S45 Form

What is the S45

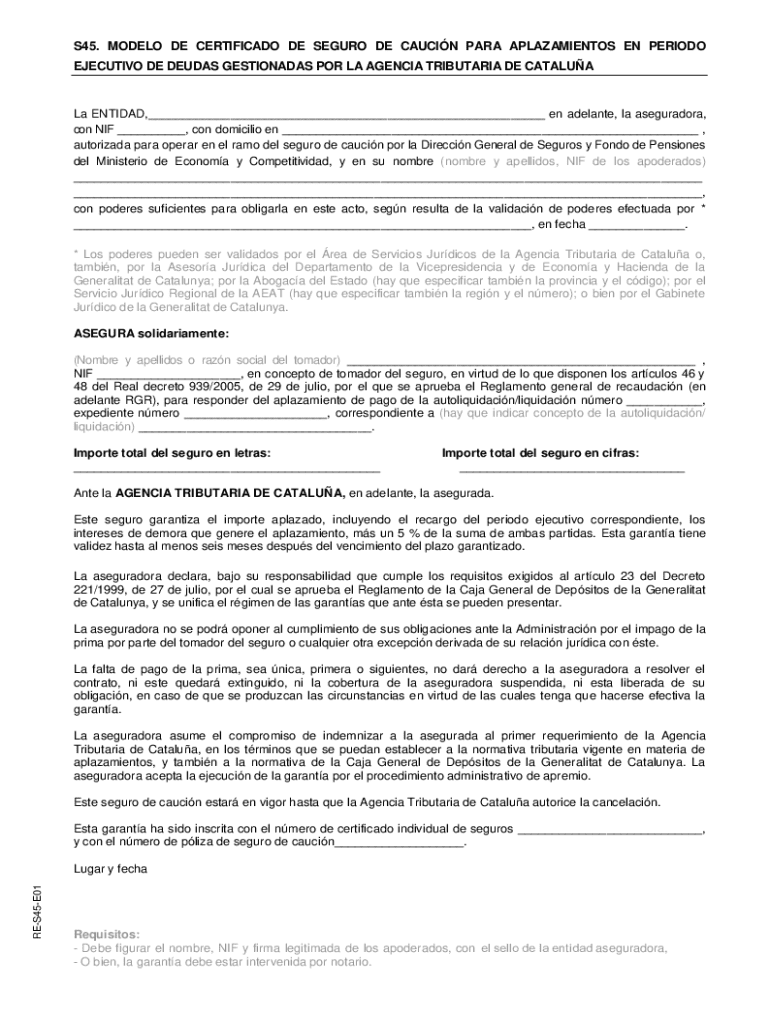

The S45 form is an essential document used primarily for reporting specific tax-related information to the Internal Revenue Service (IRS). It is commonly utilized by businesses and individuals to disclose various financial details, ensuring compliance with federal tax regulations. Understanding the purpose and function of the S45 is crucial for accurate tax reporting and avoidance of potential penalties.

How to use the S45

Using the S45 form involves several key steps. First, gather all necessary financial documents that pertain to the reporting period. This may include income statements, expense reports, and any other relevant financial records. Next, carefully fill out the form, ensuring that all information is accurate and complete. After completing the form, review it for any errors before submission to avoid delays or compliance issues.

Steps to complete the S45

Completing the S45 form requires attention to detail. Follow these steps:

- Begin by entering your personal or business information at the top of the form.

- Provide the necessary financial data as requested in the designated sections.

- Double-check all figures for accuracy, ensuring they match your financial records.

- Sign and date the form to certify that the information provided is true and correct.

Legal use of the S45

The S45 form must be used in accordance with IRS guidelines to ensure legal compliance. It is important to understand the specific requirements for filing this form, including deadlines and eligibility criteria. Failure to adhere to these regulations can result in penalties or audits, making it essential for users to familiarize themselves with the legal implications of the S45.

Filing Deadlines / Important Dates

Filing deadlines for the S45 form are critical to avoid late penalties. Typically, the form must be submitted by a specific date each year, often coinciding with the tax filing season. Keeping track of these important dates ensures timely compliance with IRS requirements, allowing individuals and businesses to maintain good standing with tax authorities.

Required Documents

To complete the S45 form accurately, certain documents are required. These may include:

- Financial statements that detail income and expenses.

- Previous year’s tax returns for reference.

- Any additional documentation that supports the figures reported on the form.

Having these documents on hand will streamline the completion process and enhance accuracy.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the s45

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the S45 feature in airSlate SignNow?

The S45 feature in airSlate SignNow is designed to streamline the document signing process. It allows users to send, track, and manage eSignatures efficiently, ensuring that all documents are signed in a timely manner. This feature is particularly beneficial for businesses looking to enhance their workflow and reduce turnaround times.

-

How much does the S45 plan cost?

The S45 plan offers competitive pricing tailored to meet the needs of various businesses. Depending on the size and requirements of your organization, you can choose from different pricing tiers. This ensures that you get the best value for your investment in document management and eSigning solutions.

-

What are the key benefits of using the S45 solution?

The S45 solution provides numerous benefits, including increased efficiency, reduced paper usage, and enhanced security for your documents. By utilizing airSlate SignNow, businesses can save time and resources while ensuring compliance with legal standards. This makes the S45 an ideal choice for organizations aiming to modernize their document processes.

-

Can I integrate S45 with other software?

Yes, the S45 feature in airSlate SignNow seamlessly integrates with various third-party applications. This includes popular tools like CRM systems, project management software, and cloud storage services. Such integrations enhance the overall functionality and allow for a more cohesive workflow across different platforms.

-

Is the S45 solution suitable for small businesses?

Absolutely! The S45 solution is designed to cater to businesses of all sizes, including small enterprises. Its user-friendly interface and cost-effective pricing make it an excellent choice for small businesses looking to improve their document signing processes without breaking the bank.

-

What types of documents can I send using S45?

With the S45 feature, you can send a wide variety of documents for eSigning, including contracts, agreements, and forms. This versatility allows businesses to handle all their document needs in one place. Additionally, airSlate SignNow supports various file formats, ensuring compatibility with your existing documents.

-

How secure is the S45 eSigning process?

The S45 eSigning process is highly secure, utilizing advanced encryption and authentication methods to protect your documents. airSlate SignNow complies with industry standards and regulations, ensuring that your sensitive information remains confidential. This level of security is crucial for businesses that handle sensitive data.

Get more for S45

Find out other S45

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors