Cooksey Tax and Notary 2024

What is the Cooksey Tax And Notary

The Cooksey Tax And Notary is a specialized service that combines tax preparation and notary services. This dual function allows individuals and businesses to manage their tax obligations while also having access to notary services, which are essential for the signing and verification of important documents. This service is particularly beneficial for those who require assistance with tax filings and need to notarize documents such as affidavits, contracts, and other legal forms.

How to use the Cooksey Tax And Notary

Using the Cooksey Tax And Notary involves a straightforward process. First, clients can schedule an appointment to discuss their tax needs and any documents that require notarization. During the appointment, a tax professional will assist in preparing the necessary tax forms while also providing notary services for any documents that need to be signed. This integrated approach ensures that all tax-related and notarization tasks are handled efficiently in one location.

Steps to complete the Cooksey Tax And Notary

To complete the Cooksey Tax And Notary process, follow these steps:

- Gather all necessary financial documents, including income statements, previous tax returns, and any documents requiring notarization.

- Schedule an appointment with the Cooksey Tax And Notary office.

- During the appointment, collaborate with the tax professional to complete your tax forms.

- Present any documents that require notarization for signing in the presence of the notary.

- Review all completed documents for accuracy before submission.

Legal use of the Cooksey Tax And Notary

The Cooksey Tax And Notary operates within legal guidelines established for tax preparation and notary services in the United States. Tax professionals are required to adhere to IRS regulations when preparing tax returns, ensuring that all information is accurate and compliant. Notaries are also bound by state laws, which govern their authority to witness signatures and verify identities. This legal framework ensures that clients receive trustworthy and legitimate services.

Required Documents

When utilizing the Cooksey Tax And Notary services, clients should prepare the following documents:

- Identification documents, such as a driver's license or passport.

- Social Security numbers for all individuals listed on the tax return.

- Income documentation, including W-2 forms and 1099 forms.

- Any prior year tax returns for reference.

- Documents requiring notarization, such as contracts or legal affidavits.

Filing Deadlines / Important Dates

It is crucial to be aware of key filing deadlines when using the Cooksey Tax And Notary services. Generally, the deadline for individual tax returns is April 15 each year. If this date falls on a weekend or holiday, the deadline may be extended. Additionally, clients should keep track of any state-specific deadlines that may apply to their tax filings. Being informed about these dates helps ensure timely submission and compliance with tax regulations.

Create this form in 5 minutes or less

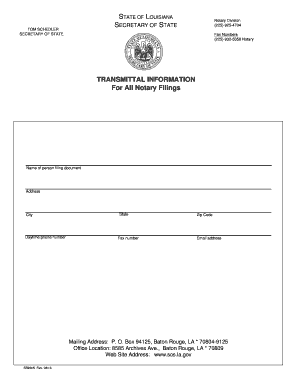

Find and fill out the correct cooksey tax and notary

Create this form in 5 minutes!

How to create an eSignature for the cooksey tax and notary

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What services does Cooksey Tax And Notary offer?

Cooksey Tax And Notary provides a range of services including tax preparation, notary services, and document management. Their expertise ensures that clients receive accurate tax filings and reliable notarization, making it a one-stop solution for your financial and legal documentation needs.

-

How does Cooksey Tax And Notary ensure data security?

At Cooksey Tax And Notary, data security is a top priority. They utilize advanced encryption methods and secure servers to protect sensitive information, ensuring that your documents and personal data remain confidential and safe from unauthorized access.

-

What are the pricing options for Cooksey Tax And Notary services?

Cooksey Tax And Notary offers competitive pricing tailored to meet the needs of various clients. They provide transparent pricing structures with no hidden fees, allowing you to choose the services that best fit your budget and requirements.

-

Can I integrate Cooksey Tax And Notary with other software?

Yes, Cooksey Tax And Notary can be easily integrated with various accounting and document management software. This seamless integration enhances workflow efficiency, allowing you to manage your tax and notary services alongside your existing tools.

-

What are the benefits of using Cooksey Tax And Notary for my business?

Using Cooksey Tax And Notary provides numerous benefits, including expert guidance on tax matters, reliable notary services, and streamlined document management. Their comprehensive approach helps businesses save time and reduce stress during tax season and beyond.

-

Is Cooksey Tax And Notary suitable for small businesses?

Absolutely! Cooksey Tax And Notary is designed to cater to businesses of all sizes, including small businesses. Their tailored services help small business owners navigate tax complexities and ensure compliance, allowing them to focus on growth.

-

How can I contact Cooksey Tax And Notary for support?

You can easily contact Cooksey Tax And Notary through their website, where you will find various options for support including phone, email, and live chat. Their dedicated customer service team is ready to assist you with any inquiries or issues you may have.

Get more for Cooksey Tax And Notary

- New resident guide missouri form

- Satisfaction release or cancellation of deed of trust by corporation missouri form

- Satisfaction release or cancellation of deed of trust by individual missouri form

- Partial release deed form

- Partial release property 497313498 form

- Warranty deed for husband and wife converting property from tenants in common to joint tenancy missouri form

- Warranty deed for parents to child with reservation of life estate missouri form

- Warranty deed for separate or joint property to joint tenancy missouri form

Find out other Cooksey Tax And Notary

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online