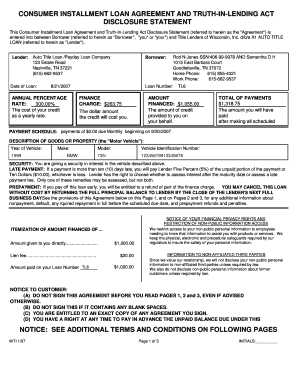

The Consumer Installment Loan Agreement is a legal document that outlines the terms and conditions of a loan provided to a borrower. It details the amount borrowed, interest rates, repayment schedule, and any fees associated with the loan. The Truth in Lending Act (TILA) is a federal law designed to promote informed consumer decision-making through the disclosure of key loan terms. This act requires lenders to provide clear and concise information regarding the cost of credit, enabling borrowers to compare different loan offers effectively. Understanding both the agreement and TILA is essential for consumers to make informed financial choices.

Key Elements of the Consumer Installment Loan Agreement and Truth in Lending Act BB

Several critical components are included in the Consumer Installment Loan Agreement. These elements typically encompass:

- Loan Amount: The total sum of money being borrowed.

- Interest Rate: The percentage charged on the borrowed amount, which can be fixed or variable.

- Repayment Terms: The schedule detailing when payments are due and how long the borrower has to repay the loan.

- Fees: Any additional costs associated with the loan, such as origination fees or late payment penalties.

- Disclosure Requirements: Information mandated by TILA that must be provided to the borrower, including the Annual Percentage Rate (APR) and total cost of the loan.

These elements ensure that borrowers are fully aware of their obligations and the costs involved in the loan agreement.

Steps to Complete the Consumer Installment Loan Agreement and Truth in Lending Act BB

Completing the Consumer Installment Loan Agreement involves several key steps:

- Review the Loan Terms: Carefully read the terms of the loan, including interest rates, repayment schedules, and fees.

- Gather Required Information: Collect necessary documentation, such as identification and income verification.

- Fill Out the Agreement: Complete all sections of the loan agreement accurately, ensuring all information is correct.

- Sign the Agreement: Sign the document to indicate your acceptance of the terms. Digital signatures are often accepted, providing a convenient option.

- Submit the Agreement: Return the signed agreement to the lender, either electronically or via mail, as specified by the lender.

Following these steps helps ensure that the loan process is smooth and compliant with legal requirements.

Legal Use of the Consumer Installment Loan Agreement and Truth in Lending Act BB

The Consumer Installment Loan Agreement is legally binding once signed by both parties. It is essential for lenders to comply with the Truth in Lending Act, which mandates transparency in lending practices. This includes providing borrowers with a clear understanding of their rights and responsibilities. Violations of TILA can result in penalties for lenders, emphasizing the importance of adhering to legal standards in the loan process.

How to Obtain the Consumer Installment Loan Agreement and Truth in Lending Act BB

To obtain a Consumer Installment Loan Agreement, borrowers typically need to approach a financial institution or lender that offers installment loans. Many lenders provide these agreements online, allowing for easy access and completion. It is advisable to compare different lenders to find the most favorable terms. Additionally, resources related to the Truth in Lending Act can be found on government websites, providing further insight into consumer rights and protections.

Examples of Using the Consumer Installment Loan Agreement and Truth in Lending Act BB

Examples of scenarios where the Consumer Installment Loan Agreement is applicable include:

- Purchasing a vehicle through financing, where the loan agreement details the terms of repayment.

- Taking out a personal loan for home improvements, with clear disclosures as mandated by TILA.

- Obtaining a loan for educational expenses, ensuring that borrowers understand their repayment obligations.

These examples illustrate the practical application of the agreement and the importance of TILA in protecting consumer interests.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the consumer installment loan agreement and truth in lending act bb

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Consumer Installment Loan Agreement And Truth in Lending Act Bb?

A Consumer Installment Loan Agreement And Truth in Lending Act Bb is a legal document that outlines the terms of a loan provided to consumers. It ensures transparency by detailing the loan amount, interest rates, and repayment schedule, in compliance with the Truth in Lending Act. This agreement protects consumers by providing clear information about their financial obligations.

-

How does airSlate SignNow facilitate the signing of a Consumer Installment Loan Agreement And Truth in Lending Act Bb?

airSlate SignNow simplifies the process of signing a Consumer Installment Loan Agreement And Truth in Lending Act Bb by allowing users to eSign documents securely and efficiently. The platform provides an intuitive interface that enables businesses to send agreements for signature quickly. This streamlines the loan process, making it easier for both lenders and borrowers.

-

What are the benefits of using airSlate SignNow for Consumer Installment Loan Agreements?

Using airSlate SignNow for Consumer Installment Loan Agreements offers numerous benefits, including enhanced security, reduced turnaround time, and improved compliance with legal standards. The platform ensures that all signatures are legally binding and securely stored. Additionally, it helps businesses maintain a professional image by providing a seamless signing experience.

-

Is airSlate SignNow cost-effective for managing Consumer Installment Loan Agreements?

Yes, airSlate SignNow is a cost-effective solution for managing Consumer Installment Loan Agreements. The platform offers various pricing plans tailored to different business needs, ensuring that companies can find an option that fits their budget. By reducing paper usage and streamlining the signing process, businesses can save both time and money.

-

Can airSlate SignNow integrate with other software for Consumer Installment Loan Agreements?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing its functionality for managing Consumer Installment Loan Agreements. This allows businesses to connect their existing systems, such as CRM and accounting software, to streamline workflows and improve efficiency. Integrations help ensure that all data is synchronized and accessible.

-

What features does airSlate SignNow provide for Consumer Installment Loan Agreements?

airSlate SignNow provides a range of features for Consumer Installment Loan Agreements, including customizable templates, automated reminders, and real-time tracking of document status. These features help businesses manage their agreements more effectively and ensure that all parties are informed throughout the signing process. The platform also supports multiple file formats for added convenience.

-

How secure is airSlate SignNow for handling Consumer Installment Loan Agreements?

Security is a top priority for airSlate SignNow when handling Consumer Installment Loan Agreements. The platform employs advanced encryption methods to protect sensitive information and ensure that documents are safe from unauthorized access. Additionally, airSlate SignNow complies with industry standards and regulations to maintain the integrity of all transactions.

Get more for Consumer Installment Loan Agreement And Truth in lending Act Bb

Find out other Consumer Installment Loan Agreement And Truth in lending Act Bb

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document