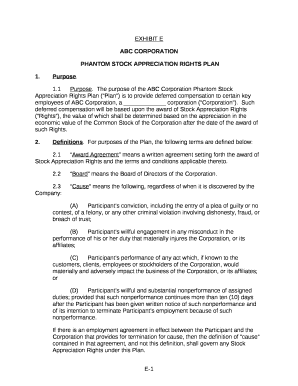

PHANTOM Stock Appreciation RIGHTS PLAN Form

What is the PHANTOM Stock Appreciation RIGHTS PLAN

The PHANTOM Stock Appreciation Rights Plan is a compensation mechanism that allows employees to benefit from the increase in a company's stock value without actually owning shares. This plan provides employees with the right to receive a cash payment or stock equivalent, reflecting the appreciation in stock value over a specified period. It is often used as a tool to attract and retain talent, aligning employee interests with company performance.

How to use the PHANTOM Stock Appreciation RIGHTS PLAN

To utilize the PHANTOM Stock Appreciation Rights Plan effectively, companies must first establish clear guidelines outlining eligibility criteria, vesting schedules, and payment structures. Employees should familiarize themselves with the plan's terms, including how and when they can exercise their rights. Understanding the tax implications and the process for receiving payments is crucial for maximizing the benefits of this plan.

Key elements of the PHANTOM Stock Appreciation RIGHTS PLAN

Several key elements define the PHANTOM Stock Appreciation Rights Plan. These include:

- Vesting Schedule: Determines when employees can exercise their rights.

- Appreciation Calculation: Defines how the increase in stock value is measured.

- Payment Method: Specifies whether payments will be made in cash or stock equivalents.

- Tax Treatment: Outlines the tax implications for employees upon exercise of rights.

Steps to complete the PHANTOM Stock Appreciation RIGHTS PLAN

Completing the PHANTOM Stock Appreciation Rights Plan involves several steps:

- Define the plan's objectives and structure.

- Establish eligibility criteria for employees.

- Determine the vesting schedule and appreciation calculation method.

- Communicate the plan details to employees.

- Monitor the plan's performance and make adjustments as necessary.

Legal use of the PHANTOM Stock Appreciation RIGHTS PLAN

Compliance with legal requirements is essential for the PHANTOM Stock Appreciation Rights Plan. Companies must ensure that the plan adheres to federal and state regulations, including securities laws and tax guidelines. Proper documentation and reporting are necessary to avoid potential legal issues and to maintain transparency with employees.

Eligibility Criteria

Eligibility for the PHANTOM Stock Appreciation Rights Plan typically includes full-time employees, though companies may choose to extend eligibility to part-time employees or contractors. Specific criteria may vary based on company policy, and it is vital for employees to understand the requirements to participate in the plan fully.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the phantom stock appreciation rights plan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a PHANTOM Stock Appreciation RIGHTS PLAN?

A PHANTOM Stock Appreciation RIGHTS PLAN is a compensation strategy that allows employees to benefit from the increase in the company's stock value without actually owning shares. This plan provides a cash or stock payout based on the appreciation of the company's stock, aligning employee interests with company performance.

-

How does a PHANTOM Stock Appreciation RIGHTS PLAN benefit employees?

Employees benefit from a PHANTOM Stock Appreciation RIGHTS PLAN by receiving financial rewards tied to the company's success. This plan motivates employees to contribute to the company's growth, as their compensation increases with the stock's appreciation, fostering a sense of ownership and commitment.

-

What are the key features of a PHANTOM Stock Appreciation RIGHTS PLAN?

Key features of a PHANTOM Stock Appreciation RIGHTS PLAN include the ability to set vesting schedules, determine payout structures, and establish performance metrics. These features allow companies to tailor the plan to their specific goals and employee needs, ensuring effective incentive alignment.

-

Is a PHANTOM Stock Appreciation RIGHTS PLAN cost-effective for businesses?

Yes, a PHANTOM Stock Appreciation RIGHTS PLAN can be a cost-effective solution for businesses. It allows companies to offer competitive compensation without diluting equity, making it an attractive option for startups and established firms looking to incentivize employees while managing costs.

-

How can I integrate a PHANTOM Stock Appreciation RIGHTS PLAN with existing HR systems?

Integrating a PHANTOM Stock Appreciation RIGHTS PLAN with existing HR systems can streamline administration and tracking. Many HR software solutions offer customizable modules that can accommodate the specifics of the plan, ensuring seamless management of employee benefits and compensation.

-

What are the tax implications of a PHANTOM Stock Appreciation RIGHTS PLAN?

The tax implications of a PHANTOM Stock Appreciation RIGHTS PLAN can vary based on jurisdiction and specific plan structure. Generally, employees may be taxed on the payout received, while companies can often deduct the expense when the payout is made, making it essential to consult with a tax professional.

-

Can a PHANTOM Stock Appreciation RIGHTS PLAN be customized for different employee levels?

Absolutely, a PHANTOM Stock Appreciation RIGHTS PLAN can be customized to cater to different employee levels within an organization. Companies can create tiered plans that offer varying benefits based on position, performance, or tenure, ensuring that all employees feel valued and motivated.

Get more for PHANTOM Stock Appreciation RIGHTS PLAN

- Certification of trust form 1113 weoc

- Civil summons form fill in the blank

- Judgment and decree of dissolution of marriage form cafc070 491109833

- Affidavit of financial status the western district of missouri form

- Vat1614g form

- Affidavit of indigency legal fill court and legal forms

- Forms ampamp helpful linkscity of katy tx

- Eeo exemption form

Find out other PHANTOM Stock Appreciation RIGHTS PLAN

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document