Form 8582 CR Rev December Passive Activity Credit Limitations 2024-2026

What is the Form 8582 CR Rev December Passive Activity Credit Limitations

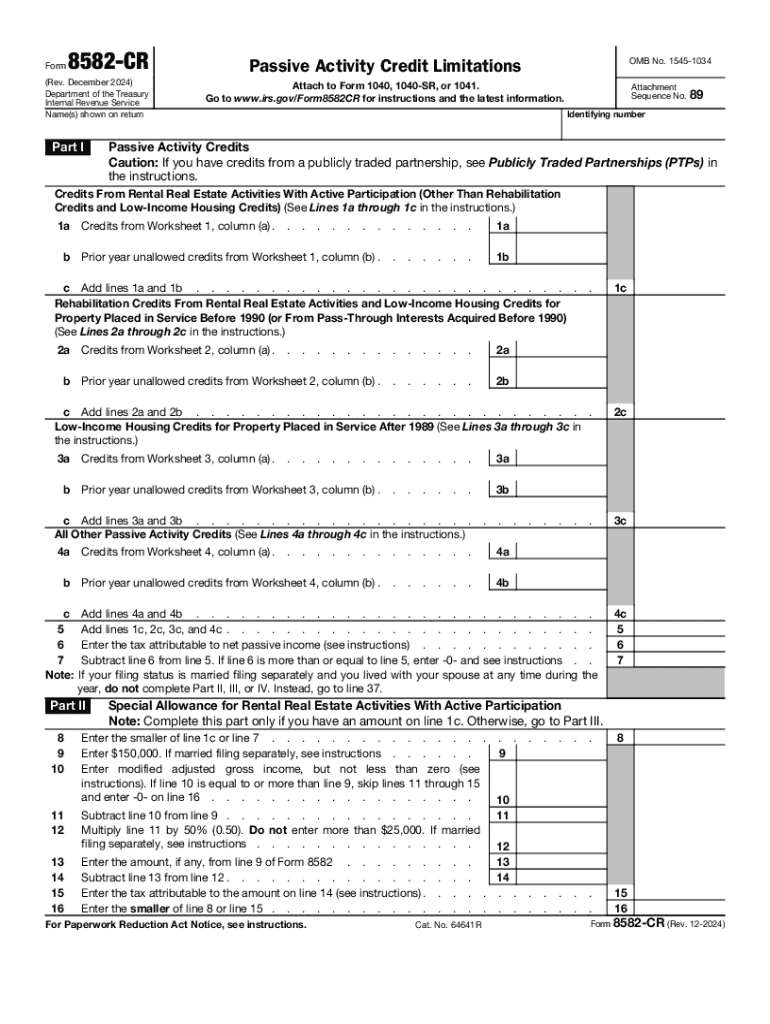

The Form 8582 CR Rev December is a tax form used by individuals and businesses to report passive activity credits. This form is essential for calculating the allowable credits against tax liabilities related to passive activities, which are defined as trade or business activities in which the taxpayer does not materially participate. The form helps taxpayers determine the limitations on these credits based on their income and the nature of their passive activities.

How to use the Form 8582 CR Rev December Passive Activity Credit Limitations

Using the Form 8582 CR Rev December involves several key steps. Taxpayers must first gather all relevant information regarding their passive activities, including income, losses, and any credits earned. Next, they will fill out the form by entering the required data, ensuring that all calculations are accurate. After completing the form, it should be submitted along with the taxpayer's federal income tax return, either electronically or via mail, depending on their filing preference.

Steps to complete the Form 8582 CR Rev December Passive Activity Credit Limitations

Completing the Form 8582 CR Rev December requires careful attention to detail. Here are the steps to follow:

- Gather documentation related to all passive activities, including income statements and loss records.

- Fill out the identification section with taxpayer information.

- Report passive activity income and losses on the appropriate lines of the form.

- Calculate the total credits available based on the provided guidelines.

- Review the completed form for accuracy before submission.

Key elements of the Form 8582 CR Rev December Passive Activity Credit Limitations

Several key elements are crucial for understanding the Form 8582 CR Rev December. These include:

- Passive Activity Income: Income generated from activities in which the taxpayer does not materially participate.

- Passive Activity Losses: Losses incurred from passive activities that can offset passive income.

- Credit Limitations: Restrictions on the amount of passive activity credits that can be claimed, based on overall income levels.

- Carryover Rules: Provisions allowing unused credits to be carried forward to future tax years.

IRS Guidelines

The IRS provides specific guidelines for completing the Form 8582 CR Rev December. These guidelines outline the eligibility criteria for passive activity credits, the calculation methods for determining allowable credits, and the documentation required to support claims. Taxpayers should refer to the latest IRS publications and instructions to ensure compliance with current tax laws and regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8582 CR Rev December align with the standard federal tax return deadlines. Typically, individual taxpayers must file their returns by April 15 of the following year. However, if the due date falls on a weekend or holiday, the deadline is extended to the next business day. It is essential for taxpayers to be aware of these dates to avoid penalties and ensure timely submission of their forms.

Create this form in 5 minutes or less

Find and fill out the correct form 8582 cr rev december passive activity credit limitations

Create this form in 5 minutes!

How to create an eSignature for the form 8582 cr rev december passive activity credit limitations

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 8582 CR Rev December Passive Activity Credit Limitations?

The Form 8582 CR Rev December Passive Activity Credit Limitations is a tax form used to calculate the limitations on passive activity credits. It helps taxpayers determine how much of their passive activity credits can be utilized against their tax liabilities. Understanding this form is crucial for maximizing tax benefits.

-

How can airSlate SignNow assist with Form 8582 CR Rev December Passive Activity Credit Limitations?

airSlate SignNow provides an efficient platform for electronically signing and sending documents related to Form 8582 CR Rev December Passive Activity Credit Limitations. Our solution simplifies the process, ensuring that all necessary forms are completed and submitted accurately and on time.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax documents like Form 8582 CR Rev December Passive Activity Credit Limitations. These features streamline the workflow, making it easier to handle important tax-related paperwork.

-

Is airSlate SignNow cost-effective for small businesses dealing with tax forms?

Yes, airSlate SignNow is a cost-effective solution for small businesses managing tax forms, including Form 8582 CR Rev December Passive Activity Credit Limitations. Our pricing plans are designed to fit various budgets, ensuring that businesses can access essential eSigning services without breaking the bank.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, enhancing your ability to manage Form 8582 CR Rev December Passive Activity Credit Limitations and other tax documents. This integration allows for a smoother workflow and better organization of your financial records.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, such as Form 8582 CR Rev December Passive Activity Credit Limitations, offers numerous benefits, including increased efficiency, reduced errors, and enhanced security. Our platform ensures that your documents are handled with care and delivered promptly.

-

How secure is airSlate SignNow for handling sensitive tax information?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive tax information, including details related to Form 8582 CR Rev December Passive Activity Credit Limitations. You can trust that your documents are safe with us.

Get more for Form 8582 CR Rev December Passive Activity Credit Limitations

- Tennessee contractor form

- Foundation contract for contractor tennessee form

- Plumbing contract for contractor tennessee form

- Brick mason contract for contractor tennessee form

- Roofing contract for contractor tennessee form

- Electrical contract for contractor tennessee form

- Sheetrock drywall contract for contractor tennessee form

- Flooring contract for contractor tennessee form

Find out other Form 8582 CR Rev December Passive Activity Credit Limitations

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe