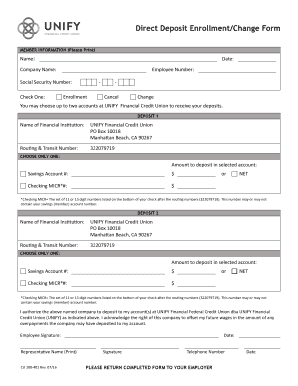

You May Choose Up to Two Accounts at UNIFY Financial Credit Union to Receive Your Deposits Form

Understanding the Account Selection Process at UNIFY Financial Credit Union

The option to choose up to two accounts at UNIFY Financial Credit Union for receiving deposits allows members to manage their finances more effectively. This feature is designed to provide flexibility, enabling members to direct their deposits into accounts that best suit their financial needs. Members can select accounts such as savings, checking, or other specialized accounts offered by the credit union. Understanding how this selection works is crucial for maximizing the benefits of your accounts.

Steps to Complete Your Account Selection

To select your accounts for deposit at UNIFY Financial Credit Union, follow these steps:

- Log in to your online banking portal or visit a local branch.

- Navigate to the account selection section, typically found under account management.

- Choose up to two accounts from the available options.

- Confirm your selections and review any terms associated with the accounts.

- Submit your choices for processing.

Once submitted, you will receive a confirmation of your selections, ensuring that your deposits will be directed accordingly.

Legal Considerations for Account Selection

When selecting accounts for receiving deposits, it is important to be aware of any legal implications. Members should ensure that their choices comply with the credit union's policies and federal regulations. This includes understanding the terms of each account and any potential fees or restrictions that may apply. Additionally, members should keep in mind that the selection process is subject to the credit union's approval.

Required Documentation for Account Selection

To complete the account selection process, members may need to provide certain documentation. This could include:

- Proof of identity, such as a driver's license or passport.

- Account numbers for the accounts you wish to designate for deposits.

- Any additional forms required by UNIFY Financial Credit Union.

Having these documents ready can streamline the process and ensure that your selections are processed without delay.

Examples of Account Selection Scenarios

Consider these scenarios to understand how selecting accounts can benefit you:

- A member may choose a checking account for direct deposit of their salary and a savings account for emergency funds.

- An individual may select a business account for deposits related to their freelance work and a personal account for everyday expenses.

These examples illustrate the flexibility offered by UNIFY Financial Credit Union, allowing members to tailor their deposit preferences to their financial situations.

Eligibility Criteria for Account Selection

To be eligible to choose accounts for receiving deposits at UNIFY Financial Credit Union, members must meet certain criteria. This typically includes:

- Being a member of the credit union in good standing.

- Having active accounts that are eligible for deposits.

- Meeting any specific requirements set forth by the credit union.

Understanding these criteria can help ensure a smooth selection process and avoid any potential issues.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the you may choose up to two accounts at unify financial credit union to receive your deposits

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What does it mean when you say 'You May Choose Up To Two Accounts At UNIFY Financial Credit Union To Receive Your Deposits'?

This means that as a member of UNIFY Financial Credit Union, you have the flexibility to designate up to two accounts where your deposits can be directed. This feature allows you to manage your finances more effectively by splitting your deposits according to your needs.

-

Are there any fees associated with choosing two accounts at UNIFY Financial Credit Union?

No, there are no additional fees for selecting up to two accounts at UNIFY Financial Credit Union to receive your deposits. This service is designed to enhance your banking experience without incurring extra costs.

-

How can I set up my accounts to receive deposits at UNIFY Financial Credit Union?

To set up your accounts, simply log into your UNIFY Financial Credit Union online banking portal or visit a local branch. You can specify which two accounts you would like to receive your deposits, making it a straightforward process.

-

What are the benefits of choosing two accounts for deposits at UNIFY Financial Credit Union?

Choosing two accounts allows for better financial management and budgeting. You can allocate funds for different purposes, such as savings and daily expenses, ensuring that your financial goals are met efficiently.

-

Can I change the accounts I have chosen for deposits at UNIFY Financial Credit Union?

Yes, you can change the accounts designated to receive your deposits at any time. Simply contact customer service or access your online banking to update your preferences as your financial needs evolve.

-

Is there a limit to the amount I can deposit into my accounts at UNIFY Financial Credit Union?

While there is no specific limit on the number of deposits you can make, individual account limits may apply based on the type of account you hold. It's best to check with UNIFY Financial Credit Union for specific details regarding deposit limits.

-

How does airSlate SignNow integrate with UNIFY Financial Credit Union for document signing?

airSlate SignNow provides a seamless integration with UNIFY Financial Credit Union, allowing you to eSign documents related to your accounts easily. This integration enhances your banking experience by streamlining the process of managing your financial documents.

Get more for You May Choose Up To Two Accounts At UNIFY Financial Credit Union To Receive Your Deposits

Find out other You May Choose Up To Two Accounts At UNIFY Financial Credit Union To Receive Your Deposits

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form