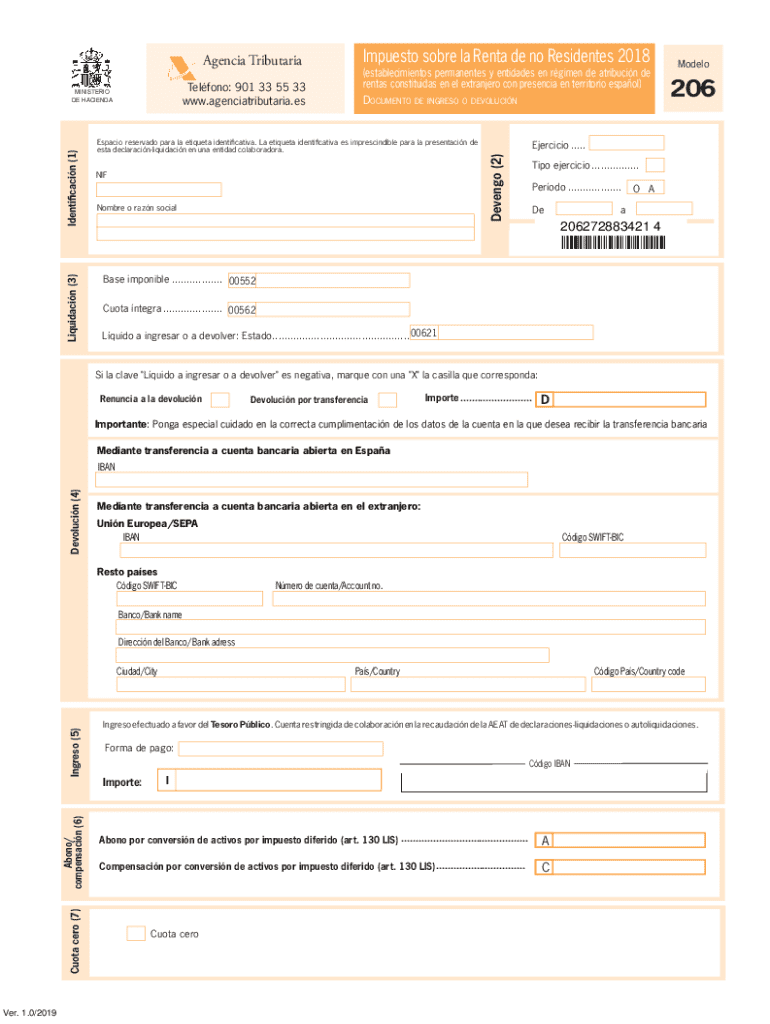

Establecimientos Permanentes Y Entidades En Rgimen De Atribucin De Form

What is the establecimientos Permanentes Y Entidades En Rgimen De Atribucin De

The term "establecimientos Permanentes Y Entidades En Rgimen De Atribucin De" refers to a specific classification used primarily in tax regulations. It pertains to permanent establishments and entities that operate under a system of attribution for tax purposes. This classification is essential for determining the tax obligations of foreign entities conducting business in the United States. Understanding this concept is crucial for compliance with U.S. tax laws, especially for businesses that engage in cross-border transactions.

Key elements of the establecimientos Permanentes Y Entidades En Rgimen De Atribucin De

Several key elements define the "establecimientos Permanentes Y Entidades En Rgimen De Atribucin De." These include:

- Physical Presence: A permanent establishment typically requires a fixed place of business, such as an office or branch.

- Business Activities: The nature of activities conducted at the establishment plays a significant role in determining tax liability.

- Duration: The length of time the establishment operates can influence tax obligations, with longer durations generally leading to more significant tax responsibilities.

- Local Regulations: Compliance with local laws and regulations is essential for maintaining the legal status of a permanent establishment.

How to obtain the establecimientos Permanentes Y Entidades En Rgimen De Atribucin De

Obtaining the "establecimientos Permanentes Y Entidades En Rgimen De Atribucin De" classification involves several steps. First, businesses must assess their activities in the U.S. to determine if they meet the criteria for a permanent establishment. This assessment typically includes reviewing the nature of business operations and the physical presence in the country. Once the criteria are met, businesses must register with the appropriate tax authorities and ensure compliance with all relevant regulations. This process may require documentation that outlines business activities, location, and duration of operations.

