Tax Utah GovcommissiondecisionLOCALLY ASSESSED PROPERTY SIGNED 09 24 09 COMMISSIONERS P 2014-2026

Understanding the Tax Utah Gov Commission Decision for Locally Assessed Property

The Tax Utah Gov Commission Decision for Locally Assessed Property, signed on September 24, 2009, outlines specific guidelines and regulations regarding property assessments in Utah. This decision is crucial for property owners and assessors as it establishes the framework for how properties are evaluated for tax purposes. Understanding this decision helps ensure compliance with state laws and provides clarity on the assessment process.

Steps to Use the Tax Utah Gov Commission Decision

To effectively utilize the Tax Utah Gov Commission Decision for Locally Assessed Property, follow these steps:

- Review the decision document thoroughly to understand the key provisions.

- Ensure that your property assessment aligns with the guidelines set forth in the decision.

- Consult with a tax professional or local assessor if you have questions about your property’s assessment.

- Keep records of any communications or documentation related to your property assessment.

Obtaining the Tax Utah Gov Commission Decision

To obtain a copy of the Tax Utah Gov Commission Decision for Locally Assessed Property, you can visit the official Utah state tax website or contact your local tax assessor's office. They can provide you with the necessary documents and any additional information regarding the decision's implications for property assessments.

Key Elements of the Tax Utah Gov Commission Decision

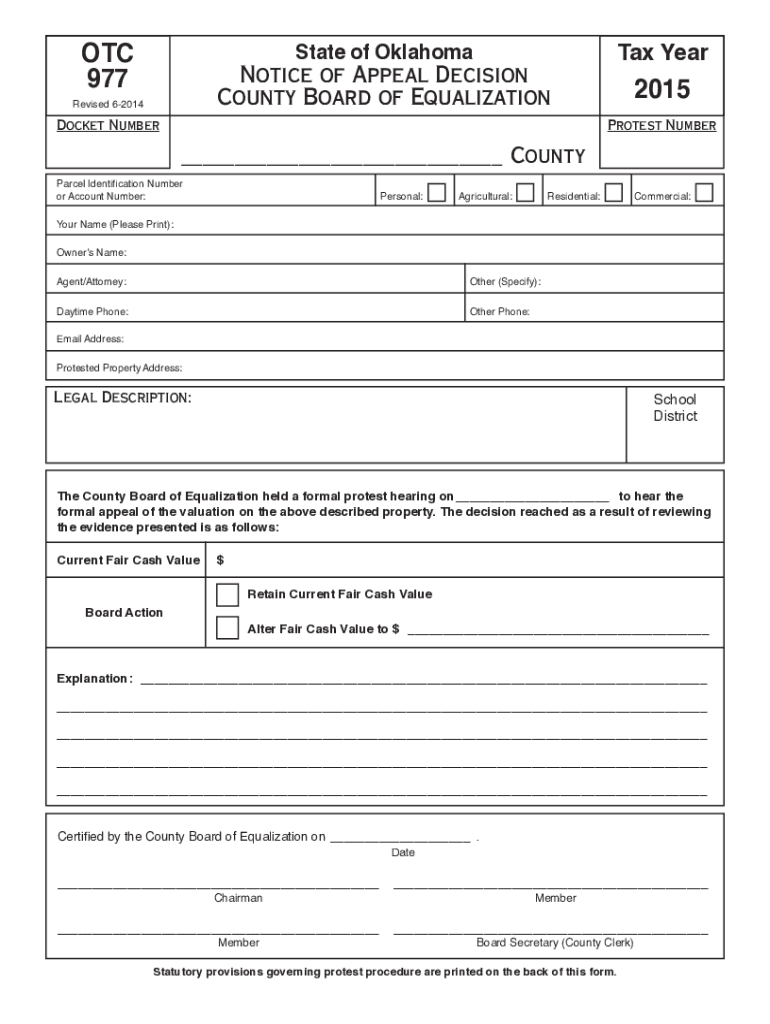

Several key elements are integral to the Tax Utah Gov Commission Decision for Locally Assessed Property:

- Assessment criteria for different property types, including residential and commercial properties.

- Procedures for appealing property assessments.

- Guidelines for property tax exemptions and reductions.

- Requirements for documentation and evidence in support of property assessments.

Legal Use of the Tax Utah Gov Commission Decision

The legal use of the Tax Utah Gov Commission Decision for Locally Assessed Property is essential for both property owners and assessors. This decision serves as a legal reference point for property tax assessments and appeals. It ensures that all parties involved adhere to the established laws and regulations, fostering a fair assessment process.

Filing Deadlines and Important Dates

It is important to be aware of filing deadlines and important dates related to property assessments under the Tax Utah Gov Commission Decision. Key dates may include:

- Deadline for filing property tax appeals.

- Dates for property tax assessment notifications.

- Important dates for tax payment submissions.

Create this form in 5 minutes or less

Find and fill out the correct tax utah govcommissiondecisionlocally assessed property signed 09 24 09 commissioners p

Create this form in 5 minutes!

How to create an eSignature for the tax utah govcommissiondecisionlocally assessed property signed 09 24 09 commissioners p

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of the Tax utah govcommissiondecisionLOCALLY ASSESSED PROPERTY SIGNED 09 24 09 COMMISSIONERS P.?

The Tax utah govcommissiondecisionLOCALLY ASSESSED PROPERTY SIGNED 09 24 09 COMMISSIONERS P. is a crucial document that outlines the assessment procedures for locally assessed properties in Utah. Understanding this decision can help property owners navigate tax implications effectively.

-

How can airSlate SignNow assist with the Tax utah govcommissiondecisionLOCALLY ASSESSED PROPERTY SIGNED 09 24 09 COMMISSIONERS P.?

airSlate SignNow provides a streamlined platform for eSigning and managing documents related to the Tax utah govcommissiondecisionLOCALLY ASSESSED PROPERTY SIGNED 09 24 09 COMMISSIONERS P. Our solution simplifies the process, ensuring compliance and efficiency in handling important tax documents.

-

What features does airSlate SignNow offer for managing tax-related documents?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax-related documents like the Tax utah govcommissiondecisionLOCALLY ASSESSED PROPERTY SIGNED 09 24 09 COMMISSIONERS P. These features enhance productivity and ensure that all documents are handled securely.

-

Is airSlate SignNow cost-effective for small businesses dealing with tax documents?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses managing tax documents. With competitive pricing plans, it allows users to efficiently handle documents like the Tax utah govcommissiondecisionLOCALLY ASSESSED PROPERTY SIGNED 09 24 09 COMMISSIONERS P. without breaking the bank.

-

Can airSlate SignNow integrate with other software for tax management?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your tax management processes. This integration is particularly beneficial for handling documents related to the Tax utah govcommissiondecisionLOCALLY ASSESSED PROPERTY SIGNED 09 24 09 COMMISSIONERS P., allowing for a more cohesive workflow.

-

What are the benefits of using airSlate SignNow for tax document management?

Using airSlate SignNow for tax document management offers numerous benefits, including increased efficiency, enhanced security, and improved compliance. These advantages are particularly relevant when dealing with important documents like the Tax utah govcommissiondecisionLOCALLY ASSESSED PROPERTY SIGNED 09 24 09 COMMISSIONERS P.

-

How does airSlate SignNow ensure the security of sensitive tax documents?

airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect sensitive tax documents. This is crucial for documents such as the Tax utah govcommissiondecisionLOCALLY ASSESSED PROPERTY SIGNED 09 24 09 COMMISSIONERS P., ensuring that your information remains confidential and secure.

Get more for Tax utah govcommissiondecisionLOCALLY ASSESSED PROPERTY SIGNED 09 24 09 COMMISSIONERS P

- Clear all form

- Form it 6111 ampquotclaim for brownfield redevelopment tax

- Exempt purposes internal revenue code section 501c3 form

- Credit claim forms for corporations current year taxnygov

- 2022 california form 3885 l depreciation and amortization 2022 california form 3885 l depreciation and amortization

- 2023 form 590 p nonresident withholding exemption certificate for previously reported income

- 2022 form 3596 paid preparers due diligence checklist for california earned income tax credit

- New york state non resident tax information forms it

Find out other Tax utah govcommissiondecisionLOCALLY ASSESSED PROPERTY SIGNED 09 24 09 COMMISSIONERS P

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF