Ohio it 10 Do Not Staple or Paper Clip Zero 2024-2026

Understanding the Ohio IT 10 Do Not Staple Or Paper Clip Zero

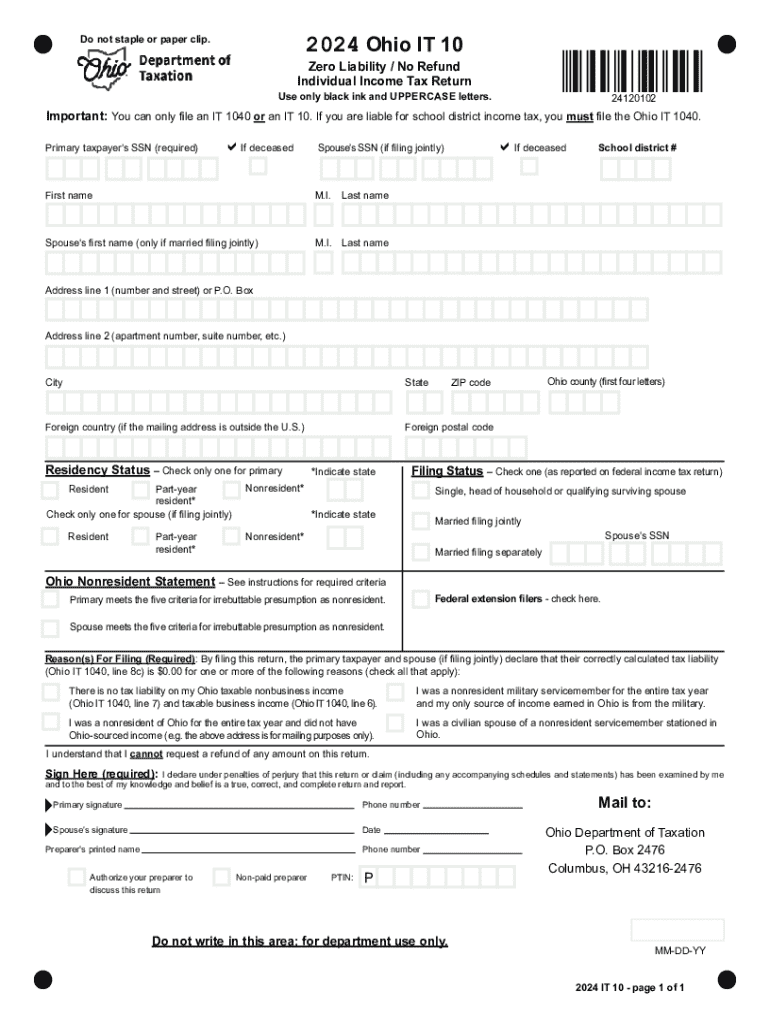

The Ohio IT 10 Do Not Staple Or Paper Clip Zero is a tax form used by individuals and businesses to report income and calculate tax liabilities in the state of Ohio. This form is crucial for ensuring compliance with state tax regulations. It is specifically designed to streamline the filing process, allowing for efficient data entry and processing by the Ohio Department of Taxation.

This form is particularly important for taxpayers who need to report various types of income, including wages, business earnings, and other sources of revenue. The designation "Do Not Staple Or Paper Clip" indicates that the form must be submitted without any fasteners, which helps maintain the integrity of the document during processing.

Steps to Complete the Ohio IT 10 Do Not Staple Or Paper Clip Zero

Completing the Ohio IT 10 requires careful attention to detail to ensure accuracy and compliance. Here are the essential steps:

- Gather Required Information: Collect all necessary financial documents, including W-2s, 1099s, and any other relevant income statements.

- Fill Out the Form: Enter your personal information, including your name, address, and Social Security number. Report your income accurately in the designated sections.

- Calculate Your Tax Liability: Follow the instructions on the form to determine your total tax owed based on your reported income and applicable tax rates.

- Review Your Submission: Double-check all entries for accuracy, ensuring that no information is missing or incorrect.

- Submit the Form: Send the completed form to the Ohio Department of Taxation, ensuring it is free of staples or paper clips as per the instructions.

Legal Use of the Ohio IT 10 Do Not Staple Or Paper Clip Zero

The Ohio IT 10 is legally recognized as a valid document for reporting income to the state. It must be used in accordance with Ohio tax laws, which require accurate reporting of income and payment of any taxes owed. Failure to use the form correctly can result in penalties, including fines or interest on unpaid taxes.

Taxpayers should ensure that they are using the most current version of the form and adhering to all filing requirements set forth by the Ohio Department of Taxation. This ensures compliance and helps avoid any legal complications.

