Desistiment De Taxaci Pericial Contradict Ria Form

What is the Desistiment De Taxació Pericial Contradictòria

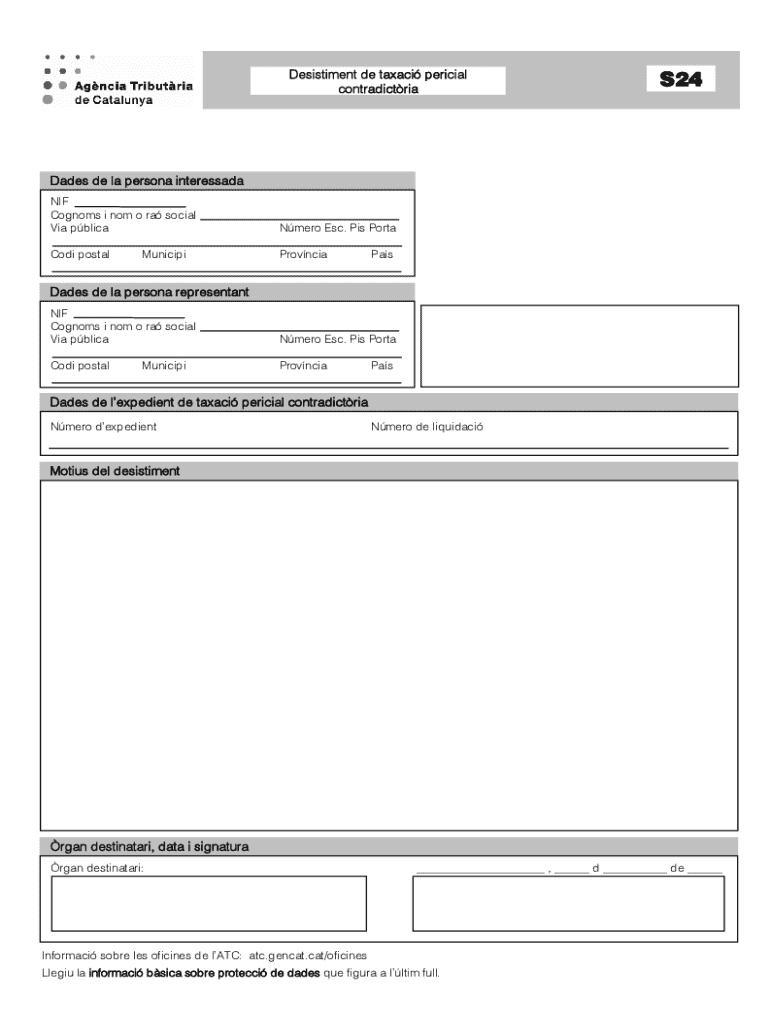

The Desistiment De Taxació Pericial Contradictòria is a formal document used in tax disputes, primarily concerning property valuations. This form allows individuals or businesses to formally withdraw from a contradictory appraisal process, which is essential when they believe the assessed value of their property is inaccurate. By submitting this form, taxpayers can communicate their intention to cease contesting the valuation, thereby simplifying the resolution process.

How to use the Desistiment De Taxació Pericial Contradictòria

To effectively use the Desistiment De Taxació Pericial Contradictòria, individuals must complete the form with accurate information regarding their property and the appraisal in question. It is crucial to include details such as the property address, the original assessment value, and any relevant case numbers. Once filled out, the form should be submitted to the appropriate tax authority, ensuring that it is done within any specified deadlines to avoid complications.

Steps to complete the Desistiment De Taxació Pericial Contradictòria

Completing the Desistiment De Taxació Pericial Contradictòria involves several key steps:

- Gather all necessary information about the property and the original assessment.

- Obtain the form from the relevant tax authority or their website.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions.

- Submit the form according to the guidelines provided by the tax authority.

Required Documents

When submitting the Desistiment De Taxació Pericial Contradictòria, certain documents may be required to support your claim. These typically include:

- A copy of the original property assessment notice.

- Any correspondence related to the appraisal process.

- Proof of ownership, such as a deed or title.

Legal use of the Desistiment De Taxació Pericial Contradictòria

The legal use of the Desistiment De Taxació Pericial Contradictòria is crucial for taxpayers who wish to withdraw from an ongoing appraisal dispute. This form serves as a formal notification to the tax authority, ensuring that the taxpayer's rights are preserved while also complying with legal requirements. It is important to understand that submitting this form may have implications on future assessments and disputes.

Eligibility Criteria

Eligibility to use the Desistiment De Taxació Pericial Contradictòria generally includes individuals or businesses that have filed a formal appeal against a property assessment. The property in question must be located within the jurisdiction of the tax authority to which the form is submitted. Additionally, taxpayers should ensure that they are within any applicable deadlines for withdrawing their appeal.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the desistiment de taxaci pericial contradictria

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Desistiment De Taxació Pericial Contradictòria?

Desistiment De Taxació Pericial Contradictòria refers to the process of withdrawing from a contradictory expert appraisal. This legal procedure is essential for individuals or businesses looking to contest a tax assessment. Understanding this process can help you navigate your tax obligations more effectively.

-

How can airSlate SignNow assist with Desistiment De Taxació Pericial Contradictòria?

airSlate SignNow provides a streamlined platform for managing documents related to Desistiment De Taxació Pericial Contradictòria. With our eSigning capabilities, you can easily prepare, send, and sign necessary documents, ensuring compliance and efficiency in your tax-related processes.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet various business needs. Our plans are designed to be cost-effective, allowing you to manage documents related to Desistiment De Taxació Pericial Contradictòria without breaking the bank. Explore our pricing page for detailed information on features included in each plan.

-

What features does airSlate SignNow offer for document management?

Our platform includes features such as customizable templates, secure eSigning, and real-time tracking of document status. These tools are particularly beneficial for handling Desistiment De Taxació Pericial Contradictòria, as they simplify the document workflow and enhance collaboration among stakeholders.

-

Is airSlate SignNow compliant with legal standards for Desistiment De Taxació Pericial Contradictòria?

Yes, airSlate SignNow is fully compliant with legal standards for electronic signatures and document management. This compliance ensures that your documents related to Desistiment De Taxació Pericial Contradictòria are legally binding and recognized by authorities, providing peace of mind for your transactions.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, enhancing your workflow. Whether you need to connect with CRM systems or accounting software, our integrations can help streamline the process of managing Desistiment De Taxació Pericial Contradictòria documents.

-

What are the benefits of using airSlate SignNow for my business?

Using airSlate SignNow can signNowly improve your document management efficiency. By simplifying the process of handling Desistiment De Taxació Pericial Contradictòria, you can save time, reduce errors, and enhance collaboration among team members, ultimately leading to better business outcomes.

Get more for Desistiment De Taxaci Pericial Contradict ria

- Adobe reader download cnet for windows 10 form

- Iepa wpc ps 1 form

- Cbp form 4609

- Dance team contract template form

- Chapter 2 test the american colonies emerge answers form

- Aac026 emergency contact details australian army cadets form

- Parenting plan form 100067354

- Job application fayetteville athletic club form

Find out other Desistiment De Taxaci Pericial Contradict ria

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors