Pautang Form

What is the Pautang Form

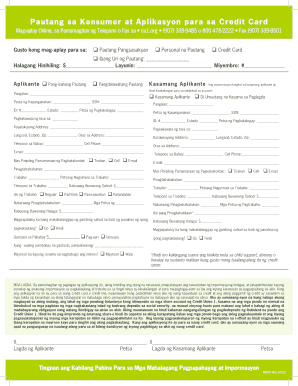

The Pautang Form is a document used primarily for loan agreements between parties, often in personal or informal lending situations. This form outlines the terms of the loan, including the amount borrowed, interest rates, repayment schedules, and any collateral involved. It serves as a legal record of the agreement, ensuring both parties understand their obligations and rights under the terms of the loan.

How to use the Pautang Form

Using the Pautang Form involves several steps to ensure clarity and legality. First, both the lender and borrower should fill out their respective sections of the form, providing accurate personal information. Next, the terms of the loan should be clearly stated, including the total loan amount, interest rate, payment due dates, and any penalties for late payments. Once completed, both parties should sign the form to validate the agreement, and it is advisable to keep copies for their records.

Steps to complete the Pautang Form

Completing the Pautang Form requires attention to detail. Follow these steps:

- Gather necessary information, including names, addresses, and contact details of both parties.

- Clearly state the loan amount and the purpose of the loan.

- Specify the interest rate and repayment terms, including the duration of the loan.

- Include any collateral or guarantees if applicable.

- Review the form for accuracy and completeness.

- Both parties should sign and date the form to finalize the agreement.

Key elements of the Pautang Form

The Pautang Form should include several key elements to ensure it is legally binding and clear. These elements include:

- The full names and addresses of the lender and borrower.

- The specific amount of money being loaned.

- The interest rate applied to the loan.

- A detailed repayment schedule, including due dates.

- Any penalties for late payments or defaults.

- Signatures of both parties, indicating agreement to the terms.

Legal use of the Pautang Form

The Pautang Form holds legal significance once signed by both parties. It acts as a binding contract that can be enforced in a court of law if necessary. To ensure its legality, both parties must understand the terms and conditions outlined in the form. It is also advisable to have the form notarized, which adds an additional layer of authenticity and can help prevent disputes in the future.

Who Issues the Form

The Pautang Form is typically created by the lender or borrower, depending on their preference. There is no central authority that issues this form, as it is often tailored to fit the specific needs of the parties involved. However, templates are available that can guide users in drafting a comprehensive and legally sound agreement.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pautang form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Pautang Form and how can it be used?

A Pautang Form is a document used to formalize a loan agreement between parties. It outlines the terms of the loan, including the amount, interest rate, and repayment schedule. Using airSlate SignNow, you can easily create, send, and eSign your Pautang Form, ensuring a smooth and legally binding transaction.

-

How does airSlate SignNow simplify the creation of a Pautang Form?

airSlate SignNow offers a user-friendly interface that allows you to create a Pautang Form quickly and efficiently. With customizable templates and drag-and-drop features, you can tailor the form to meet your specific needs. This streamlines the process, saving you time and reducing errors.

-

What are the pricing options for using airSlate SignNow for Pautang Forms?

airSlate SignNow provides flexible pricing plans to accommodate various business needs. Whether you're a small business or a large enterprise, you can choose a plan that fits your budget while still accessing essential features for managing Pautang Forms. Visit our pricing page for detailed information on each plan.

-

Can I integrate airSlate SignNow with other applications for managing Pautang Forms?

Yes, airSlate SignNow offers seamless integrations with various applications, enhancing your workflow for managing Pautang Forms. You can connect with popular tools like Google Drive, Dropbox, and CRM systems to streamline document management and improve collaboration. This integration capability makes it easier to handle your loan agreements.

-

What are the benefits of using airSlate SignNow for Pautang Forms?

Using airSlate SignNow for Pautang Forms provides numerous benefits, including enhanced security, faster processing times, and improved accuracy. The platform ensures that your documents are securely stored and easily accessible, while electronic signatures expedite the approval process. This leads to a more efficient loan management experience.

-

Is it easy to eSign a Pautang Form with airSlate SignNow?

Absolutely! airSlate SignNow makes it incredibly easy to eSign a Pautang Form. Recipients receive a notification to review and sign the document electronically, which can be done from any device. This convenience helps speed up the loan agreement process signNowly.

-

What security measures does airSlate SignNow implement for Pautang Forms?

airSlate SignNow prioritizes the security of your Pautang Forms by implementing robust encryption and compliance with industry standards. All documents are securely stored, and access is controlled to protect sensitive information. You can trust that your loan agreements are safe and confidential.

Get more for Pautang Form

Find out other Pautang Form

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word

- How To Sign Missouri Banking Form

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document