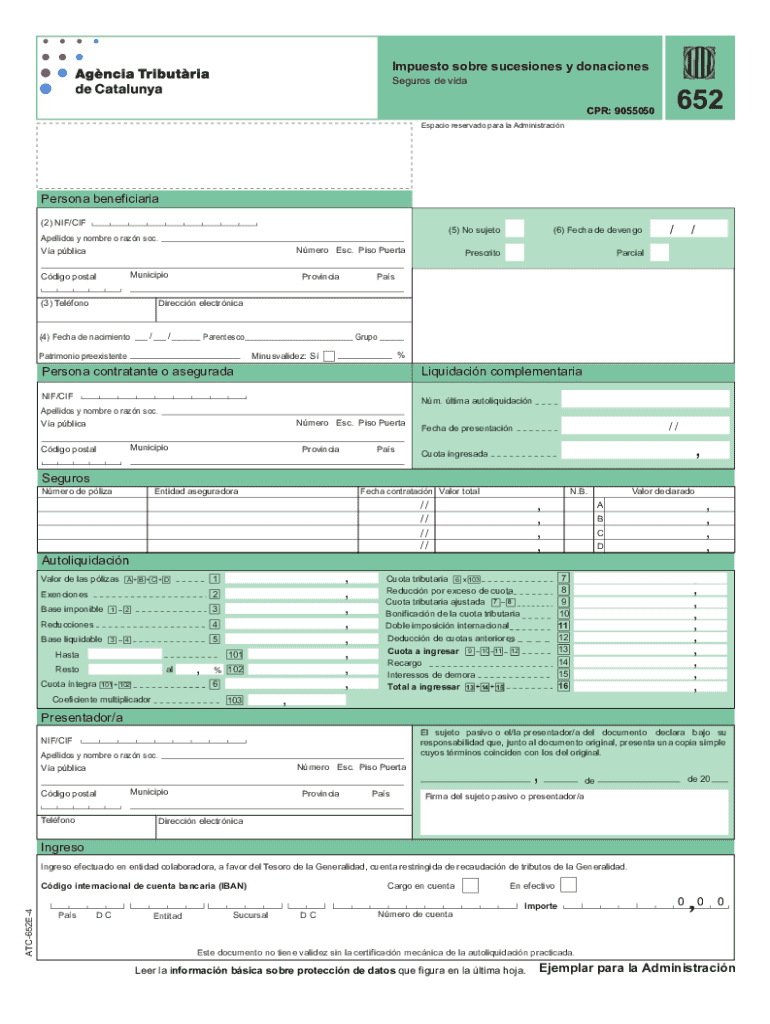

Impuesto Sobre Sucesiones Y Donaciones Form

What is the Impuesto Sobre Sucesiones Y Donaciones

The Impuesto Sobre Sucesiones Y Donaciones refers to the tax on inheritances and donations, primarily applicable in various jurisdictions. This tax is levied on the transfer of assets from one individual to another, either through inheritance after death or as a gift during the giver's lifetime. The specific rules and rates can vary significantly based on state laws, making it essential for individuals to understand the implications of this tax in their respective states.

Steps to complete the Impuesto Sobre Sucesiones Y Donaciones

Completing the Impuesto Sobre Sucesiones Y Donaciones typically involves several key steps:

- Determine the value of the assets being transferred.

- Gather necessary documentation, including proof of ownership and any appraisals.

- Complete the appropriate tax forms as required by your state.

- Calculate the tax owed based on the applicable rates and exemptions.

- Submit the completed forms along with any required payment by the deadline.

Required Documents

To successfully file the Impuesto Sobre Sucesiones Y Donaciones, individuals must prepare several documents:

- Death certificate (for inheritances).

- Gift documentation (for donations).

- Appraisals of the assets being transferred.

- Proof of relationship to the deceased or donor.

- Completed tax forms specific to the state.

Filing Deadlines / Important Dates

Filing deadlines for the Impuesto Sobre Sucesiones Y Donaciones can vary by state. Generally, it is crucial to file the necessary forms within a specific period following the transfer of assets. Missing these deadlines can result in penalties or interest on unpaid taxes. It is advisable to check state-specific guidelines for exact dates and any extensions that may apply.

Legal use of the Impuesto Sobre Sucesiones Y Donaciones

The Impuesto Sobre Sucesiones Y Donaciones serves a legal purpose by ensuring that the transfer of wealth is appropriately taxed. Understanding the legal framework surrounding this tax is vital for compliance. Individuals must be aware of their rights and obligations under state law, including any exemptions or deductions that may apply to their situation.

State-specific rules for the Impuesto Sobre Sucesiones Y Donaciones

Each state has its own regulations governing the Impuesto Sobre Sucesiones Y Donaciones. These rules can dictate tax rates, exemptions, and filing procedures. For example, some states may offer higher exemptions for close relatives, while others may have progressive tax rates based on the value of the estate or gift. Familiarity with these state-specific rules is essential for accurate tax reporting and compliance.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the impuesto sobre sucesiones y donaciones

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Impuesto Sobre Sucesiones Y Donaciones?

The Impuesto Sobre Sucesiones Y Donaciones is a tax levied on inheritances and donations in Spain. Understanding this tax is crucial for individuals and businesses involved in estate planning or transferring assets. airSlate SignNow can help streamline the documentation process related to these transactions.

-

How can airSlate SignNow assist with Impuesto Sobre Sucesiones Y Donaciones?

airSlate SignNow provides a user-friendly platform for creating, sending, and signing documents related to the Impuesto Sobre Sucesiones Y Donaciones. This ensures that all necessary paperwork is completed efficiently and securely. Our solution simplifies the process, making it easier for users to manage their tax obligations.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for individuals dealing with Impuesto Sobre Sucesiones Y Donaciones. Each plan provides access to essential features that facilitate document management and eSigning. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing Impuesto Sobre Sucesiones Y Donaciones?

Key features of airSlate SignNow include customizable templates, secure eSigning, and document tracking, all of which are beneficial for handling Impuesto Sobre Sucesiones Y Donaciones. These tools help ensure that your documents are compliant and organized. Additionally, our platform allows for easy collaboration among stakeholders.

-

Is airSlate SignNow secure for handling sensitive documents related to Impuesto Sobre Sucesiones Y Donaciones?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for managing documents related to Impuesto Sobre Sucesiones Y Donaciones. Our platform uses advanced encryption and security protocols to protect your data. You can trust that your sensitive information is handled with the utmost care.

-

Can I integrate airSlate SignNow with other tools for managing Impuesto Sobre Sucesiones Y Donaciones?

Absolutely! airSlate SignNow offers integrations with various applications that can enhance your workflow for Impuesto Sobre Sucesiones Y Donaciones. This allows you to connect with tools you already use, streamlining the process of document management and eSigning. Check our integration options to find the best fit for your needs.

-

What are the benefits of using airSlate SignNow for Impuesto Sobre Sucesiones Y Donaciones?

Using airSlate SignNow for Impuesto Sobre Sucesiones Y Donaciones offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced collaboration. Our platform simplifies the signing process, allowing you to focus on what matters most. Additionally, it helps ensure compliance with tax regulations.

Get more for Impuesto Sobre Sucesiones Y Donaciones

Find out other Impuesto Sobre Sucesiones Y Donaciones

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney