Engagement Letter Compilation Engagement TaxAccounting4U Taxaccounting4u Form

Understanding the Engagement Letter Compilation Engagement

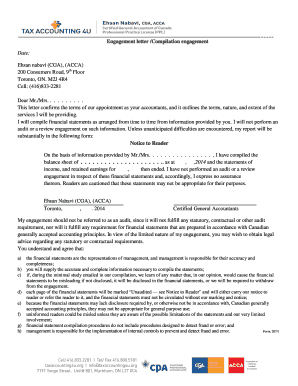

The Engagement Letter Compilation Engagement is a crucial document in the realm of tax and accounting services. It serves as a formal agreement between a client and a tax professional, outlining the scope of services to be provided. This letter not only clarifies expectations but also helps in establishing a professional relationship. It is essential for ensuring that both parties are on the same page regarding the responsibilities and deliverables involved in the engagement.

Steps to Complete the Engagement Letter Compilation Engagement

Completing the Engagement Letter Compilation Engagement involves several key steps:

- Identify the specific services to be provided, such as tax preparation, consulting, or audit support.

- Clearly outline the responsibilities of both the client and the tax professional.

- Include any relevant deadlines or timelines for the completion of services.

- Specify the fees associated with the services, including payment terms.

- Ensure that both parties review and sign the document to formalize the agreement.

Key Elements of the Engagement Letter Compilation Engagement

Several key elements should be included in the Engagement Letter Compilation Engagement to ensure clarity and completeness:

- Scope of Services: A detailed description of the services to be rendered.

- Client Responsibilities: Any information or documentation the client must provide.

- Fees and Payment Terms: Clear information on how fees will be calculated and when payments are due.

- Confidentiality Clause: A statement regarding the confidentiality of client information.

- Termination Clause: Conditions under which either party may terminate the agreement.

Legal Use of the Engagement Letter Compilation Engagement

The Engagement Letter Compilation Engagement is not just a formality; it has legal implications. By signing this document, both parties agree to the terms outlined within it. This can provide legal protection in case of disputes regarding the services provided or the expectations set forth. It is advisable for both clients and tax professionals to keep a copy of the signed engagement letter for their records.

How to Obtain the Engagement Letter Compilation Engagement

Obtaining the Engagement Letter Compilation Engagement can be done through various means:

- Consult with a tax professional who can provide a customized engagement letter based on your specific needs.

- Utilize templates available from reputable accounting organizations or websites that specialize in tax documentation.

- Ensure that any template used is tailored to comply with state-specific regulations and requirements.

Examples of Using the Engagement Letter Compilation Engagement

There are various scenarios in which the Engagement Letter Compilation Engagement can be utilized:

- A small business owner engaging a tax accountant for annual tax preparation.

- An individual seeking consulting services for tax planning strategies.

- A non-profit organization working with an auditor to ensure compliance with financial regulations.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the engagement letter compilation engagement taxaccounting4u taxaccounting4u

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Engagement Letter Compilation Engagement TaxAccounting4U Taxaccounting4u?

The Engagement Letter Compilation Engagement TaxAccounting4U Taxaccounting4u is a comprehensive solution designed to streamline the process of creating and managing engagement letters. It ensures that all necessary legal and compliance requirements are met, making it easier for businesses to maintain professionalism and clarity in their agreements.

-

How does airSlate SignNow facilitate the Engagement Letter Compilation Engagement TaxAccounting4U Taxaccounting4u?

airSlate SignNow simplifies the Engagement Letter Compilation Engagement TaxAccounting4U Taxaccounting4u by providing an intuitive platform for drafting, sending, and eSigning documents. With its user-friendly interface, businesses can quickly create customized engagement letters that meet their specific needs.

-

What are the pricing options for the Engagement Letter Compilation Engagement TaxAccounting4U Taxaccounting4u?

Pricing for the Engagement Letter Compilation Engagement TaxAccounting4U Taxaccounting4u varies based on the features and number of users. airSlate SignNow offers flexible plans that cater to businesses of all sizes, ensuring that you can find a cost-effective solution that fits your budget.

-

What features are included in the Engagement Letter Compilation Engagement TaxAccounting4U Taxaccounting4u?

The Engagement Letter Compilation Engagement TaxAccounting4U Taxaccounting4u includes features such as customizable templates, automated workflows, and secure eSigning capabilities. These features enhance efficiency and ensure that your engagement letters are processed quickly and securely.

-

What are the benefits of using airSlate SignNow for Engagement Letter Compilation Engagement TaxAccounting4U Taxaccounting4u?

Using airSlate SignNow for Engagement Letter Compilation Engagement TaxAccounting4U Taxaccounting4u offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Businesses can save time and resources while ensuring compliance and professionalism in their engagement letters.

-

Can I integrate airSlate SignNow with other tools for Engagement Letter Compilation Engagement TaxAccounting4U Taxaccounting4u?

Yes, airSlate SignNow allows for seamless integration with various tools and platforms, enhancing the Engagement Letter Compilation Engagement TaxAccounting4U Taxaccounting4u experience. This integration capability ensures that you can connect your existing workflows and systems for improved efficiency.

-

Is there customer support available for Engagement Letter Compilation Engagement TaxAccounting4U Taxaccounting4u users?

Absolutely! airSlate SignNow provides dedicated customer support for users of the Engagement Letter Compilation Engagement TaxAccounting4U Taxaccounting4u. Whether you have questions about features or need assistance with setup, our support team is here to help you every step of the way.

Get more for Engagement Letter Compilation Engagement TaxAccounting4U Taxaccounting4u

Find out other Engagement Letter Compilation Engagement TaxAccounting4U Taxaccounting4u

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile