It 20S it 65 Schedule in K 1 Form

What is the IT 20S IT 65 Schedule IN K 1

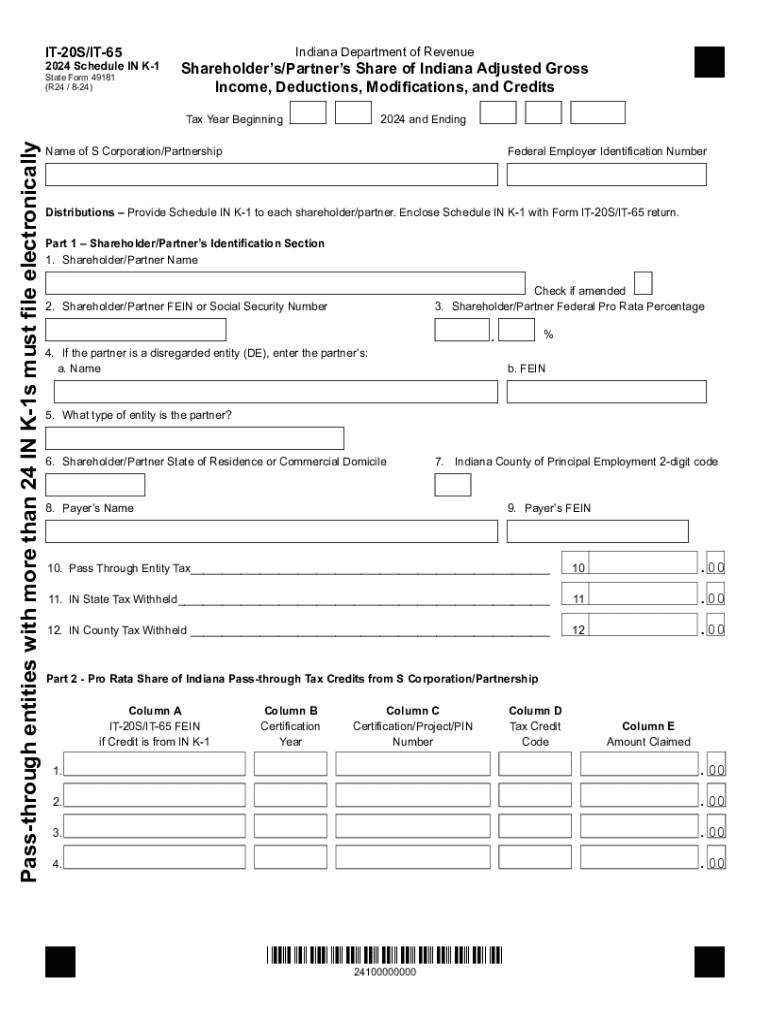

The IT 20S IT 65 Schedule IN K 1 is a tax form used in the United States, specifically for reporting income, deductions, and credits from partnerships and S corporations. This form is essential for pass-through entities, allowing them to report their income to the Internal Revenue Service (IRS) while providing necessary information to individual partners or shareholders. The form includes details such as the entity's income, expenses, and distributions, which are then passed on to the individual tax returns of the partners or shareholders.

How to use the IT 20S IT 65 Schedule IN K 1

Using the IT 20S IT 65 Schedule IN K 1 involves several steps. First, the entity must complete the form accurately, ensuring all income and deductions are reported correctly. Once completed, the form is distributed to each partner or shareholder, who will then use the information to fill out their individual tax returns. It is important to keep a copy of the form for your records, as it serves as a basis for reporting income on personal tax filings.

Steps to complete the IT 20S IT 65 Schedule IN K 1

Completing the IT 20S IT 65 Schedule IN K 1 requires careful attention to detail. Follow these steps:

- Gather all necessary financial documents, including income statements and expense reports.

- Fill out the entity's information at the top of the form, including the name, address, and Employer Identification Number (EIN).

- Report all income earned by the entity in the designated sections of the form.

- Detail any deductions that the entity is eligible for, ensuring compliance with IRS guidelines.

- Calculate the total income or loss and any distributions made to partners or shareholders.

- Distribute the completed forms to each partner or shareholder for their records and tax filing purposes.

Legal use of the IT 20S IT 65 Schedule IN K 1

The IT 20S IT 65 Schedule IN K 1 is legally required for partnerships and S corporations in the United States. It ensures that income is reported accurately to the IRS, allowing partners and shareholders to report their share of the entity's income on their personal tax returns. Failure to file this form correctly can result in penalties for both the entity and the individual partners or shareholders, making compliance essential.

Key elements of the IT 20S IT 65 Schedule IN K 1

Key elements of the IT 20S IT 65 Schedule IN K 1 include:

- Entity Information: Basic details about the partnership or S corporation, including name and EIN.

- Income Reporting: Sections for detailing various types of income earned by the entity.

- Deductions: Areas to report eligible deductions that reduce taxable income.

- Distributions: Information on distributions made to partners or shareholders during the tax year.

- Signature: A declaration section that must be signed by an authorized representative of the entity.

Filing Deadlines / Important Dates

Filing deadlines for the IT 20S IT 65 Schedule IN K 1 typically align with the overall tax return deadlines for partnerships and S corporations. Generally, these entities must file their returns by March fifteen for calendar year filers. However, if the entity requires an extension, it may file for an extension, allowing additional time to complete the form. It is crucial to stay informed about specific deadlines to avoid penalties.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the it 20s it 65 schedule in k 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IT 20S IT 65 Schedule IN K 1?

The IT 20S IT 65 Schedule IN K 1 is a tax form used by partnerships and S corporations to report income, deductions, and credits to the IRS. It provides essential information for partners and shareholders regarding their share of the entity's income. Understanding this form is crucial for accurate tax reporting and compliance.

-

How can airSlate SignNow help with the IT 20S IT 65 Schedule IN K 1?

airSlate SignNow simplifies the process of preparing and signing the IT 20S IT 65 Schedule IN K 1 by providing an intuitive platform for document management. Users can easily upload, edit, and eSign their tax forms, ensuring a smooth workflow. This efficiency helps businesses save time and reduce errors in their tax submissions.

-

What are the pricing options for using airSlate SignNow for the IT 20S IT 65 Schedule IN K 1?

airSlate SignNow offers flexible pricing plans that cater to different business needs, making it cost-effective for managing the IT 20S IT 65 Schedule IN K 1. Plans typically include features like unlimited document signing and templates. You can choose a plan that fits your budget while ensuring compliance with tax regulations.

-

What features does airSlate SignNow provide for the IT 20S IT 65 Schedule IN K 1?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking specifically for the IT 20S IT 65 Schedule IN K 1. These tools enhance the user experience by streamlining the preparation and submission process. Additionally, the platform ensures that all documents are securely stored and easily accessible.

-

Are there any integrations available with airSlate SignNow for the IT 20S IT 65 Schedule IN K 1?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage the IT 20S IT 65 Schedule IN K 1. These integrations allow for automatic data transfer and reduce the need for manual entry. This connectivity enhances productivity and ensures accuracy in tax reporting.

-

What are the benefits of using airSlate SignNow for the IT 20S IT 65 Schedule IN K 1?

Using airSlate SignNow for the IT 20S IT 65 Schedule IN K 1 offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick eSigning and document sharing, which accelerates the tax filing process. Additionally, it helps businesses maintain compliance with tax regulations.

-

Is airSlate SignNow user-friendly for preparing the IT 20S IT 65 Schedule IN K 1?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to prepare the IT 20S IT 65 Schedule IN K 1. The intuitive interface guides users through the document preparation process, ensuring that even those with minimal technical skills can navigate it effectively. This accessibility is key for busy professionals.

Get more for IT 20S IT 65 Schedule IN K 1

- Property that when fraud is proved by the defendants and against the plaintiffs and the form

- Circuit court clerks manual civil trial of the actionpost trial form

- You are instructed that a battery is an intentional unpermitted and unprivileged offensive form

- Lagging life expectancy for black men a public health form

- Plaintiffs motion in limine to preclude defendant from form

- Rule 46 admission withdrawal and discipline of attorneys form

- General motors corp v superior court supreme court of form

- Fraud on the court and abusive discovery scholarly form

Find out other IT 20S IT 65 Schedule IN K 1

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online