Erbschaftsteuererkl Rung Form

What is the Erbschaftsteuererklärung

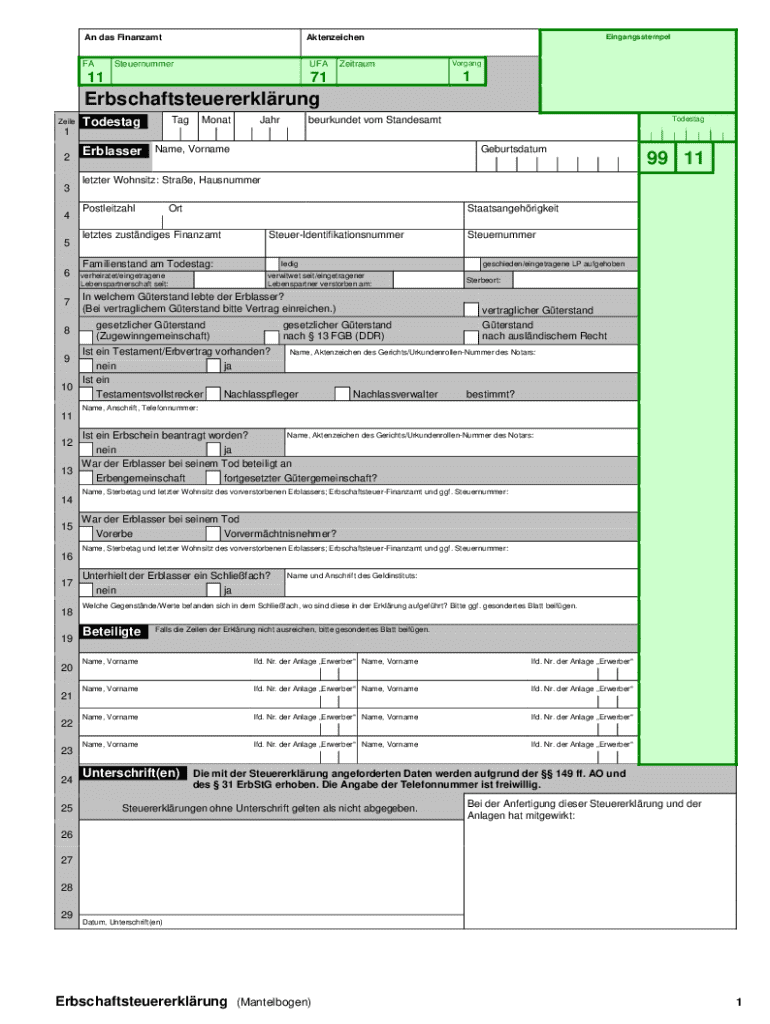

The Erbschaftsteuererklärung, or inheritance tax declaration, is a crucial document that individuals must submit to report the value of an estate after the death of an individual. This form is essential for determining the tax obligations of heirs and beneficiaries. In the United States, the estate tax is imposed by the federal government and may also be applicable at the state level, depending on where the deceased resided. The declaration includes details about the assets, liabilities, and any deductions that may apply to the estate.

Steps to complete the Erbschaftsteuererklärung

Completing the Erbschaftsteuererklärung involves several key steps. First, gather all necessary documentation, including the deceased's will, property deeds, bank statements, and any outstanding debts. Next, assess the total value of the estate by appraising all assets, such as real estate, personal property, and investments. After determining the estate's value, calculate any applicable deductions, such as funeral expenses and debts owed by the deceased. Finally, fill out the declaration form accurately, ensuring all information is complete and correct before submission.

Required Documents

To successfully file the Erbschaftsteuererklärung, specific documents are necessary. These typically include:

- The deceased's will or trust documents

- Death certificate

- List of assets, including real estate, vehicles, and financial accounts

- Liabilities, such as mortgages and loans

- Appraisals for valuable items, if applicable

- Any prior tax returns of the deceased

Having these documents organized will streamline the filing process and ensure compliance with tax regulations.

Filing Deadlines / Important Dates

Filing the Erbschaftsteuererklärung is subject to specific deadlines that must be adhered to in order to avoid penalties. Generally, the declaration must be submitted within nine months of the date of death. However, if an extension is needed, it is advisable to file for an extension prior to the deadline. It is important to check both federal and state requirements, as these can vary significantly. Missing the deadline can result in additional taxes and penalties, making timely submission crucial.

Legal use of the Erbschaftsteuererklärung

The legal use of the Erbschaftsteuererklärung is to ensure that the estate is accurately reported for tax purposes. This declaration serves as a formal notice to the tax authorities regarding the assets and liabilities of the deceased. It is essential for heirs and executors to understand their legal obligations when filing this form, as inaccuracies or omissions can lead to legal repercussions. Consulting with a tax professional or attorney can provide guidance on compliance and help navigate any complexities related to inheritance tax laws.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding the filing of the Erbschaftsteuererklärung. It is important for individuals to familiarize themselves with these guidelines to ensure compliance. The IRS outlines the types of assets that must be reported, the valuation methods that can be used, and the deductions that may be available. Additionally, the IRS offers resources and publications that can assist in understanding the requirements for filing, making it easier for individuals to navigate the process.

Who Issues the Form

The Erbschaftsteuererklärung is typically issued by the state tax authority where the deceased resided at the time of death. Each state may have its own version of the form, and the requirements can differ significantly. In some cases, the federal government may also require a separate estate tax return to be filed. It is essential for individuals to identify the correct issuing authority and obtain the appropriate form to ensure that they meet all legal requirements for reporting the estate.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the erbschaftsteuererklrung

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Erbschaftsteuererklärung?

An Erbschaftsteuererklärung is a tax declaration that must be filed in Germany when someone inherits assets. It outlines the value of the inherited property and calculates the applicable inheritance tax. Understanding this process is crucial for ensuring compliance with tax regulations.

-

How can airSlate SignNow help with my Erbschaftsteuererklärung?

airSlate SignNow simplifies the process of preparing and signing your Erbschaftsteuererklärung. With our easy-to-use platform, you can quickly fill out necessary forms, gather signatures, and securely send documents. This streamlines the entire process, making it more efficient.

-

What features does airSlate SignNow offer for Erbschaftsteuererklärung?

Our platform offers features such as customizable templates, secure eSigning, and document tracking specifically for Erbschaftsteuererklärung. These tools help ensure that your documents are completed accurately and submitted on time. Additionally, our user-friendly interface makes it easy for anyone to navigate.

-

Is airSlate SignNow cost-effective for filing Erbschaftsteuererklärung?

Yes, airSlate SignNow provides a cost-effective solution for filing your Erbschaftsteuererklärung. Our pricing plans are designed to fit various budgets, ensuring that you can access essential features without overspending. This makes it an ideal choice for individuals and businesses alike.

-

Can I integrate airSlate SignNow with other tools for my Erbschaftsteuererklärung?

Absolutely! airSlate SignNow offers integrations with various tools and platforms that can assist in managing your Erbschaftsteuererklärung. Whether you need to connect with accounting software or document management systems, our integrations enhance your workflow and efficiency.

-

What are the benefits of using airSlate SignNow for Erbschaftsteuererklärung?

Using airSlate SignNow for your Erbschaftsteuererklärung provides numerous benefits, including time savings, enhanced security, and improved accuracy. Our platform ensures that your documents are securely stored and easily accessible, reducing the risk of errors and delays in submission.

-

Is it easy to get started with airSlate SignNow for Erbschaftsteuererklärung?

Yes, getting started with airSlate SignNow for your Erbschaftsteuererklärung is very easy. Simply sign up for an account, choose the appropriate templates, and begin filling out your forms. Our intuitive interface guides you through the process, making it accessible for everyone.

Get more for Erbschaftsteuererkl rung

Find out other Erbschaftsteuererkl rung

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement