Attach to Your Form IL 1040

What is the Attach To Your Form IL 1040

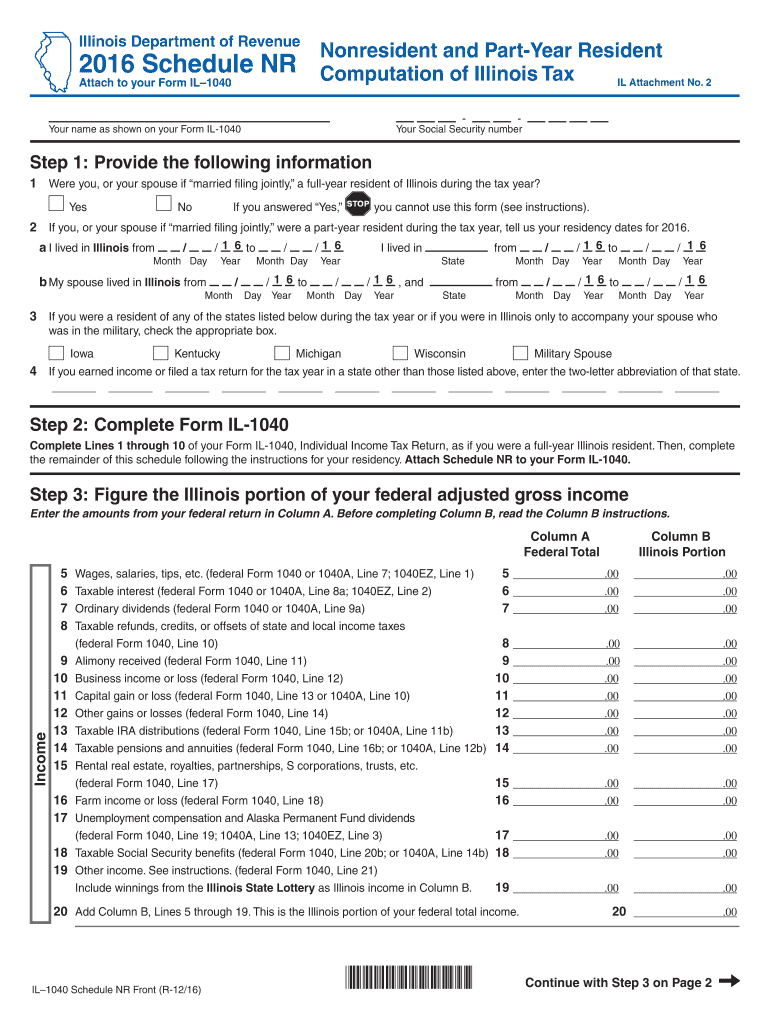

The Attach To Your Form IL 1040 is a critical document that provides additional information or supporting documentation required when filing your Illinois state income tax return. This attachment is essential for ensuring that your tax return is complete and accurate, as it may include various schedules, forms, or statements that clarify your income, deductions, or credits. Understanding its purpose helps taxpayers comply with state tax regulations and avoid potential issues with their filings.

Key elements of the Attach To Your Form IL 1040

Several key elements are essential to consider when preparing the Attach To Your Form IL 1040. These elements include:

- Supporting Documentation: This may consist of W-2 forms, 1099 forms, and any other relevant financial documents that substantiate your income.

- Schedules: Depending on your financial situation, you may need to include specific schedules that detail your income sources or deductions.

- Signature: Ensure that the form is signed and dated, as an unsigned form may lead to processing delays.

- Filing Status: Clearly indicate your filing status, as this affects your tax calculations and eligibility for certain credits.

Steps to complete the Attach To Your Form IL 1040

Completing the Attach To Your Form IL 1040 involves several straightforward steps:

- Gather all necessary documents, including W-2s, 1099s, and any other relevant financial records.

- Fill out the main IL 1040 form accurately, ensuring that all income and deductions are reported.

- Complete any required schedules or additional forms that apply to your tax situation.

- Attach all supporting documents to the IL 1040 form, ensuring they are in the correct order.

- Review the entire package for accuracy and completeness before submission.

Filing Deadlines / Important Dates

Being aware of filing deadlines is crucial for compliance. The typical deadline for submitting your Form IL 1040 is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, if you require more time, you can file for an extension, but it is essential to pay any taxes owed by the original deadline to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

You have several options for submitting your Attach To Your Form IL 1040. These methods include:

- Online Submission: Many taxpayers choose to file electronically through approved tax software, which can streamline the process and reduce errors.

- Mail: You can send your completed form and attachments via postal mail to the appropriate Illinois Department of Revenue address.

- In-Person: For those who prefer personal interaction, visiting a local tax office may be an option for submitting your forms directly.

IRS Guidelines

While the Attach To Your Form IL 1040 is specific to Illinois, it is essential to be aware of IRS guidelines that may affect your state filing. Ensure that your federal tax return aligns with your state return, as discrepancies can lead to audits or penalties. Familiarizing yourself with IRS rules regarding income reporting, deductions, and credits will help you complete your state form accurately.

Quick guide on how to complete attach to your form il 1040

Easily Prepare Attach To Your Form IL 1040 on Any Device

Digital document management has become favored by companies and individuals alike. It presents an ideal environmentally friendly alternative to traditional printed and signed papers, as you can easily locate the appropriate template and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without any holdups. Handle Attach To Your Form IL 1040 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

Effortlessly Edit and eSign Attach To Your Form IL 1040

- Locate Attach To Your Form IL 1040 and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure confidential information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method of sending your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or mishandled papers, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and eSign Attach To Your Form IL 1040 and guarantee exceptional communication throughout the form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Do I need to attach the tax form 1099-B to the form 1040 Schedule D?

This sort of question should be resolved by looking at the IRS’ official instructions for the tax form and year in question. You only need to attach such items as the IRS’ official instructions direct you to attach. Recently there has been a trend of requiring fewer attachments.For the sake of answering this specific question for this specific year, there appears to be no such requirement. The Form 1099-B was already reported to the IRS and the Schedule D instructions make no mention of attaching it. You may need to attach a “statement required under Regulations section 1.1(h)-1(e).” Id. lines 10 and 18.For actual advice on filling in your forms, consult a tax attorney or accountant.

-

Do you have to file form 8880 (attach to 1040) if you contribute to an IRA but your income exceeds the threshold allowed for the credit?

Do you have to file form 8880 (attach to 1040) if you contribute to a traditional IRA but your income exceeds the threshold allowed for the credit?NoYou only file the form if you use credit(eligible). Traditional or Roth is irrelevant for credit. But Traditional helps with lowering your income to make eligibility

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

-

How do I understand the 1040 U.S. tax form in terms of an equation instead of a ton of boxes to fill in and instructions to read?

First the 1040 is an exercise in sets:Gross Income - A collection and summation of all your income types.Adjustments - A collection of deductions the tax law allow you to deduct before signNowing AGI. (AGI is used as a threshold for another set of deductions).ExemptionsDeductions - A collection of allowed deductions.Taxes - A Collection of Different collected along with Income TaxesCredits - A collection of allowed reductions in tax owed.Net Tax Owed or Refundable - Hopefully Self Explanatory.Now the formulas:[math]Gross Income - Adjustments = Adjusted Gross Income (AGI)[/math][math]AGI - Exemptions - Deductions = Taxable Income[/math][math]Tax Function (Taxable Income ) = Income Tax[/math][math]Taxes - Credits = Net Tax Owed or Refundable[/math]Please Note each set of lines is meant as a means to make collecting and summing the subsidiary information easier.It would probably be much easier to figure out if everyone wanted to pay more taxes instead of less.

Create this form in 5 minutes!

How to create an eSignature for the attach to your form il 1040

How to make an eSignature for your Attach To Your Form Il 1040 in the online mode

How to generate an eSignature for your Attach To Your Form Il 1040 in Chrome

How to generate an eSignature for putting it on the Attach To Your Form Il 1040 in Gmail

How to make an electronic signature for the Attach To Your Form Il 1040 right from your smart phone

How to create an electronic signature for the Attach To Your Form Il 1040 on iOS devices

How to create an eSignature for the Attach To Your Form Il 1040 on Android devices

People also ask

-

How do I attach documents to my Form IL 1040 using airSlate SignNow?

To attach documents to your Form IL 1040 using airSlate SignNow, simply upload your files to the platform, and use the intuitive interface to select and attach them directly to your form. This feature streamlines your filing process, making it easier to manage your tax documents. With airSlate SignNow, you can confidently attach to your Form IL 1040 and ensure all necessary paperwork is included.

-

What are the benefits of using airSlate SignNow to attach to my Form IL 1040?

Using airSlate SignNow to attach to your Form IL 1040 offers numerous benefits, including a user-friendly platform that simplifies document management. You can eSign, store, and share your documents securely, ensuring compliance and efficiency. Additionally, our cost-effective solution saves you time and reduces the hassle of traditional filing methods.

-

Is there a cost associated with attaching to my Form IL 1040 using airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans tailored to meet different needs. You can choose a plan that allows you to easily attach to your Form IL 1040 without breaking the bank. Our pricing is transparent, and we provide a free trial to help you explore all features before committing.

-

Can I integrate airSlate SignNow with other software to help attach to my Form IL 1040?

Absolutely! airSlate SignNow seamlessly integrates with numerous applications, enhancing your ability to attach to your Form IL 1040. Whether you’re using document management systems or accounting software, our integrations ensure that your workflow remains smooth and efficient.

-

What types of documents can I attach to my Form IL 1040 with airSlate SignNow?

You can attach various types of documents to your Form IL 1040 using airSlate SignNow, including receipts, W-2 forms, and other supporting tax documents. The platform supports multiple file formats, ensuring you can upload all necessary paperwork easily. This versatility helps you meet all filing requirements without hassle.

-

Is it safe to attach my Form IL 1040 documents using airSlate SignNow?

Yes, it is completely safe to attach your Form IL 1040 documents using airSlate SignNow. We prioritize security, employing advanced encryption and compliance protocols to protect your sensitive information. You can trust that your documents are secure while using our platform.

-

How does airSlate SignNow improve the process of attaching to Form IL 1040 compared to traditional methods?

airSlate SignNow improves the process of attaching to your Form IL 1040 by offering a streamlined, digital solution that eliminates the need for physical paperwork. This not only saves time but also reduces the risk of lost documents and errors commonly associated with traditional filing methods. Our platform ensures a more efficient and organized approach to managing your tax forms.

Get more for Attach To Your Form IL 1040

Find out other Attach To Your Form IL 1040

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist