This Form is to Be Used to Authorize a Payroll Service Provider to Complete 2018

What is the form to authorize a payroll service provider?

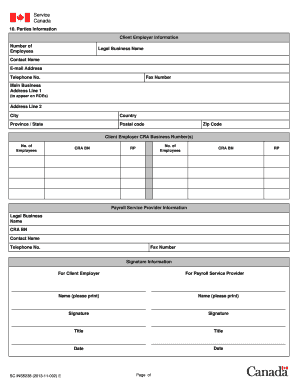

This form is designed to grant permission to a payroll service provider to handle payroll-related tasks on behalf of a business or individual. It typically includes essential information such as the employer's details, the payroll service provider's information, and the specific authorizations being granted. By completing this form, businesses can streamline their payroll processes and ensure compliance with relevant regulations.

Steps to complete the form to authorize a payroll service provider

Completing this form involves several straightforward steps:

- Gather necessary information: Collect details about your business, including the employer identification number (EIN), address, and contact information.

- Provide payroll service provider details: Enter the name, address, and contact information of the payroll service provider you wish to authorize.

- Specify authorization scope: Clearly outline the specific payroll functions the provider is authorized to perform, such as processing payroll, filing taxes, or managing employee benefits.

- Review and sign: Carefully review the completed form for accuracy, then sign and date it to confirm your authorization.

Legal use of the form to authorize a payroll service provider

This form is legally binding and establishes a formal agreement between the employer and the payroll service provider. It ensures that the provider has the authority to act on behalf of the employer regarding payroll matters. Proper use of this form helps protect both parties by clearly defining the responsibilities and expectations involved in the payroll process.

Key elements of the form to authorize a payroll service provider

Several key elements must be included in this form to ensure its effectiveness:

- Employer information: Name, address, and EIN of the business.

- Payroll service provider information: Name and contact details of the provider.

- Authorization details: A clear description of the tasks the provider is authorized to perform.

- Signatures: Signature of the employer or authorized representative, along with the date of signing.

Examples of using the form to authorize a payroll service provider

Businesses often use this form in various scenarios, such as:

- When a small business hires an external payroll service to manage employee payments and tax filings.

- When a company expands and requires professional assistance to handle payroll complexities.

- When an employer seeks to ensure compliance with federal and state payroll regulations by partnering with an experienced provider.

Form submission methods for authorizing a payroll service provider

This form can typically be submitted through various methods, depending on the payroll service provider's requirements:

- Online: Many providers offer digital submission options through their secure platforms.

- Mail: The completed form can be printed and sent via postal service to the payroll service provider.

- In-person: Some businesses may choose to deliver the form directly to the provider's office.

Create this form in 5 minutes or less

Find and fill out the correct this form is to be used to authorize a payroll service provider to complete

Create this form in 5 minutes!

How to create an eSignature for the this form is to be used to authorize a payroll service provider to complete

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the form that authorizes a payroll service provider?

This Form Is To Be Used To Authorize A Payroll Service Provider To Complete essential payroll tasks on behalf of your business. It ensures that the provider has the necessary permissions to manage payroll processes efficiently and securely.

-

How does airSlate SignNow simplify the process of using this form?

With airSlate SignNow, you can easily fill out and eSign This Form Is To Be Used To Authorize A Payroll Service Provider To Complete online. Our platform streamlines the document management process, allowing for quick and secure submissions.

-

Are there any costs associated with using airSlate SignNow for this form?

airSlate SignNow offers a cost-effective solution for managing documents, including This Form Is To Be Used To Authorize A Payroll Service Provider To Complete. Pricing plans are flexible, catering to businesses of all sizes, ensuring you only pay for what you need.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides a range of features, including eSigning, document templates, and secure storage. These features enhance the usability of This Form Is To Be Used To Authorize A Payroll Service Provider To Complete, making it easier for businesses to manage their payroll authorizations.

-

Can I integrate airSlate SignNow with other software tools?

Yes, airSlate SignNow offers integrations with various software tools, enhancing your workflow. This allows you to seamlessly use This Form Is To Be Used To Authorize A Payroll Service Provider To Complete alongside your existing systems.

-

What are the benefits of using airSlate SignNow for payroll authorization?

Using airSlate SignNow for This Form Is To Be Used To Authorize A Payroll Service Provider To Complete provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. It allows businesses to focus on their core operations while ensuring payroll processes are handled smoothly.

-

Is it easy to track the status of the authorization form?

Absolutely! airSlate SignNow allows you to track the status of This Form Is To Be Used To Authorize A Payroll Service Provider To Complete in real-time. You will receive notifications when the document is viewed, signed, or completed, ensuring you stay informed throughout the process.

Get more for This Form Is To Be Used To Authorize A Payroll Service Provider To Complete

- Illinois assignment 497306272 form

- Abandoned personal property 497306273 form

- Guaranty or guarantee of payment of rent illinois form

- Letter from landlord to tenant as notice of default on commercial lease illinois form

- Residential or rental lease extension agreement illinois form

- Il application form 497306277

- Rental application illinois form

- Il lease form

Find out other This Form Is To Be Used To Authorize A Payroll Service Provider To Complete

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract

- eSignature Missouri Business Insurance Quotation Form Mobile

- eSignature Iowa Car Insurance Quotation Form Online

- eSignature Missouri Car Insurance Quotation Form Online

- eSignature New Jersey Car Insurance Quotation Form Now

- eSignature Hawaii Life-Insurance Quote Form Easy

- How To eSignature Delaware Certeficate of Insurance Request

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking