Straight Note Interest Only Chicago Title Connection Home Form

Understanding the Straight Note Interest Only Chicago Title Connection Home

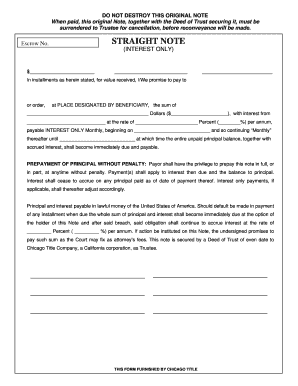

The Straight Note Interest Only Chicago Title Connection Home is a financial instrument used primarily in real estate transactions. This type of note allows borrowers to pay only the interest for a specified period, which can be beneficial for those looking to manage cash flow effectively. Typically, the principal amount remains unchanged during the interest-only period, making it crucial for borrowers to plan for the eventual repayment of the principal.

This note is often utilized in situations where homeowners may need lower initial payments, such as when purchasing a new home or refinancing an existing mortgage. Understanding the terms and conditions associated with this type of note is essential for making informed financial decisions.

Steps to Complete the Straight Note Interest Only Chicago Title Connection Home

Completing the Straight Note Interest Only Chicago Title Connection Home involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, including identification and financial statements. Next, fill out the form with precise information regarding the loan amount, interest rate, and repayment terms.

After completing the form, review it for any errors or omissions. It is advisable to consult with a financial advisor or legal expert to ensure that all terms are clearly understood. Once everything is in order, submit the form to the appropriate lender or financial institution for processing.

Legal Use of the Straight Note Interest Only Chicago Title Connection Home

The legal use of the Straight Note Interest Only Chicago Title Connection Home is governed by state and federal regulations. It is essential for borrowers to understand the legal implications of entering into such an agreement, as it may affect their financial obligations and rights. This type of note must comply with the Truth in Lending Act and other relevant laws to ensure transparency and fairness in lending practices.

Borrowers should be aware of their rights regarding disclosures and the terms of the loan. It is also important to keep records of all communications and agreements related to the note for future reference.

Key Elements of the Straight Note Interest Only Chicago Title Connection Home

Several key elements define the Straight Note Interest Only Chicago Title Connection Home. These include the loan amount, interest rate, duration of the interest-only period, and the repayment schedule for the principal. Additionally, the note should specify any fees associated with the loan, such as origination fees or prepayment penalties.

Understanding these elements is crucial for borrowers to evaluate the overall cost of the loan and its impact on their financial situation. Clear communication of these terms can help prevent misunderstandings and ensure a smooth borrowing experience.

Examples of Using the Straight Note Interest Only Chicago Title Connection Home

There are various scenarios in which the Straight Note Interest Only Chicago Title Connection Home can be beneficial. For instance, a first-time homebuyer may opt for this type of note to keep initial payments low while they settle into their new home. Another example is a homeowner looking to refinance during a period of financial uncertainty, allowing them to manage cash flow more effectively.

Additionally, real estate investors may use this note to acquire properties with minimal upfront costs, enabling them to allocate funds to renovations or other investments. Each of these examples highlights the flexibility and potential advantages of using an interest-only note in real estate transactions.

Eligibility Criteria for the Straight Note Interest Only Chicago Title Connection Home

Eligibility for the Straight Note Interest Only Chicago Title Connection Home typically depends on several factors, including creditworthiness, income stability, and the value of the property being financed. Lenders often require a thorough evaluation of the borrower's financial history and current economic situation.

Additionally, borrowers may need to provide documentation such as tax returns, pay stubs, and bank statements to demonstrate their ability to repay the loan. Understanding these criteria can help potential borrowers prepare for the application process and increase their chances of approval.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the straight note interest only chicago title connection home

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Straight Note Interest Only Chicago Title Connection Home?

A Straight Note Interest Only Chicago Title Connection Home is a financial instrument that allows borrowers to pay only the interest on a loan for a specified period. This type of note can be beneficial for those looking to manage cash flow effectively while investing in real estate. Understanding this option can help you make informed decisions about your financing needs.

-

How does the pricing work for Straight Note Interest Only Chicago Title Connection Home?

Pricing for a Straight Note Interest Only Chicago Title Connection Home typically depends on the loan amount, interest rate, and term length. It's essential to compare different lenders to find the best rates and terms that suit your financial situation. airSlate SignNow can help streamline the documentation process for these loans.

-

What are the benefits of using a Straight Note Interest Only Chicago Title Connection Home?

The primary benefit of a Straight Note Interest Only Chicago Title Connection Home is the lower initial monthly payments, as you only pay interest during the initial period. This can free up cash for other investments or expenses. Additionally, it can be a strategic choice for those expecting increased income in the future.

-

Are there any risks associated with a Straight Note Interest Only Chicago Title Connection Home?

Yes, there are risks involved with a Straight Note Interest Only Chicago Title Connection Home, primarily the potential for payment shock when the loan transitions to principal and interest payments. Borrowers should ensure they have a plan in place for future payments. It's crucial to assess your financial situation before committing to this type of loan.

-

Can I integrate airSlate SignNow with my existing financial software for Straight Note Interest Only Chicago Title Connection Home?

Absolutely! airSlate SignNow offers integrations with various financial software, making it easy to manage your Straight Note Interest Only Chicago Title Connection Home documents. This integration can enhance your workflow and ensure that all your documents are securely signed and stored.

-

How can airSlate SignNow help with the documentation for a Straight Note Interest Only Chicago Title Connection Home?

airSlate SignNow simplifies the documentation process for a Straight Note Interest Only Chicago Title Connection Home by allowing you to create, send, and eSign documents quickly. Our platform ensures that all necessary paperwork is completed accurately and efficiently, saving you time and reducing the risk of errors.

-

What features does airSlate SignNow offer for managing Straight Note Interest Only Chicago Title Connection Home?

airSlate SignNow provides features such as customizable templates, real-time tracking, and secure cloud storage for managing your Straight Note Interest Only Chicago Title Connection Home documents. These tools help streamline the signing process and ensure that you have access to your documents whenever you need them.

Get more for Straight Note Interest Only Chicago Title Connection Home

- Concluded that we can not proceed to a proper foreclosure with the state of the title as it is at this form

- Process fee form

- Enclosed herewith please find the settlement documents which have been revised in form

- Enclosed herewith please find check no form

- N a m e debtor form

- N a m e form

- Enclosed herewith please find for your file the following pleadings filed by n a m e in the form

- We have been retained by n a m e in regard to the above referenced loan form

Find out other Straight Note Interest Only Chicago Title Connection Home

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed