S43 Form

What is the S43

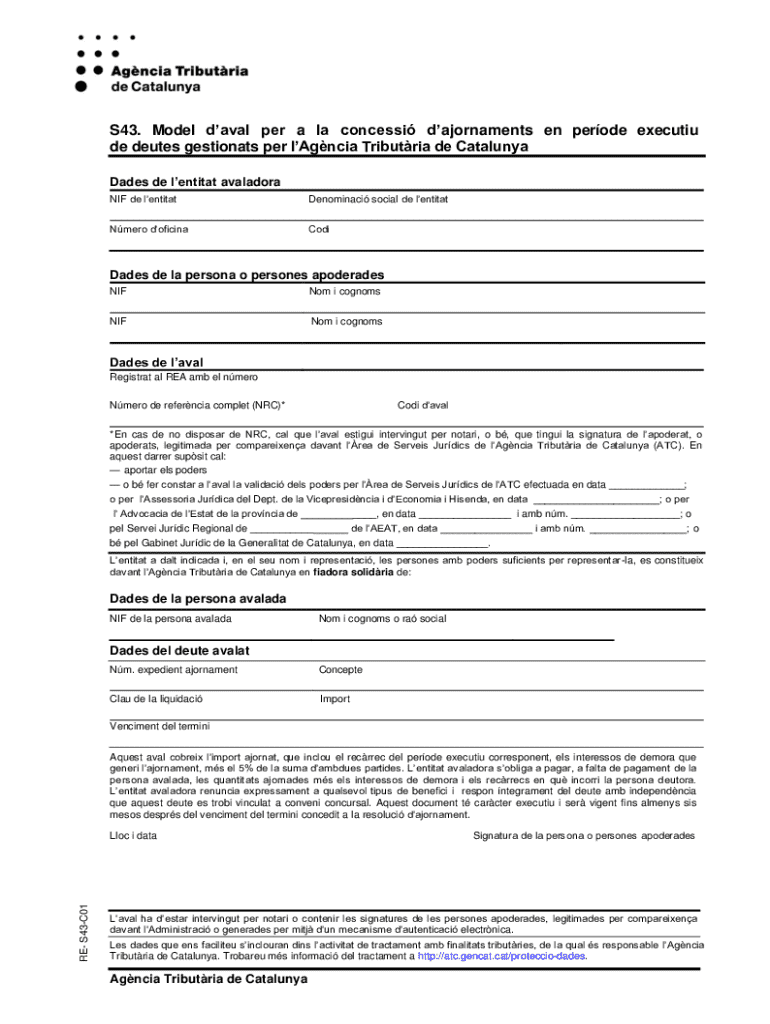

The S43 is a specific form used in various administrative processes, often related to tax or regulatory compliance. It serves as a standardized document that individuals or businesses must fill out to provide necessary information to relevant authorities. Understanding the purpose and requirements of the S43 is crucial for ensuring compliance with applicable laws and regulations.

How to use the S43

Using the S43 involves several straightforward steps. First, gather all required information, such as personal identification details, financial data, or any other relevant documentation. Next, accurately fill out the form, ensuring that all fields are completed to avoid delays. After completing the form, review it for accuracy before submission. This careful approach helps in maintaining compliance and avoiding potential issues.

Steps to complete the S43

Completing the S43 requires attention to detail. Follow these steps:

- Collect necessary documents and information.

- Fill out the form, ensuring all sections are completed.

- Double-check for any errors or omissions.

- Sign and date the form where required.

- Submit the form according to the specified guidelines.

Legal use of the S43

The S43 must be used in accordance with relevant laws and regulations. It is essential to understand the legal implications of the information provided on the form. Misrepresentation or failure to comply with submission requirements can lead to penalties or legal consequences. Therefore, ensuring that the form is completed truthfully and accurately is vital for legal compliance.

Required Documents

When preparing to complete the S43, certain documents may be required. These can include:

- Identification documents, such as a driver's license or social security number.

- Financial statements or tax returns, depending on the purpose of the form.

- Any additional documentation that supports the information provided on the form.

Form Submission Methods

The S43 can typically be submitted through various methods, including online, by mail, or in person. Each submission method may have its own guidelines and deadlines. It is important to choose the method that best suits your needs while ensuring that you comply with any specific requirements associated with that method.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the s43

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the S43 feature in airSlate SignNow?

The S43 feature in airSlate SignNow allows users to streamline their document signing process with advanced automation tools. This feature enhances efficiency by enabling users to create, send, and manage documents seamlessly. With S43, businesses can reduce turnaround times and improve overall productivity.

-

How much does the S43 plan cost?

The S43 plan is competitively priced to provide businesses with a cost-effective solution for document management. Pricing varies based on the number of users and features selected, ensuring that companies can find a plan that fits their budget. For detailed pricing information, visit our website or contact our sales team.

-

What are the key benefits of using S43?

Using the S43 feature in airSlate SignNow offers numerous benefits, including enhanced security, faster document processing, and improved collaboration. It allows teams to work together efficiently, ensuring that all stakeholders can access and sign documents quickly. Additionally, S43 helps businesses maintain compliance with industry regulations.

-

Can I integrate S43 with other software?

Yes, the S43 feature in airSlate SignNow supports integrations with various third-party applications, including CRM systems and cloud storage services. This flexibility allows businesses to create a customized workflow that fits their existing processes. Integrating S43 with your tools can enhance productivity and streamline operations.

-

Is S43 suitable for small businesses?

Absolutely! The S43 feature is designed to cater to businesses of all sizes, including small enterprises. Its user-friendly interface and cost-effective pricing make it an ideal choice for small businesses looking to improve their document management processes without breaking the bank.

-

How does S43 ensure document security?

S43 prioritizes document security by implementing advanced encryption and authentication measures. This ensures that all documents are protected during transmission and storage. Additionally, airSlate SignNow complies with industry standards to safeguard sensitive information, giving users peace of mind.

-

What types of documents can I manage with S43?

With the S43 feature, you can manage a wide variety of documents, including contracts, agreements, and forms. The platform supports multiple file formats, making it easy to upload and send any document for eSignature. This versatility allows businesses to handle all their document needs in one place.

Get more for S43

Find out other S43

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online

- eSignature Pennsylvania Sales Invoice Template Free

- eSignature Pennsylvania Sales Invoice Template Secure