Steps to complete the establecimientos Permanentes Y Entidades En Rgimen De Atribucin De

Completing the "establecimientos Permanentes Y Entidades En Rgimen De Atribucin De" involves specific steps:

- Step 1: Evaluate your business activities to determine if they constitute a permanent establishment.

- Step 2: Gather necessary documentation, including business registration and operational details.

- Step 3: Submit the required forms to the relevant tax authority, ensuring all information is accurate and complete.

- Step 4: Maintain records of business activities and compliance efforts for future reference and audits.

Legal use of the establecimientos Permanentes Y Entidades En Rgimen De Atribucin De

The legal use of the "establecimientos Permanentes Y Entidades En Rgimen De Atribucin De" is critical for ensuring compliance with U.S. tax laws. Businesses must adhere to specific regulations governing the operation of permanent establishments. This includes understanding tax obligations, filing requirements, and potential penalties for non-compliance. Legal guidance may be necessary to navigate these complexities, particularly for foreign entities unfamiliar with U.S. tax regulations.

IRS Guidelines

The Internal Revenue Service (IRS) provides guidelines for entities classified under "establecimientos Permanentes Y Entidades En Rgimen De Atribucin De." These guidelines outline the tax responsibilities of foreign businesses operating in the U.S., including the need to file specific tax forms and report income generated within the country. It is essential for businesses to familiarize themselves with these guidelines to ensure compliance and avoid penalties. Regular updates from the IRS may also affect the obligations of these entities, making it important to stay informed.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the establecimientos permanentes y entidades en rgimen de atribucin de

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are establecimientos Permanentes Y Entidades En Rgimen De Atribucin De?

Establecimientos Permanentes Y Entidades En Rgimen De Atribucin De refer to specific business structures that have tax implications. Understanding these terms is crucial for businesses operating in multiple jurisdictions. airSlate SignNow can help streamline document management for these entities, ensuring compliance and efficiency.

-

How does airSlate SignNow support establecimientos Permanentes Y Entidades En Rgimen De Atribucin De?

airSlate SignNow provides a user-friendly platform for managing documents related to establecimientos Permanentes Y Entidades En Rgimen De Atribucin De. Our solution allows businesses to easily send, sign, and store important documents securely. This helps ensure that all necessary paperwork is handled efficiently and in compliance with regulations.

-

What features does airSlate SignNow offer for businesses with establecimientos Permanentes Y Entidades En Rgimen De Atribucin De?

Our platform offers features such as customizable templates, automated workflows, and secure eSigning capabilities. These features are designed to simplify the document management process for establishments and entities under the regime of attribution. This ensures that all documentation is processed quickly and accurately.

-

Is airSlate SignNow cost-effective for establishments and entities?

Yes, airSlate SignNow is a cost-effective solution for establishments Permanentes Y Entidades En Rgimen De Atribucin De. We offer flexible pricing plans that cater to businesses of all sizes, ensuring that you only pay for what you need. This makes it an ideal choice for organizations looking to optimize their document management without breaking the bank.

-

Can airSlate SignNow integrate with other tools for my business?

Absolutely! airSlate SignNow integrates seamlessly with various business tools and applications. This includes CRM systems, cloud storage services, and more, making it easier for establishments Permanentes Y Entidades En Rgimen De Atribucin De to manage their documents within their existing workflows.

-

What are the benefits of using airSlate SignNow for my establishment?

Using airSlate SignNow offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security for your documents. For establishments Permanentes Y Entidades En Rgimen De Atribucin De, this means less time spent on administrative tasks and more focus on core business activities. Our platform is designed to simplify your document processes.

-

How secure is airSlate SignNow for handling sensitive documents?

Security is a top priority for airSlate SignNow. We utilize advanced encryption and security protocols to protect your documents, especially those related to establecimientos Permanentes Y Entidades En Rgimen De Atribucin De. You can trust that your sensitive information is safe with us, allowing you to focus on your business.

Get more for establecimientos Permanentes Y Entidades En Rgimen De Atribucin De

Find out other establecimientos Permanentes Y Entidades En Rgimen De Atribucin De

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple