Business Cash Advance Application Green Payment Solutions Form

Understanding the Business Cash Advance Application

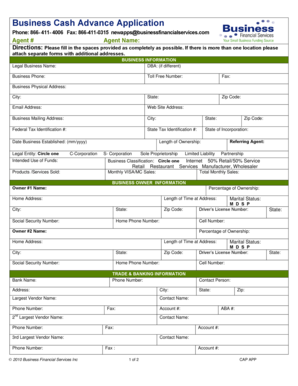

The Business Cash Advance Application from Green Payment Solutions is a financial tool designed to help businesses secure quick funding. This application allows business owners to request a cash advance based on their future credit card sales. By leveraging anticipated revenue, businesses can access funds without the lengthy approval processes typical of traditional loans. This form is particularly beneficial for small to medium-sized enterprises that may face cash flow challenges or need immediate capital for growth opportunities.

Steps to Complete the Business Cash Advance Application

Completing the Business Cash Advance Application involves several key steps to ensure accuracy and efficiency:

- Gather Required Information: Collect necessary business details, including the legal name, address, and tax identification number.

- Financial Documentation: Prepare recent bank statements and credit card processing statements to demonstrate cash flow and sales history.

- Fill Out the Application: Provide all requested information on the application form, ensuring clarity and completeness.

- Review and Submit: Double-check the application for accuracy before submitting it online or via mail.

Eligibility Criteria for the Business Cash Advance Application

To qualify for the Business Cash Advance Application, businesses must meet certain eligibility criteria. Generally, applicants should:

- Have a valid business license and operate in the United States.

- Demonstrate a minimum monthly credit card sales volume, often set at a threshold by Green Payment Solutions.

- Maintain a positive credit history, although some options may be available for businesses with less-than-perfect credit.

Required Documents for the Application

Submitting the Business Cash Advance Application requires specific documentation to verify the business's financial health. Commonly required documents include:

- Recent bank statements, typically covering the last three months.

- Credit card processing statements to establish sales volume.

- Personal identification for business owners, such as a driver's license or passport.

Application Process and Approval Time

The application process for the Business Cash Advance Application is designed to be straightforward. After submission, the review process typically takes one to three business days. Once approved, funds can be disbursed quickly, often within twenty-four to seventy-two hours. This rapid turnaround is one of the key advantages of using a cash advance over traditional financing methods.

Legal Use of the Business Cash Advance Application

Utilizing the Business Cash Advance Application must comply with relevant financial regulations and laws. Businesses should ensure that they understand the terms of the advance, including repayment conditions and any associated fees. It is advisable to consult with a financial advisor or legal expert to navigate the implications of cash advances on overall business finances.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the business cash advance application green payment solutions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Business Cash Advance Application with Green Payment Solutions?

A Business Cash Advance Application with Green Payment Solutions allows businesses to access quick funding based on future credit card sales. This solution is designed to provide fast cash flow without the lengthy approval processes typical of traditional loans.

-

How does the Business Cash Advance Application process work?

The Business Cash Advance Application process is straightforward. Businesses submit their application online, and upon approval, they receive funds quickly, which can be used for various operational needs. This process is designed to be efficient and user-friendly.

-

What are the benefits of using Green Payment Solutions for a Business Cash Advance?

Using Green Payment Solutions for a Business Cash Advance offers several benefits, including fast access to funds, flexible repayment options, and no collateral requirements. This allows businesses to manage their cash flow effectively while focusing on growth.

-

Are there any fees associated with the Business Cash Advance Application?

Yes, there may be fees associated with the Business Cash Advance Application through Green Payment Solutions. These fees can vary based on the amount advanced and the repayment terms, but they are typically transparent and outlined during the application process.

-

Can I integrate the Business Cash Advance Application with my existing payment systems?

Absolutely! The Business Cash Advance Application with Green Payment Solutions is designed to integrate seamlessly with various payment systems. This ensures that businesses can continue to operate smoothly while benefiting from the cash advance.

-

What types of businesses can benefit from the Business Cash Advance Application?

Any business that relies on credit card sales can benefit from the Business Cash Advance Application with Green Payment Solutions. This includes retail stores, restaurants, and service providers looking for quick access to cash for operational expenses.

-

How quickly can I receive funds after submitting my Business Cash Advance Application?

Once your Business Cash Advance Application is approved, you can typically receive funds within 24 to 48 hours. This quick turnaround is one of the key advantages of using Green Payment Solutions for your funding needs.

Get more for Business Cash Advance Application Green Payment Solutions

- Quitclaim deed three individuals to one individual california form

- Grant deed form 497298306

- Notice of acceptance or rejection of disputed work construction liens business entity california form

- Quitclaim deed husband and wife to two individuals california form

- Deed lieu foreclosure 497298309 form

- Ca business entity search form

- California quitclaim deed form

- Notice of cessation construction liens individual ca civil code section 8188 california form

Find out other Business Cash Advance Application Green Payment Solutions

- Sign New York Codicil to Will Now

- Sign Oregon Codicil to Will Later

- How Do I Sign Oregon Bank Loan Proposal Template

- Help Me With Sign Oregon Bank Loan Proposal Template

- Sign Michigan Gift Affidavit Mobile

- How To Sign North Carolina Gift Affidavit

- How Do I Sign Oregon Financial Affidavit

- Sign Maine Revocation of Power of Attorney Online

- Sign Louisiana Mechanic's Lien Online

- How To Sign New Mexico Revocation of Power of Attorney

- How Can I Sign Ohio Revocation of Power of Attorney

- Sign Michigan Mechanic's Lien Easy

- How To Sign Texas Revocation of Power of Attorney

- Sign Virginia Revocation of Power of Attorney Easy

- Can I Sign North Carolina Mechanic's Lien

- Sign Maine Payment Guaranty Myself

- Help Me With Sign Oklahoma Mechanic's Lien

- Sign Oregon Mechanic's Lien Simple

- How To Sign Utah Mechanic's Lien

- How To Sign Washington Mechanic's Lien