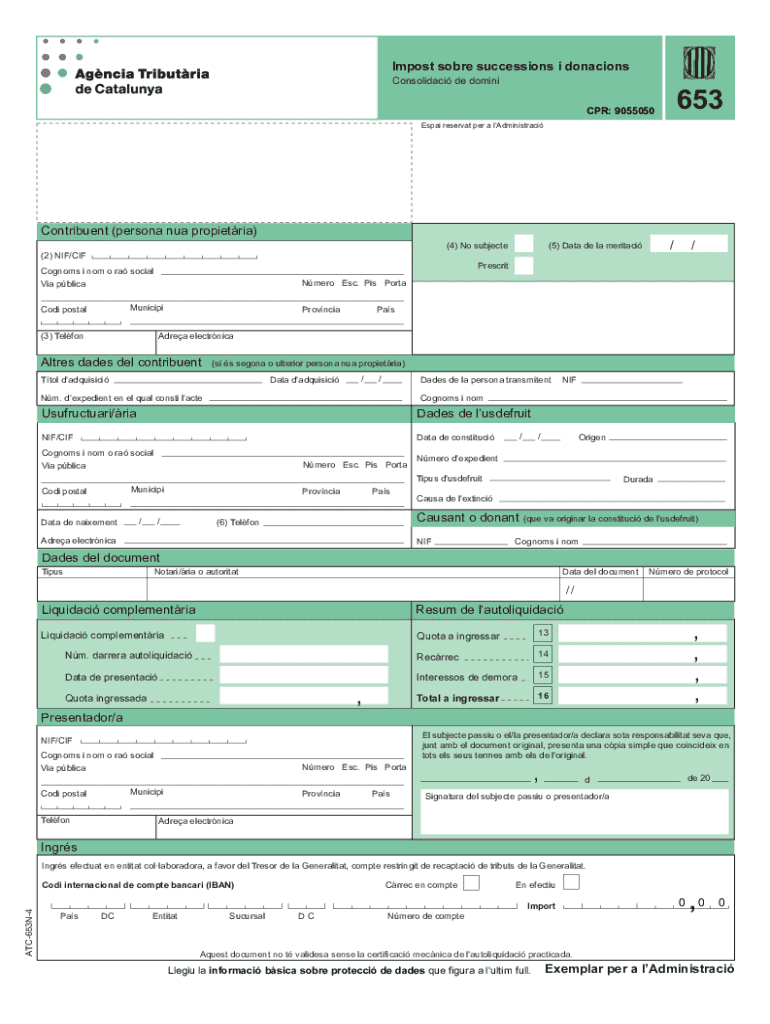

Impost Sobre Successions I Donacions Form

What is the Impost Sobre Successions I Donacions

The Impost Sobre Successions I Donacions is a tax levied on inheritances and donations in certain jurisdictions. This tax applies to the transfer of assets from one individual to another, whether through death or as a gift. Understanding this tax is crucial for individuals who may be involved in estate planning or who are set to receive assets from a deceased relative or as a gift. The rates and regulations can vary significantly, making it essential to be aware of the specific laws applicable in your state.

Steps to complete the Impost Sobre Successions I Donacions

Completing the Impost Sobre Successions I Donacions involves several key steps:

- Determine the applicable tax rate based on the value of the assets received.

- Gather necessary documentation, including the will, asset valuations, and any relevant gift declarations.

- Fill out the required forms accurately, ensuring that all information is complete and truthful.

- Submit the forms to the appropriate tax authority, either online or via mail, depending on the jurisdiction's requirements.

- Keep copies of all submitted documents for your records and future reference.

Required Documents

To successfully file the Impost Sobre Successions I Donacions, you will need several key documents:

- The decedent's will or trust documents.

- Proof of asset valuations, such as appraisals or market assessments.

- Gift declarations if applicable, detailing any gifts made prior to death.

- Identification documents for both the giver and the recipient.

Filing Deadlines / Important Dates

Filing deadlines for the Impost Sobre Successions I Donacions can vary by state, but generally, you should be aware of the following:

- The deadline for filing the tax return is typically within a few months of the decedent's date of death.

- Extensions may be available, but they must be requested before the original deadline.

- Penalties for late filing can accrue, so it is important to adhere to these deadlines.

Legal use of the Impost Sobre Successions I Donacions

The legal framework surrounding the Impost Sobre Successions I Donacions is designed to ensure that taxes are fairly assessed on the transfer of wealth. It is important to understand the legal implications of this tax:

- Failure to comply with tax regulations can result in penalties or legal action.

- Understanding state-specific laws is essential, as they can dictate how the tax is assessed and collected.

- Consulting with a legal or tax professional can provide clarity on obligations and rights under the law.

Who Issues the Form

The form for the Impost Sobre Successions I Donacions is typically issued by the state tax authority. This agency is responsible for the administration and enforcement of tax laws related to inheritances and donations. It is important to ensure that you are using the most current version of the form, as regulations and requirements may change over time.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the impost sobre successions i donacions 635303881

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Impost Sobre Successions I Donacions?

The Impost Sobre Successions I Donacions is a tax levied on inheritances and donations in certain jurisdictions. Understanding this tax is crucial for individuals and businesses involved in estate planning or asset transfer. airSlate SignNow can help streamline the documentation process related to these transactions.

-

How can airSlate SignNow assist with Impost Sobre Successions I Donacions?

airSlate SignNow provides an efficient platform for creating, sending, and signing documents related to the Impost Sobre Successions I Donacions. Our solution simplifies the paperwork involved in estate planning and ensures compliance with legal requirements. This makes managing your tax obligations easier and more organized.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs, including those dealing with Impost Sobre Successions I Donacions. Our plans are designed to be cost-effective while providing essential features for document management and eSigning. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing Impost Sobre Successions I Donacions?

Our platform includes features such as customizable templates, secure eSigning, and document tracking, all of which are beneficial for handling Impost Sobre Successions I Donacions. These tools help ensure that your documents are completed accurately and efficiently. Additionally, our user-friendly interface makes it easy for anyone to navigate.

-

Is airSlate SignNow compliant with legal standards for Impost Sobre Successions I Donacions?

Yes, airSlate SignNow is designed to comply with legal standards for document management, including those related to Impost Sobre Successions I Donacions. We prioritize security and legal compliance to protect your sensitive information. This ensures that your documents are valid and enforceable.

-

Can I integrate airSlate SignNow with other tools for managing Impost Sobre Successions I Donacions?

Absolutely! airSlate SignNow offers integrations with various applications that can enhance your workflow related to Impost Sobre Successions I Donacions. Whether you use CRM systems, cloud storage, or accounting software, our platform can seamlessly connect to improve efficiency and collaboration.

-

What are the benefits of using airSlate SignNow for Impost Sobre Successions I Donacions?

Using airSlate SignNow for Impost Sobre Successions I Donacions provides numerous benefits, including time savings, reduced paperwork, and enhanced security. Our solution allows you to manage your documents digitally, making it easier to track and organize important information. This ultimately leads to a smoother process for handling taxes and legal obligations.

Get more for Impost Sobre Successions I Donacions

Find out other Impost Sobre Successions I Donacions

- Sign Alaska Rental lease agreement Mobile

- Sign Connecticut Rental lease agreement Easy

- Sign Hawaii Rental lease agreement Mobile

- Sign Hawaii Rental lease agreement Simple

- Sign Kansas Rental lease agreement Later

- How Can I Sign California Rental house lease agreement

- How To Sign Nebraska Rental house lease agreement

- How To Sign North Dakota Rental house lease agreement

- Sign Vermont Rental house lease agreement Now

- How Can I Sign Colorado Rental lease agreement forms

- Can I Sign Connecticut Rental lease agreement forms

- Sign Florida Rental lease agreement template Free

- Help Me With Sign Idaho Rental lease agreement template

- Sign Indiana Rental lease agreement forms Fast

- Help Me With Sign Kansas Rental lease agreement forms

- Can I Sign Oregon Rental lease agreement template

- Can I Sign Michigan Rental lease agreement forms

- Sign Alaska Rental property lease agreement Simple

- Help Me With Sign North Carolina Rental lease agreement forms

- Sign Missouri Rental property lease agreement Mobile