Nicole Cayton Non Prime Lender Form

What is the Nicole Cayton Non Prime Lender

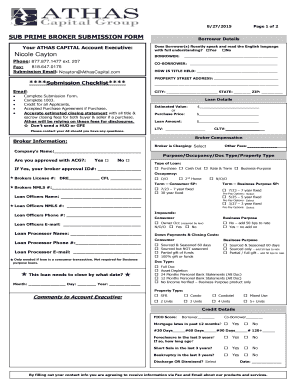

The Nicole Cayton Non Prime Lender is a financial product designed for borrowers who may not qualify for traditional prime lending options. This form serves as a means for individuals seeking loans that cater to those with less-than-ideal credit scores or unique financial situations. Typically, non-prime lenders offer more flexible terms and conditions, allowing for a broader range of applicants to secure financing for various needs, such as home purchases, refinancing, or personal loans.

How to use the Nicole Cayton Non Prime Lender

Using the Nicole Cayton Non Prime Lender involves several straightforward steps. First, potential borrowers should assess their financial situation and determine their borrowing needs. Next, they can complete the necessary application form, providing essential information such as income, employment history, and credit details. After submission, the lender will review the application and may request additional documentation to verify the applicant's financial status. Once approved, borrowers can receive the funds and utilize them according to their specified needs.

Steps to complete the Nicole Cayton Non Prime Lender

Completing the Nicole Cayton Non Prime Lender application requires careful attention to detail. Follow these steps:

- Gather necessary financial documents, including proof of income, bank statements, and identification.

- Fill out the application form accurately, ensuring all information is current and truthful.

- Submit the application through the designated method, whether online, by mail, or in person.

- Respond promptly to any requests for additional information from the lender.

- Review the loan terms and conditions once approved, ensuring they align with your financial goals.

Eligibility Criteria

Eligibility for the Nicole Cayton Non Prime Lender typically depends on several factors. While credit scores may be lower than those required for prime lending, lenders will still consider the applicant's overall financial profile. Key criteria often include:

- Minimum income requirements to demonstrate the ability to repay the loan.

- Employment stability, indicating a reliable source of income.

- Existing debt levels, which help assess the borrower's financial obligations.

- Credit history, even if it includes some negative marks, to evaluate past borrowing behavior.

Required Documents

When applying for the Nicole Cayton Non Prime Lender, applicants must provide specific documentation to support their application. Commonly required documents include:

- Government-issued identification, such as a driver's license or passport.

- Proof of income, which may include pay stubs, tax returns, or bank statements.

- Details of existing debts, including credit card statements and loan agreements.

- Any additional documentation requested by the lender to verify financial status.

Legal use of the Nicole Cayton Non Prime Lender

The legal use of the Nicole Cayton Non Prime Lender involves adhering to federal and state regulations governing lending practices. Lenders must comply with the Truth in Lending Act, which mandates clear disclosure of loan terms, including interest rates and fees. Borrowers should also be aware of their rights under the Fair Lending Act, which prohibits discrimination in lending based on race, gender, or other protected characteristics. Understanding these legal frameworks helps ensure a fair and transparent lending process for all parties involved.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nicole cayton non prime lender

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Nicole Cayton Non Prime Lender?

A Nicole Cayton Non Prime Lender specializes in providing loans to borrowers who may not qualify for traditional financing options. This type of lender focuses on offering flexible terms and conditions, making it easier for individuals with less-than-perfect credit to secure funding.

-

How does airSlate SignNow benefit Nicole Cayton Non Prime Lenders?

airSlate SignNow streamlines the document signing process for Nicole Cayton Non Prime Lenders, allowing them to send and eSign important documents quickly and securely. This efficiency helps lenders close deals faster and improve customer satisfaction.

-

What are the pricing options for using airSlate SignNow as a Nicole Cayton Non Prime Lender?

airSlate SignNow offers competitive pricing plans tailored for Nicole Cayton Non Prime Lenders, ensuring that they can access essential features without breaking the bank. The pricing is designed to be cost-effective, making it an ideal choice for lenders looking to optimize their operations.

-

Can Nicole Cayton Non Prime Lenders integrate airSlate SignNow with other tools?

Yes, airSlate SignNow provides seamless integrations with various CRM and financial software, making it easy for Nicole Cayton Non Prime Lenders to incorporate the eSigning solution into their existing workflows. This integration enhances productivity and ensures a smooth user experience.

-

What features does airSlate SignNow offer for Nicole Cayton Non Prime Lenders?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure cloud storage, all tailored for Nicole Cayton Non Prime Lenders. These features help streamline the document management process and improve overall efficiency.

-

How secure is airSlate SignNow for Nicole Cayton Non Prime Lenders?

Security is a top priority for airSlate SignNow, especially for Nicole Cayton Non Prime Lenders who handle sensitive financial documents. The platform employs advanced encryption and compliance measures to ensure that all transactions and data are protected.

-

What are the benefits of using airSlate SignNow for Nicole Cayton Non Prime Lenders?

Using airSlate SignNow allows Nicole Cayton Non Prime Lenders to enhance their operational efficiency, reduce paperwork, and improve client interactions. The platform's user-friendly interface makes it easy for both lenders and borrowers to navigate the signing process.

Get more for Nicole Cayton Non Prime Lender

Find out other Nicole Cayton Non Prime Lender

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF