Payment Extension 2015

What is the Payment Extension

The Payment Extension is a formal request that allows taxpayers to extend the deadline for making tax payments. This extension is particularly useful for individuals and businesses that may need additional time to gather funds or complete their tax filings. It is important to note that while the extension grants more time for payment, it does not extend the deadline for filing tax returns. Understanding the Payment Extension can help taxpayers manage their financial obligations more effectively.

How to use the Payment Extension

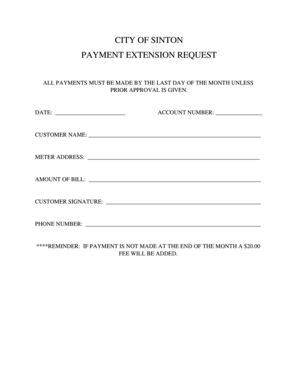

To utilize the Payment Extension, taxpayers must fill out the appropriate form, indicating their intention to delay payment. This form typically requires basic information such as the taxpayer's name, Social Security number, and the amount owed. After completing the form, it should be submitted to the relevant tax authority. It is advisable to keep a copy for personal records. Additionally, taxpayers should ensure that they comply with any specific instructions provided by the tax authority to avoid complications.

Steps to complete the Payment Extension

Completing the Payment Extension involves several key steps:

- Gather necessary information, including your tax identification details and the amount due.

- Obtain the correct form for the Payment Extension from the tax authority's website or office.

- Fill out the form accurately, ensuring all required fields are completed.

- Submit the form by the specified deadline, either online or via mail, depending on the options provided.

- Retain a copy of the submitted form for your records.

Legal use of the Payment Extension

The Payment Extension is legally recognized and provides taxpayers with a legitimate means to defer payment without incurring penalties, provided the request is made in accordance with the established guidelines. Taxpayers must ensure they meet the eligibility criteria and adhere to the submission deadlines to maintain compliance with tax laws. Understanding the legal framework surrounding the Payment Extension can help prevent potential issues with the tax authorities.

Eligibility Criteria

Eligibility for the Payment Extension typically includes being a taxpayer who is unable to meet the payment deadline due to financial constraints or unforeseen circumstances. Specific criteria may vary based on the tax authority's regulations, but generally, both individuals and businesses can qualify. It is essential to review the guidelines provided by the tax authority to confirm eligibility and ensure that all requirements are met before submitting the request.

Filing Deadlines / Important Dates

Filing deadlines for the Payment Extension are crucial for taxpayers to observe. Generally, the request for an extension must be submitted by the original payment due date. Failure to file the Payment Extension on time may result in penalties or interest charges on the unpaid amount. Taxpayers should consult the tax authority's calendar for specific dates related to the Payment Extension to ensure timely compliance.

Required Documents

When applying for a Payment Extension, certain documents may be required to support the request. Commonly needed documents include:

- Completed Payment Extension form.

- Tax identification number (Social Security number or Employer Identification Number).

- Proof of income or financial hardship, if applicable.

Having these documents ready can streamline the process and help ensure a successful application for the Payment Extension.

Create this form in 5 minutes or less

Find and fill out the correct payment extension

Create this form in 5 minutes!

How to create an eSignature for the payment extension

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Payment Extension in airSlate SignNow?

A Payment Extension in airSlate SignNow allows users to manage and extend payment deadlines for signed documents. This feature is particularly useful for businesses that require flexibility in payment terms, ensuring that all parties can agree on a timeline that suits their needs.

-

How does the Payment Extension feature benefit my business?

The Payment Extension feature benefits your business by providing greater flexibility in managing payment schedules. This can enhance customer satisfaction, reduce late payments, and streamline your cash flow management, making it easier to maintain positive relationships with clients.

-

Is there an additional cost for using the Payment Extension feature?

The Payment Extension feature is included in various pricing plans of airSlate SignNow, but specific costs may vary based on the plan you choose. It's advisable to review the pricing details on our website or contact our sales team for more information on how this feature fits into your budget.

-

Can I customize the Payment Extension terms for different clients?

Yes, airSlate SignNow allows you to customize Payment Extension terms for different clients. This flexibility ensures that you can tailor agreements to meet the specific needs of each client, enhancing your service offerings and improving client relationships.

-

What integrations support the Payment Extension feature?

The Payment Extension feature in airSlate SignNow integrates seamlessly with various payment processors and CRM systems. This allows you to automate payment reminders and track payment statuses directly within your existing workflows, enhancing efficiency and reducing manual tasks.

-

How do I set up a Payment Extension for a document?

Setting up a Payment Extension in airSlate SignNow is straightforward. Simply create your document, specify the payment terms, and select the Payment Extension option before sending it for eSignature. This ensures that all parties are aware of the agreed-upon payment timeline.

-

Can I track the status of a Payment Extension request?

Yes, airSlate SignNow provides tracking capabilities for Payment Extension requests. You can easily monitor the status of your payment agreements, ensuring that you stay informed about when payments are due and if any extensions have been granted.

Get more for Payment Extension

- Final cast list information sheet

- Taft hartley report for principals new media sag aftra form

- Sag new media performer contract

- Blank fct data collection sheet csesa form

- En109 reading writing and research in the workplace cms montgomerycollege form

- Saq dpdf pci security standards council pcisecuritystandards form

- Sky zone van nuys form

- Chemistry worksheet matter 1 form

Find out other Payment Extension

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free