Do Not Staple or Paper Clip Ohio it 4738 Elec Form

What is the Do Not Staple Or Paper Clip Ohio IT 4738 Elec

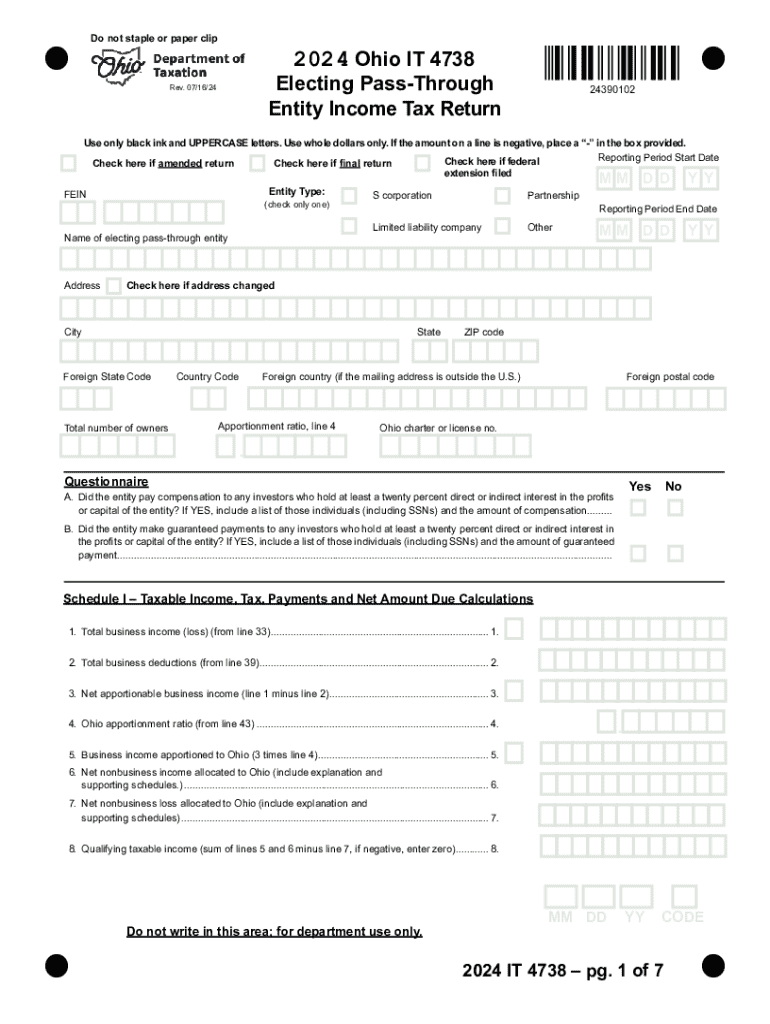

The Do Not Staple Or Paper Clip Ohio IT 4738 Elec is a specific form used in Ohio for electronic filing of income tax returns. This form is essential for taxpayers who need to report their income and calculate their tax obligations accurately. It is designed to streamline the filing process, ensuring that documents are submitted in a clear and organized manner. The instructions emphasize that no staples or paper clips should be used, as these can interfere with processing and scanning of the documents.

How to use the Do Not Staple Or Paper Clip Ohio IT 4738 Elec

Using the Do Not Staple Or Paper Clip Ohio IT 4738 Elec involves several straightforward steps. First, ensure that you have all necessary information and documents ready for input. Fill out the form electronically, following the prompts carefully to avoid errors. After completing the form, review all entries for accuracy. Once confirmed, submit the form electronically through the designated platform. Remember to keep a copy of the completed form for your records. Avoid any physical alterations, such as stapling or clipping, to maintain compliance with submission guidelines.

Steps to complete the Do Not Staple Or Paper Clip Ohio IT 4738 Elec

Completing the Do Not Staple Or Paper Clip Ohio IT 4738 Elec involves a series of organized steps:

- Gather all required information, including personal identification details and income documentation.

- Access the electronic version of the form through the appropriate channels.

- Fill in the form fields accurately, ensuring all calculations are correct.

- Review the completed form thoroughly to catch any mistakes.

- Submit the form electronically, ensuring no physical attachments are included.

Key elements of the Do Not Staple Or Paper Clip Ohio IT 4738 Elec

The Do Not Staple Or Paper Clip Ohio IT 4738 Elec contains several key elements that are crucial for proper filing:

- Taxpayer Information: This section requires personal details such as name, address, and Social Security number.

- Income Reporting: Taxpayers must accurately report all sources of income, including wages and investment earnings.

- Deductions and Credits: The form allows for the inclusion of eligible deductions and tax credits, which can reduce the overall tax liability.

- Signature Section: An electronic signature may be required to validate the submission.

Legal use of the Do Not Staple Or Paper Clip Ohio IT 4738 Elec

The legal use of the Do Not Staple Or Paper Clip Ohio IT 4738 Elec is governed by Ohio tax regulations. This form must be used by individuals and businesses filing their state income taxes electronically. Compliance with the no-staple and no-paper-clip rule is essential, as failure to adhere to these guidelines can lead to processing delays or rejection of the form. Understanding the legal implications ensures that taxpayers fulfill their obligations while avoiding penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Do Not Staple Or Paper Clip Ohio IT 4738 Elec are critical for compliance. Generally, the deadline for submitting state income tax returns is April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important for taxpayers to stay informed about any changes to deadlines or additional requirements that may arise during the tax season. Marking these dates on a calendar can help ensure timely submission.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the do not staple or paper clip ohio it 4738 elec

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of 'Do Not Staple Or Paper Clip Ohio IT 4738 Elec.'?

The instruction 'Do Not Staple Or Paper Clip Ohio IT 4738 Elec.' is crucial for ensuring that your documents are processed correctly. Stapling or paper clipping can interfere with scanning and processing, leading to delays. By following this guideline, you help maintain the integrity of your submission.

-

How does airSlate SignNow help with the Ohio IT 4738 Elec. form?

airSlate SignNow provides a seamless way to complete and eSign the Ohio IT 4738 Elec. form without the need for physical staples or paper clips. Our platform allows you to fill out the form digitally, ensuring compliance with the 'Do Not Staple Or Paper Clip Ohio IT 4738 Elec.' requirement. This streamlines your submission process and enhances efficiency.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Our plans are designed to be cost-effective while providing all the necessary features to manage documents, including those requiring adherence to 'Do Not Staple Or Paper Clip Ohio IT 4738 Elec.' guidelines. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes a range of features such as eSigning, document templates, and secure storage. These features ensure that you can manage your documents efficiently while adhering to instructions like 'Do Not Staple Or Paper Clip Ohio IT 4738 Elec.' Our user-friendly interface makes it easy to navigate and utilize these tools.

-

Can airSlate SignNow integrate with other software?

Yes, airSlate SignNow offers integrations with various software applications to enhance your workflow. This means you can easily connect with tools you already use while ensuring compliance with 'Do Not Staple Or Paper Clip Ohio IT 4738 Elec.' requirements. Our integrations help streamline your processes and improve productivity.

-

What are the benefits of using airSlate SignNow for eSigning?

Using airSlate SignNow for eSigning provides numerous benefits, including speed, security, and convenience. You can sign documents from anywhere without the hassle of printing or mailing, which is especially important for forms like 'Do Not Staple Or Paper Clip Ohio IT 4738 Elec.' This not only saves time but also reduces paper waste.

-

Is airSlate SignNow secure for handling sensitive documents?

Absolutely, airSlate SignNow prioritizes the security of your documents. We implement advanced encryption and security protocols to protect your information, ensuring that your submissions, including those related to 'Do Not Staple Or Paper Clip Ohio IT 4738 Elec.', are safe from unauthorized access. You can trust us with your sensitive data.

Get more for Do Not Staple Or Paper Clip Ohio IT 4738 Elec

- Mutual release of purchase agreementpdf form

- Msds metal form f 140 argosdirect

- Application for a disabled hunter permit wyoming wgfd wyo form

- Florida marriage license application form florida marriage license application form listify

- Ssa 8001 form 2015 2019

- Part iia of form adv firm brochure cadaret grant amp co

- Field trip waiver form

- Form f 7 passenger capacity allocation request form commuter

Find out other Do Not Staple Or Paper Clip Ohio IT 4738 Elec

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free