Filing Deadlines for the Ohio IT 10 Do Not Staple Or Paper Clip Zero

Timely filing of the Ohio IT 10 is essential to avoid penalties. The standard deadline for submitting this form is typically aligned with the federal tax filing deadline, which is April fifteenth. However, specific deadlines may vary based on individual circumstances, such as extensions or special filing situations.

Taxpayers should remain aware of any changes to deadlines announced by the Ohio Department of Taxation, especially during unusual circumstances, such as natural disasters or public health emergencies.

Required Documents for the Ohio IT 10 Do Not Staple Or Paper Clip Zero

To accurately complete the Ohio IT 10, taxpayers need to gather several key documents:

- W-2 Forms: These forms report wages and tax withholdings from employers.

- 1099 Forms: These are used for reporting various types of income received, such as freelance work or interest income.

- Supporting Documentation: Any additional records that substantiate income claims, deductions, or credits.

Having all necessary documents ready before starting the form will help streamline the process and reduce the likelihood of errors.

Examples of Using the Ohio IT 10 Do Not Staple Or Paper Clip Zero

The Ohio IT 10 can be utilized in various scenarios, including:

- Individual Tax Filers: Individuals reporting income from employment or self-employment use this form to calculate their state tax obligations.

- Small Business Owners: Business owners reporting income from their operations must accurately complete the form to ensure compliance with state tax laws.

- Freelancers and Contractors: Those earning income through freelance work or contract jobs can use the Ohio IT 10 to report their earnings and pay any applicable taxes.

Each of these examples highlights the importance of the Ohio IT 10 in maintaining compliance with state tax regulations while accurately reporting income.

Create this form in 5 minutes or less

Find and fill out the correct ohio it 10 do not staple or paper clip zero

Create this form in 5 minutes!

How to create an eSignature for the ohio it 10 do not staple or paper clip zero

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Ohio IT 10 Do Not Staple Or Paper Clip Zero?

Ohio IT 10 Do Not Staple Or Paper Clip Zero is a specific guideline for handling important documents in Ohio. This protocol ensures that documents remain intact and legible, which is crucial for legal and administrative purposes. By following this guideline, businesses can avoid potential issues with document processing.

-

How does airSlate SignNow support Ohio IT 10 Do Not Staple Or Paper Clip Zero?

airSlate SignNow provides a seamless eSigning experience that aligns with Ohio IT 10 Do Not Staple Or Paper Clip Zero. Our platform allows users to send and sign documents electronically without the need for physical staples or paper clips. This not only enhances document integrity but also streamlines the signing process.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs, including those adhering to Ohio IT 10 Do Not Staple Or Paper Clip Zero. Our plans are designed to be cost-effective, ensuring that businesses can manage their document signing processes without breaking the bank. You can choose from monthly or annual subscriptions based on your usage.

-

What features does airSlate SignNow offer for compliance with Ohio IT 10 Do Not Staple Or Paper Clip Zero?

Our platform includes features such as secure document storage, customizable templates, and audit trails, all of which support compliance with Ohio IT 10 Do Not Staple Or Paper Clip Zero. These features ensure that your documents are handled properly and remain compliant with state regulations. Additionally, our user-friendly interface makes it easy to manage your documents.

-

Can airSlate SignNow integrate with other software for Ohio IT 10 Do Not Staple Or Paper Clip Zero compliance?

Yes, airSlate SignNow integrates with various software applications to enhance your workflow while adhering to Ohio IT 10 Do Not Staple Or Paper Clip Zero. Our integrations with popular tools like CRM systems and cloud storage services allow for a more streamlined document management process. This ensures that your documents are easily accessible and compliant.

-

What are the benefits of using airSlate SignNow for Ohio IT 10 Do Not Staple Or Paper Clip Zero?

Using airSlate SignNow for Ohio IT 10 Do Not Staple Or Paper Clip Zero offers numerous benefits, including increased efficiency and reduced paper waste. Our electronic signing solution eliminates the need for physical document handling, which aligns with the guidelines. Additionally, it enhances security and provides a clear audit trail for all signed documents.

-

Is airSlate SignNow suitable for small businesses in Ohio?

Absolutely! airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses in Ohio. By following Ohio IT 10 Do Not Staple Or Paper Clip Zero, small businesses can streamline their document processes without incurring high costs. Our platform is user-friendly, making it easy for anyone to adopt.

Get more for Ohio IT 10 Do Not Staple Or Paper Clip Zero

Find out other Ohio IT 10 Do Not Staple Or Paper Clip Zero

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online