Uniform Sales and Use Tax Certificate Example

What is the Uniform Sales And Use Tax Certificate Example

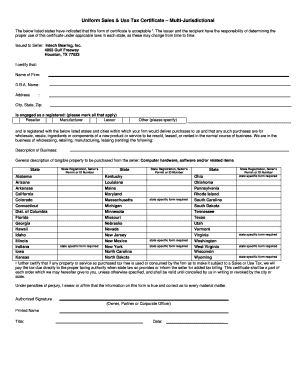

The Uniform Sales And Use Tax Certificate Example is a standardized document used by businesses in the United States to claim exemption from sales tax on purchases. This certificate serves as proof that the buyer is eligible for a tax exemption, often due to the nature of the goods or services being purchased. It is essential for ensuring compliance with state tax regulations while facilitating smoother transactions between buyers and sellers.

How to use the Uniform Sales And Use Tax Certificate Example

To use the Uniform Sales And Use Tax Certificate Example, a buyer must complete the certificate accurately, providing necessary details such as their name, address, and the reason for the exemption. Once filled out, the buyer presents the certificate to the seller at the time of purchase. The seller retains the certificate for their records, ensuring they are not liable for collecting sales tax on the exempt transaction.

Key elements of the Uniform Sales And Use Tax Certificate Example

Key elements of the Uniform Sales And Use Tax Certificate Example include:

- Buyer Information: Name, address, and contact details of the buyer.

- Seller Information: Name and address of the seller.

- Exemption Reason: A clear statement of the reason for the tax exemption.

- Signature: The buyer must sign the certificate to validate it.

- Date: The date when the certificate is completed and signed.

Steps to complete the Uniform Sales And Use Tax Certificate Example

Completing the Uniform Sales And Use Tax Certificate Example involves several straightforward steps:

- Obtain a copy of the certificate, which can often be found online or requested from state tax authorities.

- Fill in the buyer's information, including the name and address.

- Provide the seller's information accurately.

- Clearly state the reason for the exemption, ensuring it aligns with state guidelines.

- Sign and date the certificate to finalize it.

Legal use of the Uniform Sales And Use Tax Certificate Example

The legal use of the Uniform Sales And Use Tax Certificate Example is governed by state laws. Buyers must ensure that the certificate is used only for eligible purchases that qualify for tax exemption. Misuse of the certificate can lead to penalties, including back taxes and fines. Sellers must verify the legitimacy of the certificate and keep it on file to protect themselves from liability.

State-specific rules for the Uniform Sales And Use Tax Certificate Example

Each state in the U.S. has its own rules regarding the use of the Uniform Sales And Use Tax Certificate Example. Some states may require additional documentation or have specific forms that must be used. It is important for both buyers and sellers to familiarize themselves with their state’s regulations to ensure compliance and avoid any potential issues during audits.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the uniform sales and use tax certificate example

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Uniform Sales And Use Tax Certificate Example?

A Uniform Sales And Use Tax Certificate Example is a standardized document used by businesses to claim exemption from sales tax on purchases. This certificate helps streamline the tax-exempt process and ensures compliance with state regulations. By using this example, businesses can easily fill out their own certificates.

-

How can airSlate SignNow help with Uniform Sales And Use Tax Certificate Example?

airSlate SignNow provides a user-friendly platform to create, send, and eSign your Uniform Sales And Use Tax Certificate Example. Our solution simplifies the document management process, allowing you to efficiently handle tax exemption certificates. This ensures that your business remains compliant while saving time.

-

Is there a cost associated with using airSlate SignNow for Uniform Sales And Use Tax Certificate Example?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan provides access to features that facilitate the creation and management of documents, including the Uniform Sales And Use Tax Certificate Example. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing Uniform Sales And Use Tax Certificate Example?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking for your Uniform Sales And Use Tax Certificate Example. These tools enhance efficiency and ensure that all parties involved can easily access and sign the necessary documents. Additionally, our platform supports collaboration among team members.

-

Can I integrate airSlate SignNow with other software for Uniform Sales And Use Tax Certificate Example?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to streamline your workflow when managing Uniform Sales And Use Tax Certificate Example. This means you can connect with your existing tools, such as CRM systems or accounting software, to enhance productivity and data accuracy.

-

What are the benefits of using airSlate SignNow for Uniform Sales And Use Tax Certificate Example?

Using airSlate SignNow for your Uniform Sales And Use Tax Certificate Example provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows for quick document turnaround, ensuring that your tax-exempt transactions are processed smoothly. Additionally, eSigning adds a layer of security to your documents.

-

How secure is airSlate SignNow when handling Uniform Sales And Use Tax Certificate Example?

airSlate SignNow prioritizes security and compliance, ensuring that your Uniform Sales And Use Tax Certificate Example is protected. We utilize advanced encryption methods and secure cloud storage to safeguard your documents. This commitment to security helps you maintain confidentiality and trust with your clients.

Get more for Uniform Sales And Use Tax Certificate Example

- E commerce product comparison matrix form

- Employment contract worksheet 497332762 form

- Competitor analysis worksheet form

- Marketing campaign evaluation form

- Staff performance appraisal

- Sample letter for declination of venture offer form

- Sample letter owed form

- One minute goal setting management objectives form

Find out other Uniform Sales And Use Tax Certificate Example

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement