Modelo 200 Form

What is the Modelo 200

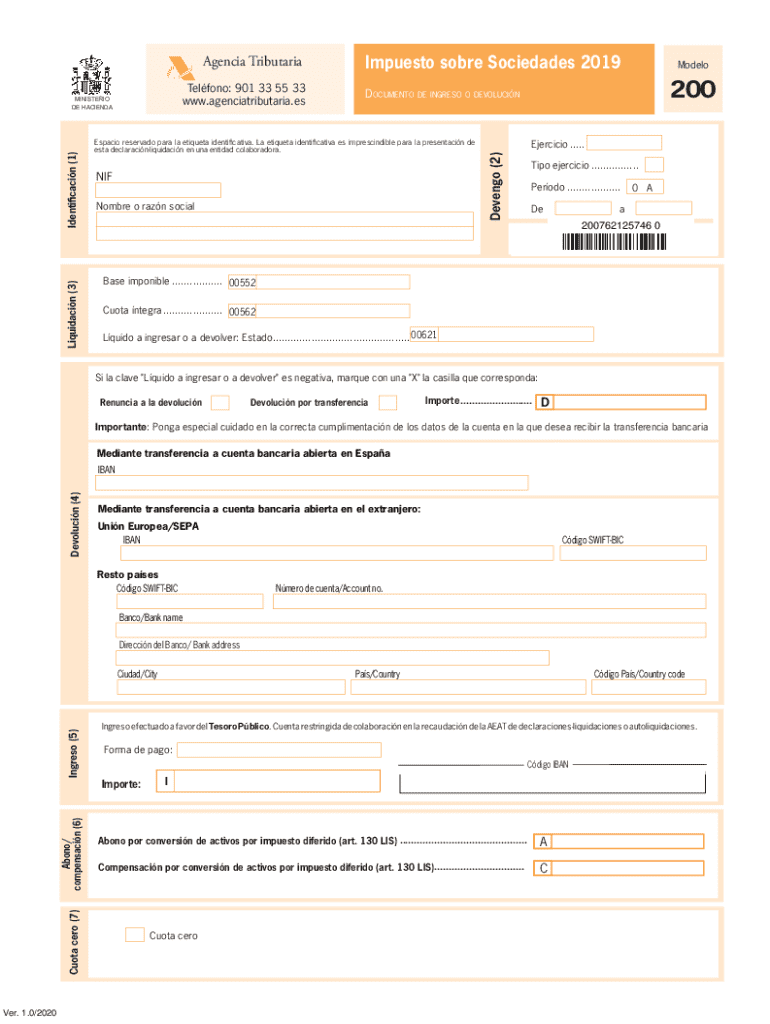

The Modelo 200 is a tax form used primarily for declaring and paying certain types of taxes in Spain. It is commonly associated with corporate tax obligations, including those for limited liability companies and other business entities. The form serves as a means for businesses to report their income, expenses, and the taxes owed to the government. Understanding this form is crucial for compliance with tax regulations and for ensuring that businesses meet their financial obligations in a timely manner.

How to use the Modelo 200

Using the Modelo 200 involves several key steps. First, businesses must gather all necessary financial documents, including income statements and expense reports. Next, they should accurately fill out the form, ensuring that all figures are correct and reflect the business's financial situation. Once completed, the form can be submitted electronically or via traditional mail, depending on the preferences of the business owner. It is essential to keep a copy of the submitted form for record-keeping purposes.

Steps to complete the Modelo 200

Completing the Modelo 200 requires careful attention to detail. Here are the essential steps:

- Gather financial records, including income and expense statements.

- Access the Modelo 200 form, which can be downloaded or filled out online.

- Fill in the required fields, ensuring accuracy in all reported figures.

- Review the form for any errors or omissions before submission.

- Submit the completed form either electronically or by mail, as preferred.

Legal use of the Modelo 200

The legal use of the Modelo 200 is governed by tax regulations set forth by the Spanish government. Businesses are required to use this form to report their tax obligations accurately. Failure to do so can result in penalties, including fines or additional taxes owed. It is important for business owners to understand their legal responsibilities regarding the completion and submission of this form to avoid non-compliance issues.

Filing Deadlines / Important Dates

Filing deadlines for the Modelo 200 are critical for compliance. Typically, businesses must submit the form within a specific timeframe following the end of the fiscal year. It is advisable for business owners to mark these dates on their calendars to ensure timely submission. Missing the deadline can lead to penalties and interest on unpaid taxes, making it essential to stay informed about these important dates.

Required Documents

To complete the Modelo 200 accurately, several documents are required. These typically include:

- Income statements that detail revenue generated by the business.

- Expense reports that outline all costs incurred during the fiscal year.

- Previous tax returns, if applicable, to provide context for current filings.

- Any additional documentation that supports claims made on the form.

Form Submission Methods (Online / Mail / In-Person)

The Modelo 200 can be submitted through various methods, providing flexibility for business owners. The online submission process is often the quickest and most efficient, allowing for immediate confirmation of receipt. Alternatively, businesses can choose to mail the completed form to the appropriate tax authority or submit it in person at designated offices. Each method has its own advantages, and businesses should select the one that best suits their needs.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the modelo 200

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Modelo 200 and how does it work?

Modelo 200 is a digital document management solution that allows users to create, send, and eSign documents efficiently. With airSlate SignNow, you can streamline your workflow by automating the signing process, ensuring that your documents are signed quickly and securely.

-

What are the key features of Modelo 200?

Modelo 200 offers a range of features including customizable templates, real-time tracking of document status, and secure cloud storage. These features help businesses manage their documents more effectively and enhance collaboration among team members.

-

How much does Modelo 200 cost?

The pricing for Modelo 200 varies based on the plan you choose, with options for individuals, small businesses, and enterprises. airSlate SignNow provides a cost-effective solution that scales with your needs, ensuring you only pay for what you use.

-

What are the benefits of using Modelo 200?

Using Modelo 200 can signNowly reduce the time spent on document management and signing processes. It enhances productivity by allowing users to send and receive signed documents instantly, which can lead to faster decision-making and improved business efficiency.

-

Can Modelo 200 integrate with other software?

Yes, Modelo 200 seamlessly integrates with various software applications, including CRM systems, cloud storage services, and productivity tools. This integration capability allows businesses to enhance their existing workflows and improve overall efficiency.

-

Is Modelo 200 secure for sensitive documents?

Absolutely, Modelo 200 prioritizes security with features like encryption, secure access controls, and compliance with industry standards. This ensures that your sensitive documents are protected throughout the signing process.

-

How can I get started with Modelo 200?

Getting started with Modelo 200 is simple. You can sign up for a free trial on the airSlate SignNow website, where you can explore its features and see how it can benefit your business before committing to a paid plan.

Get more for Modelo 200

- Material composition declaration ipc 1752 98asa99256d 1352 03 1352 8 lead tpmp gull wing form

- Reference form pdf

- Induction hse pdf form

- The wind and the sun lesson plan form

- Texas medicaid application pdf form

- Cocolife reimbursement claim form

- Lesson 4 homework practice surface area of prisms form

- X x x x factor x x 1 x 4 4 x 1 meaning means 21176639 form

Find out other Modelo 200

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later