Verifica E Corrispondenza Tra Il Codice Fiscale E I Dati Anagrafici Di Una Form

What is the Verifica E Corrispondenza Tra Il Codice Fiscale E I Dati Anagrafici Di Una

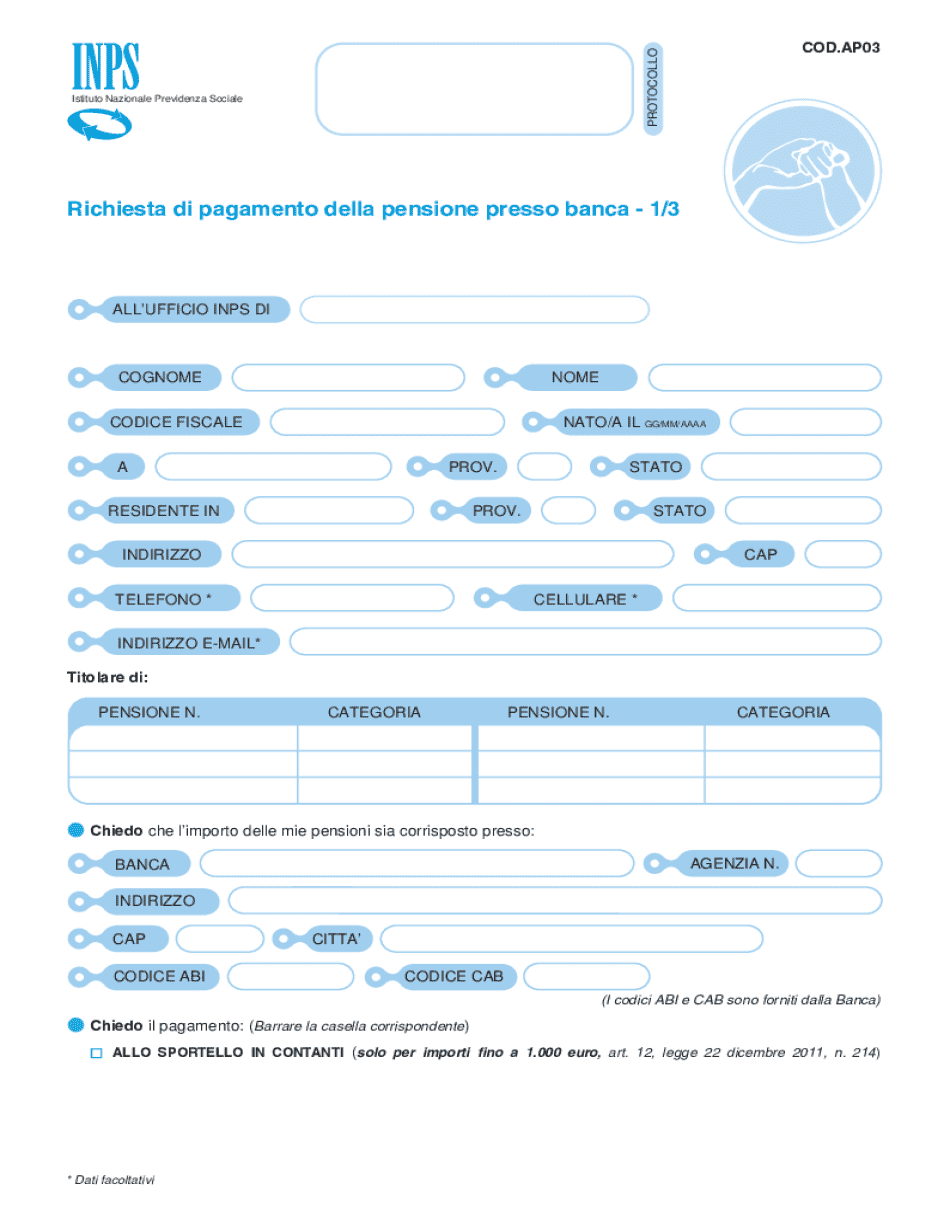

The Verifica E Corrispondenza Tra Il Codice Fiscale E I Dati Anagrafici Di Una is a verification process used to ensure that an individual's tax code aligns accurately with their personal data. This process is crucial for various administrative tasks, including tax filings and identity verification. The tax code, known as the codice fiscale in Italy, serves as a unique identifier for individuals, similar to a Social Security number in the United States. Ensuring the accuracy of this information helps prevent fraud and ensures compliance with tax regulations.

How to use the Verifica E Corrispondenza Tra Il Codice Fiscale E I Dati Anagrafici Di Una

Using the Verifica E Corrispondenza Tra Il Codice Fiscale E I Dati Anagrafici Di Una involves a few straightforward steps. First, gather the necessary personal information, including the codice fiscale and relevant identification details. Next, access the appropriate verification platform or service that supports this process. Input the required data into the designated fields and submit the request. The system will then cross-reference the information and provide confirmation of any discrepancies or affirm the accuracy of the data provided.

Steps to complete the Verifica E Corrispondenza Tra Il Codice Fiscale E I Dati Anagrafici Di Una

Completing the verification involves several key steps:

- Gather all necessary documents, including your codice fiscale and identification.

- Choose a reliable verification service or platform.

- Enter your personal information accurately into the system.

- Submit the verification request for processing.

- Review the results to confirm the accuracy of your data.

Following these steps ensures a smooth verification process, helping to maintain accurate records and compliance.

Required Documents

To perform the Verifica E Corrispondenza Tra Il Codice Fiscale E I Dati Anagrafici Di Una, certain documents are essential. These typically include:

- Your codice fiscale, which is necessary for identification.

- A government-issued identification document, such as a passport or driver's license.

- Any additional documentation that may support your identity verification, such as utility bills or bank statements showing your name and address.

Having these documents ready will facilitate a quicker and more efficient verification process.

Legal use of the Verifica E Corrispondenza Tra Il Codice Fiscale E I Dati Anagrafici Di Una

The legal use of the Verifica E Corrispondenza Tra Il Codice Fiscale E I Dati Anagrafici Di Una is essential for ensuring compliance with tax laws and regulations. This verification is often required by government agencies, financial institutions, and employers to confirm an individual's identity and tax status. Proper use of this verification helps prevent identity theft and fraud, safeguarding both the individual and the institution involved. It is important to ensure that the process is conducted in accordance with applicable laws to protect personal information and maintain privacy.

Examples of using the Verifica E Corrispondenza Tra Il Codice Fiscale E I Dati Anagrafici Di Una

There are several practical scenarios where the Verifica E Corrispondenza Tra Il Codice Fiscale E I Dati Anagrafici Di Una is utilized:

- When applying for a loan, financial institutions may require verification to ensure the applicant's identity.

- During tax preparation, individuals may need to verify their codice fiscale against personal data to avoid discrepancies.

- Employers may use this verification process to confirm the identity of new hires for tax reporting purposes.

These examples illustrate the importance of this verification in various financial and administrative contexts.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the verifica e corrispondenza tra il codice fiscale e i dati anagrafici di una

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for 'Verifica E Corrispondenza Tra Il Codice Fiscale E I Dati Anagrafici Di Una'?

The process for 'Verifica E Corrispondenza Tra Il Codice Fiscale E I Dati Anagrafici Di Una' involves cross-referencing the fiscal code with the individual's personal data to ensure accuracy. This verification is crucial for compliance and helps prevent identity fraud. Our platform simplifies this process, making it quick and efficient.

-

How does airSlate SignNow ensure the accuracy of the verification?

airSlate SignNow utilizes advanced algorithms and databases to perform 'Verifica E Corrispondenza Tra Il Codice Fiscale E I Dati Anagrafici Di Una.' This ensures that the data is not only accurate but also up-to-date. Our commitment to data integrity means you can trust the results for your business needs.

-

What are the pricing options for using airSlate SignNow's verification services?

We offer flexible pricing plans tailored to different business needs for 'Verifica E Corrispondenza Tra Il Codice Fiscale E I Dati Anagrafici Di Una.' Our plans are designed to be cost-effective, ensuring you get the best value for your investment. Contact our sales team for a detailed quote based on your requirements.

-

Can I integrate airSlate SignNow with other software for verification?

Yes, airSlate SignNow supports integrations with various software solutions to enhance your workflow. This includes tools that facilitate 'Verifica E Corrispondenza Tra Il Codice Fiscale E I Dati Anagrafici Di Una.' Our API allows seamless connectivity, making it easier to incorporate verification into your existing systems.

-

What are the benefits of using airSlate SignNow for verification?

Using airSlate SignNow for 'Verifica E Corrispondenza Tra Il Codice Fiscale E I Dati Anagrafici Di Una' offers numerous benefits, including increased efficiency, reduced errors, and enhanced security. Our platform streamlines the verification process, allowing you to focus on your core business activities while ensuring compliance.

-

Is there a trial period available for airSlate SignNow's verification services?

Yes, we offer a trial period for our services, including 'Verifica E Corrispondenza Tra Il Codice Fiscale E I Dati Anagrafici Di Una.' This allows you to explore our features and see how they can benefit your business before committing to a subscription. Sign up today to experience the ease of our platform.

-

How secure is the data during the verification process?

Data security is a top priority at airSlate SignNow. During the 'Verifica E Corrispondenza Tra Il Codice Fiscale E I Dati Anagrafici Di Una,' we implement robust encryption and security protocols to protect your information. You can trust that your data is safe with us throughout the verification process.

Get more for Verifica E Corrispondenza Tra Il Codice Fiscale E I Dati Anagrafici Di Una

Find out other Verifica E Corrispondenza Tra Il Codice Fiscale E I Dati Anagrafici Di Una

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement