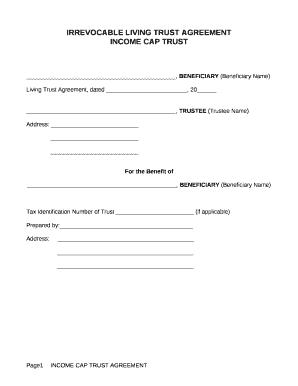

INCOME CAP TRUST Form

What is the INCOME CAP TRUST

An Income Cap Trust is a specialized legal arrangement designed to manage and distribute income generated from assets while adhering to specific financial limitations. This type of trust is often utilized to protect assets from taxation and to ensure that beneficiaries receive a steady income stream without exceeding certain income thresholds. The trust typically holds various types of assets, including cash, investments, and real estate, and is structured to benefit individuals who may be subject to income restrictions, such as those qualifying for government assistance programs.

How to use the INCOME CAP TRUST

Steps to complete the INCOME CAP TRUST

Completing an Income Cap Trust involves a series of methodical steps:

- Consult with a legal professional: Engage an attorney experienced in trust law to ensure compliance with state regulations.

- Draft the trust agreement: Outline the terms, including the trustee's powers, beneficiary rights, and income distribution methods.

- Transfer assets: Move the designated assets into the trust, ensuring proper documentation is maintained.

- File necessary paperwork: Depending on the state, certain filings may be required to formalize the trust.

- Ongoing management: The trustee must manage the trust assets and distribute income as specified in the agreement.

Legal use of the INCOME CAP TRUST

The legal use of an Income Cap Trust is primarily to protect assets while providing financial support to beneficiaries without exceeding income limits set by government programs. This trust must comply with federal and state laws, including tax regulations. Proper legal guidance is essential to navigate the complexities of trust formation and management, ensuring that the trust operates within the bounds of the law and serves its intended purpose effectively.

Key elements of the INCOME CAP TRUST

Several key elements define an Income Cap Trust:

- Trustee: The individual or entity responsible for managing the trust and ensuring compliance with its terms.

- Beneficiaries: Those who receive income distributions from the trust, often subject to specific income limits.

- Assets: The property or investments held within the trust, which generate income for the beneficiaries.

- Distribution terms: Clear guidelines on how and when income is distributed to beneficiaries.

- Compliance requirements: Adherence to legal and regulatory standards governing trusts and income limits.

Eligibility Criteria

Eligibility for establishing an Income Cap Trust typically includes factors such as the financial status of the individual creating the trust, the nature of the assets being transferred, and the specific needs of the beneficiaries. Generally, individuals who may benefit from this type of trust are those who require ongoing income support while also needing to maintain eligibility for government assistance programs. It is advisable to consult with a legal expert to determine specific eligibility requirements based on individual circumstances and state laws.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the income cap trust

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an INCOME CAP TRUST?

An INCOME CAP TRUST is a financial tool designed to help individuals manage their income while ensuring compliance with specific regulations. It allows for the preservation of assets while providing a steady income stream. Understanding how an INCOME CAP TRUST works can help you make informed decisions about your financial future.

-

How does an INCOME CAP TRUST benefit me?

The primary benefit of an INCOME CAP TRUST is its ability to protect your assets while providing a reliable income. This trust structure can help you qualify for government benefits without losing your assets. Additionally, an INCOME CAP TRUST can offer peace of mind knowing your financial future is secure.

-

What are the costs associated with setting up an INCOME CAP TRUST?

Setting up an INCOME CAP TRUST typically involves legal fees and potential ongoing management costs. While the initial investment may vary, the long-term benefits often outweigh these costs. It's essential to consult with a financial advisor to understand the specific pricing related to your situation.

-

Can I integrate airSlate SignNow with my INCOME CAP TRUST documentation?

Yes, airSlate SignNow can seamlessly integrate with your INCOME CAP TRUST documentation process. Our platform allows you to easily send, sign, and manage documents related to your trust. This integration ensures that all your paperwork is handled efficiently and securely.

-

What features does airSlate SignNow offer for managing an INCOME CAP TRUST?

airSlate SignNow offers a variety of features that are beneficial for managing an INCOME CAP TRUST, including eSignature capabilities, document templates, and secure storage. These features streamline the process of creating and managing trust documents. With airSlate SignNow, you can ensure that your INCOME CAP TRUST is handled with the utmost efficiency.

-

Is airSlate SignNow secure for handling INCOME CAP TRUST documents?

Absolutely, airSlate SignNow prioritizes security, making it a safe choice for handling INCOME CAP TRUST documents. Our platform employs advanced encryption and compliance measures to protect your sensitive information. You can trust that your documents are secure while using our services.

-

How can I ensure my INCOME CAP TRUST is compliant with regulations?

To ensure your INCOME CAP TRUST is compliant with regulations, it's crucial to work with a knowledgeable attorney or financial advisor. They can guide you through the legal requirements and help you set up the trust correctly. Additionally, using airSlate SignNow can help you maintain organized records of all necessary documentation.

Get more for INCOME CAP TRUST

- Chapter 4 the market strikes back answers form

- Eckerd college immunization form

- Snc study abroad course approval form st norbert college snc

- Mitosis paper clip activity introduction biology by napier form

- Writing a letter to finra requesting a test waiver form

- Rumpke scholarship form

- Counseling form

- Freshman parking appeal form concordia university irvine

Find out other INCOME CAP TRUST

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple