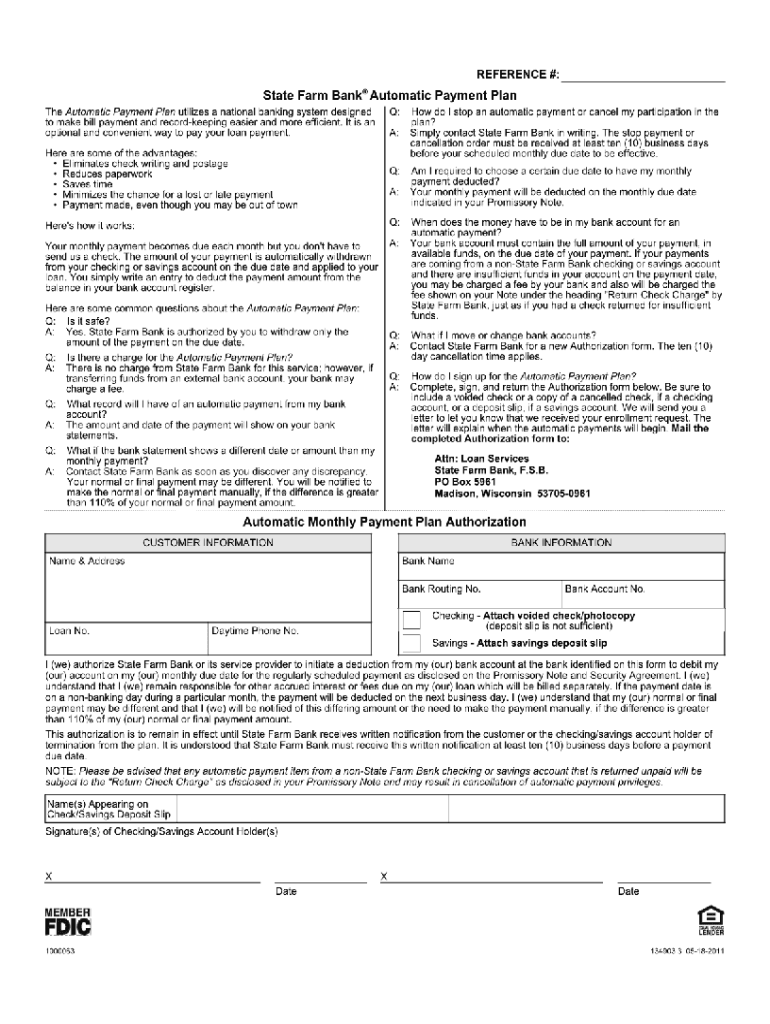

State Farm Payment Plan Form

Understanding the State Farm Payment Plan

The State Farm Payment Plan is a flexible option designed to help policyholders manage their insurance premiums more effectively. This plan allows customers to spread their payments over a specified period, making it easier to budget for insurance costs. Typically, the plan offers various payment schedules, including monthly, quarterly, or semi-annual options, catering to diverse financial situations. By utilizing this payment plan, customers can ensure continuous coverage while alleviating the financial burden of lump-sum payments.

How to Use the State Farm Payment Plan

To utilize the State Farm Payment Plan, policyholders need to follow a straightforward process. First, they must log into their State Farm account or contact their agent to express interest in the payment plan. After confirming eligibility, customers can select their preferred payment schedule and complete any necessary documentation. It is essential to review the terms and conditions associated with the plan, including any applicable fees or interest rates. Once everything is set, customers can enjoy the benefits of manageable payment options.

Steps to Complete the State Farm Payment Plan

Completing the State Farm Payment Plan involves a series of clear steps:

- Log into your State Farm account or contact your agent.

- Express interest in the payment plan and confirm eligibility.

- Select a payment schedule that suits your financial needs.

- Review the terms and conditions, including fees and interest rates.

- Complete any required documentation.

- Submit the plan for approval.

- Start making payments according to the selected schedule.

Key Elements of the State Farm Payment Plan

Several key elements define the State Farm Payment Plan:

- Payment Flexibility: Customers can choose from various payment frequencies, including monthly, quarterly, or semi-annually.

- Budget-Friendly: The plan is designed to help policyholders manage their finances by spreading out payments.

- Continuous Coverage: By using the payment plan, customers can maintain their insurance coverage without interruption.

- Transparency: Clear terms and conditions ensure that policyholders understand their obligations and any associated costs.

Eligibility Criteria for the State Farm Payment Plan

To qualify for the State Farm Payment Plan, policyholders must meet specific eligibility criteria. Generally, customers need to have an active insurance policy with State Farm. Additionally, they should demonstrate a reliable payment history and may need to meet certain credit requirements. It is advisable for customers to consult with their State Farm agent to confirm their eligibility and discuss any potential restrictions based on their individual circumstances.

Examples of Using the State Farm Payment Plan

The State Farm Payment Plan can be beneficial in various scenarios. For instance, a young family may opt for a monthly payment schedule to manage their auto insurance premiums while balancing other household expenses. Similarly, a small business owner might choose a quarterly payment plan to align insurance costs with their cash flow cycles. These examples illustrate how the payment plan can adapt to different financial situations, providing flexibility and support for policyholders.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the state farm payment plan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the State Farm Payment Plan?

The State Farm Payment Plan is a flexible payment option that allows customers to manage their insurance premiums in a way that suits their financial needs. By breaking down payments into manageable installments, it helps ensure that policyholders can maintain their coverage without financial strain.

-

How does the State Farm Payment Plan work?

The State Farm Payment Plan works by allowing customers to choose a payment schedule that fits their budget. Customers can select from various payment frequencies, such as monthly or quarterly, making it easier to keep track of their insurance expenses.

-

What are the benefits of using the State Farm Payment Plan?

Using the State Farm Payment Plan provides several benefits, including improved cash flow management and reduced financial stress. It allows policyholders to maintain continuous coverage while spreading out their payments over time, making insurance more accessible.

-

Are there any fees associated with the State Farm Payment Plan?

While the State Farm Payment Plan is designed to be cost-effective, there may be nominal fees associated with certain payment methods or late payments. It's important to review the terms and conditions to understand any potential costs involved.

-

Can I change my payment schedule with the State Farm Payment Plan?

Yes, customers can typically change their payment schedule with the State Farm Payment Plan. If your financial situation changes, you can contact State Farm to discuss options for adjusting your payment frequency or amount.

-

How do I enroll in the State Farm Payment Plan?

Enrolling in the State Farm Payment Plan is straightforward. Customers can sign up during the policy purchase process or by contacting their State Farm agent to set up the payment plan that best fits their needs.

-

Does the State Farm Payment Plan integrate with other financial tools?

Yes, the State Farm Payment Plan can integrate with various financial management tools, allowing customers to track their payments alongside other expenses. This integration helps users maintain a comprehensive view of their financial obligations.

Get more for State Farm Payment Plan

- Oklahoma property management package oklahoma form

- Application completion form

- Annual minutes for an oklahoma professional corporation oklahoma form

- Ok bylaws corporation form

- Sample corporate records for an oklahoma professional corporation oklahoma form

- Organizational minutes for an oklahoma professional corporation oklahoma form

- Sample transmittal letter for certificate of incorporation oklahoma form

- New resident guide oklahoma form

Find out other State Farm Payment Plan

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure